They say that the stock market tends to climb a wall of worry. It has been doing just that since the S&P 500 bottomed at 3666.77 on June 16. It rose 1.4% today even though Fed Chair Jerome Powell will speak at the Fed's annual Jackson Hole conference tomorrow, and might sound more hawkish to compensate for sounding too dovish at his prior speaking gig, i.e. his presser on July 27.

The bears are still growling that the stock market will retest its June 16 low and probably breach it. They have the calendar on their side: September tends to be the worst month of the year for the stock market. There's a good chance that August's M-PMI (to be released on Thursday, September 1) will fall below 50.0. There's also a good chance that the FOMC will hike the federal funds rate by 75bps on September 27. Even the Fed's regular doves are squawking like hawks.

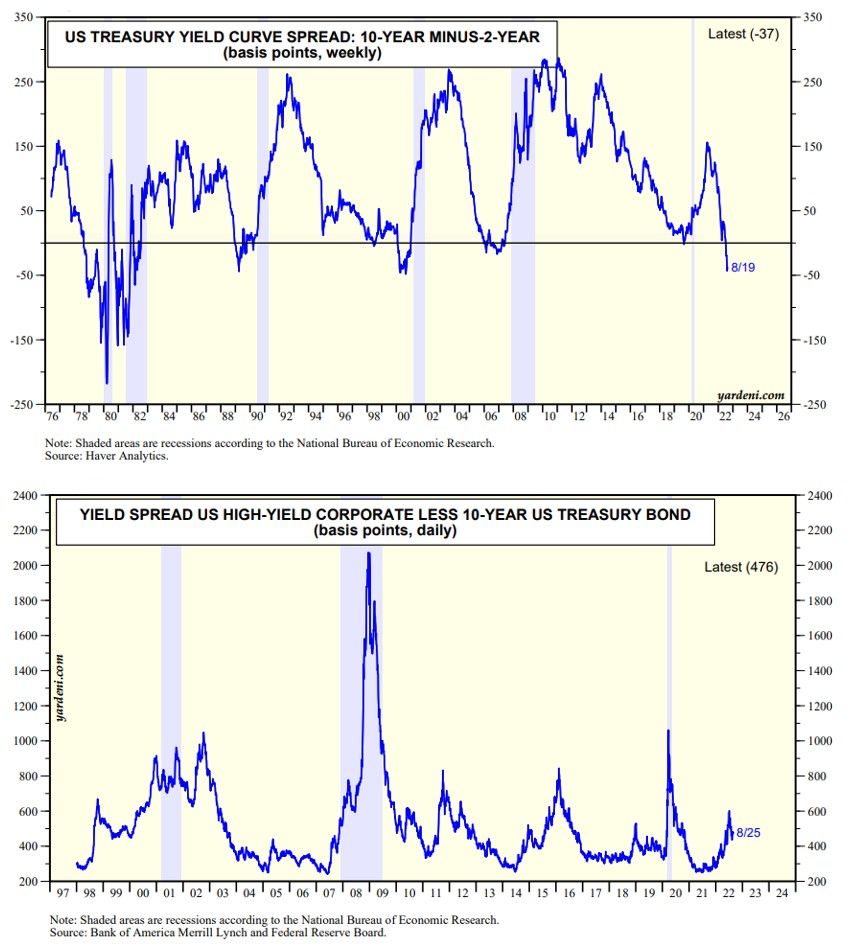

The bears also have the yield curve spread between the 10-year and 2-year US Treasury bond on their side (chart below). On the other hand, the yield curve spread between the junk bond composite and the 10-year US bond has actually narrowed recently, confirming the recent optimism of stock investors (chart below).

The tug-of-war between the bulls and the bears may remain in a draw for a while longer.