The week ahead is a light one for economic reports. The focus is mostly on the housing sector, which is showing signs of bottoming if not recovering. Meanwhile, we will continue to focus on Dr. Copper, the metal with a PhD in economics. We watch the price of copper as an indicator of global economic activity, which seems to be improving though the price of oil has yet to confirm the recent jump in the price of copper. Consider the following:

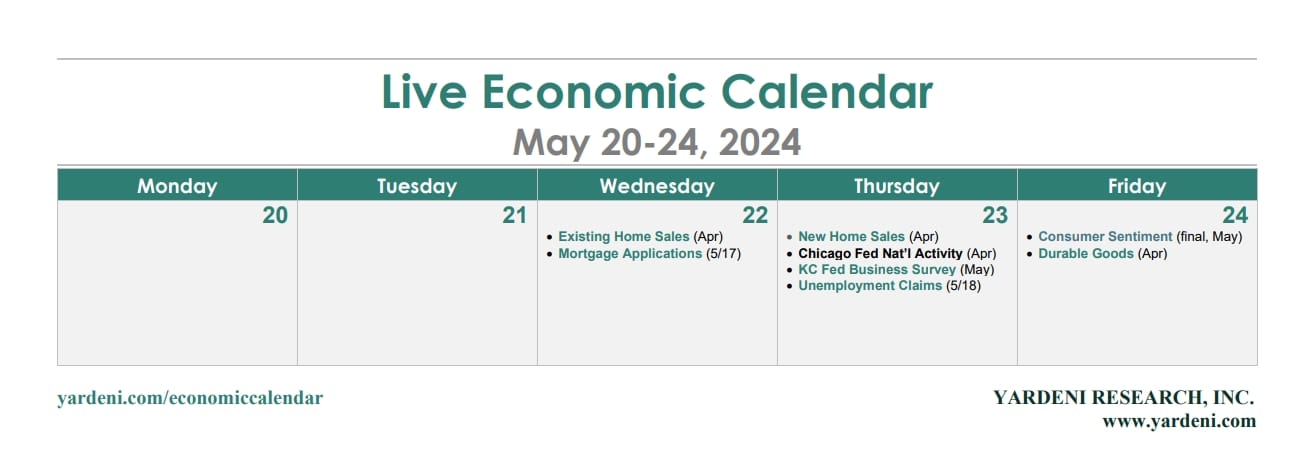

(1) Existing home sales. We expect to see April's existing home sales report (Wed) show further recovery from the lows seen late last year (Wed) (chart). Homebuyers are getting used to mortgage rates around 7%.

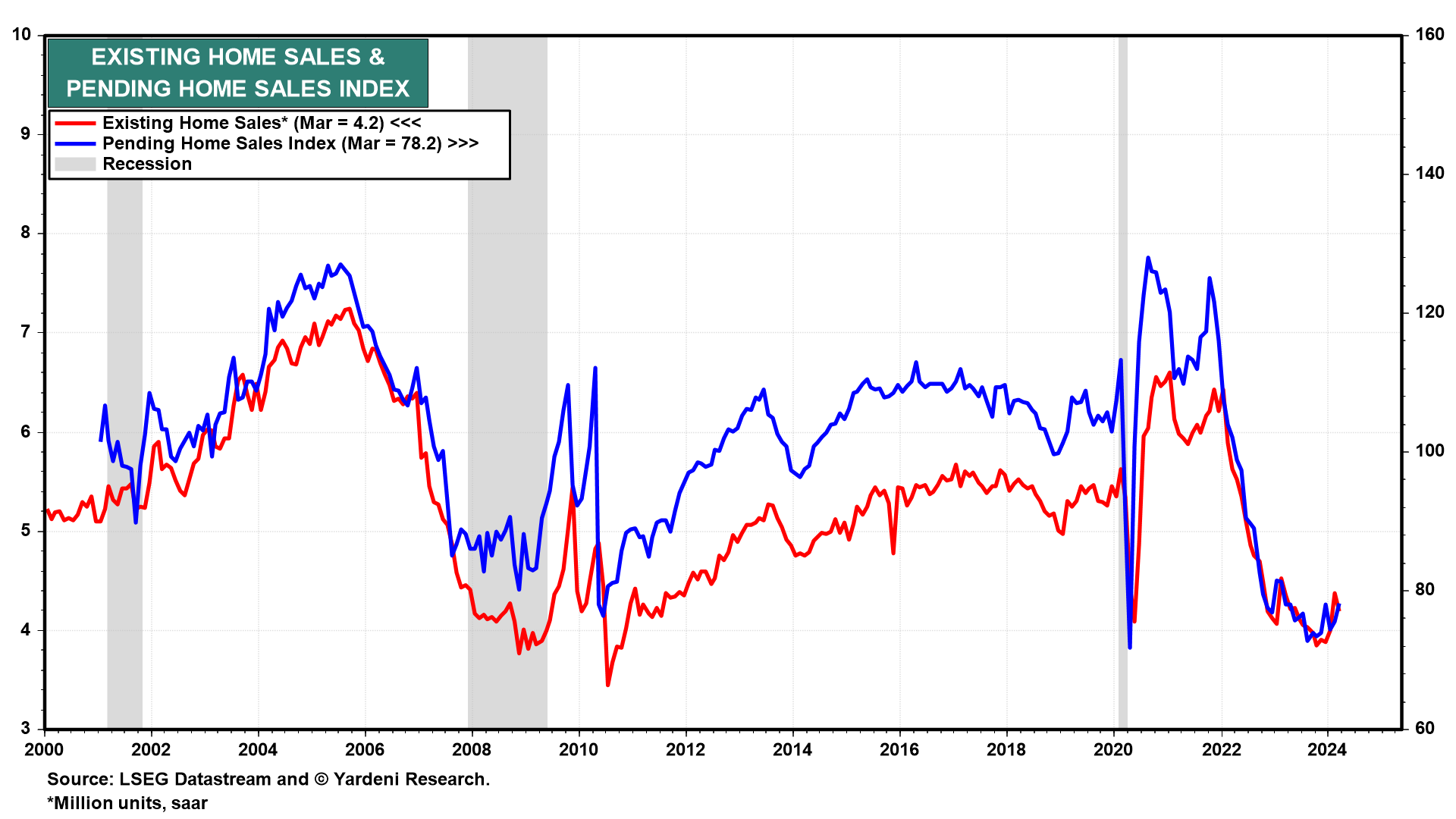

(2) New home sales. We anticipate April's new home sales (Thu) continued to climb (chart). New homes for sale are at their highest level since Q1-2007; it's no surprise homebuilders like Toll Brothers (+29.7% ytd) and PulteGroup (+17.3%) are outperforming.

(3) Home prices. April's new single-family home prices (Thu) probably continued to edge lower as rising supply is cooling prices in hot markets like Florida and Texas (WSJ). We expect to see some moderation in April's existing home prices (Wed) for the same reason. For now, home prices are providing a significant positive wealth effect on consumer spending.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a