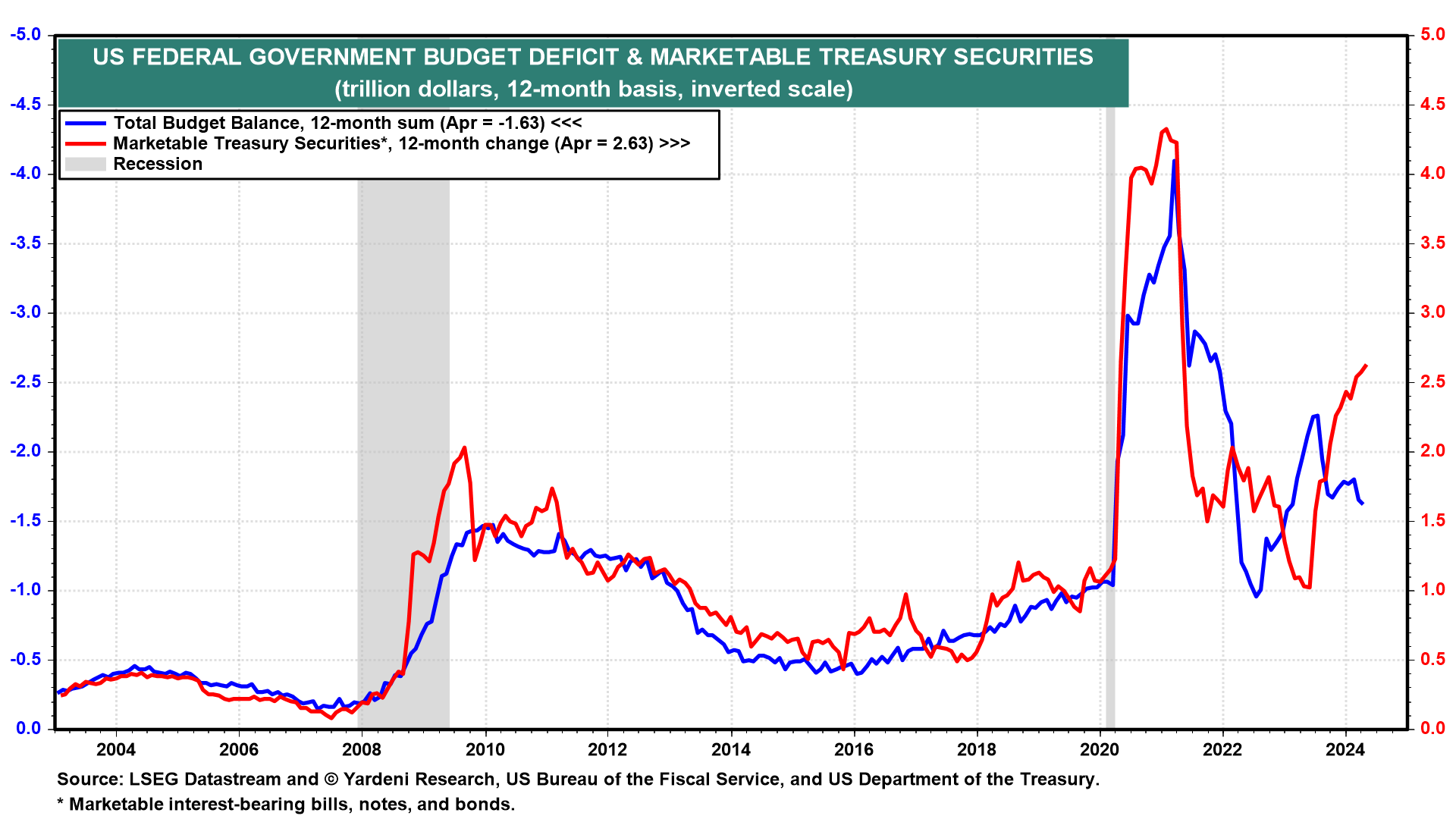

The federal deficit narrowed a bit to $1.63 trillion over the 12 months through April (chart). However, over the same period, the US Treasury had to raise $2.63 trillion by issuing marketable securities, which now total a record $26.9 trillion. The Treasury had to borrow more than the deficit to replenish its checking account at the Fed, which was down to almost zero last June. The blob keeps growing.

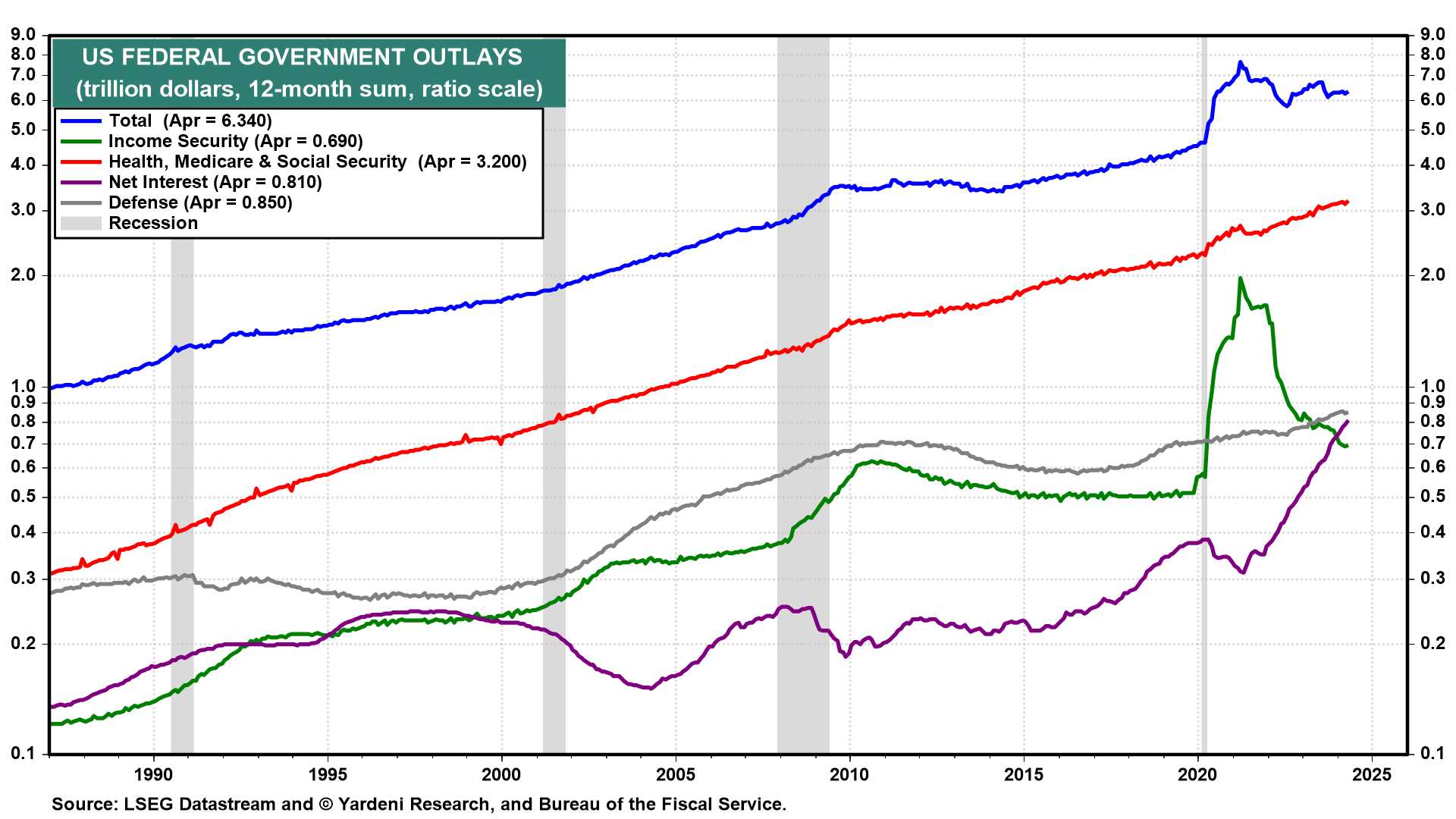

Meanwhile, the fastest growing federal government outlay is net interest paid on the debt, which totaled $810 billion over the 12 months through April (chart). It will soon exceed outlays on defense spending and reach $1.0 trillion before the end of this year.

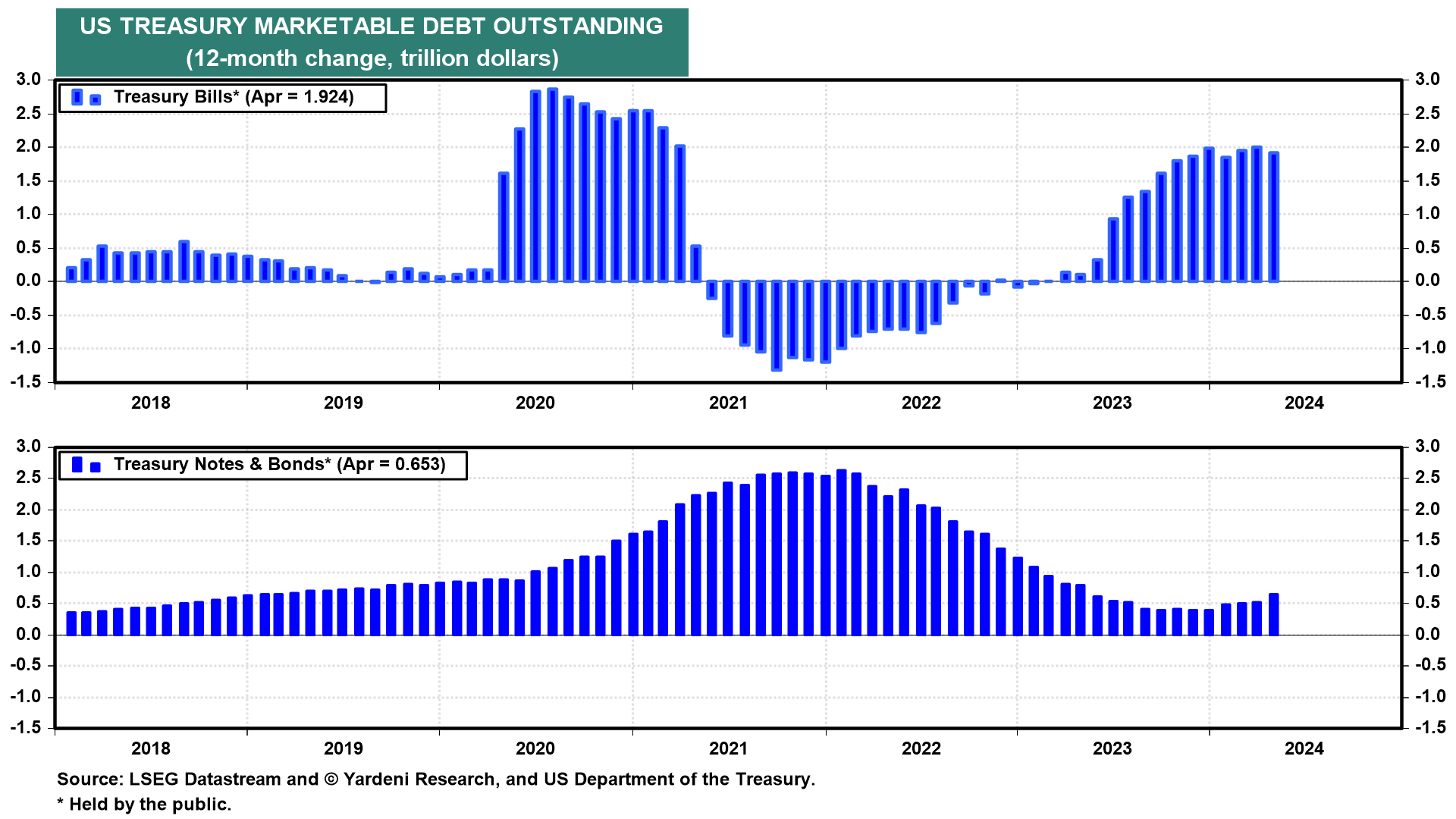

Why aren't bond yields soaring on all this supply of Treasury securities? The Treasury has been funding most of its needs over the past 12 months through April with Treasury bills ($1.92 trillion) compared to $653 billion in notes and bonds (chart).

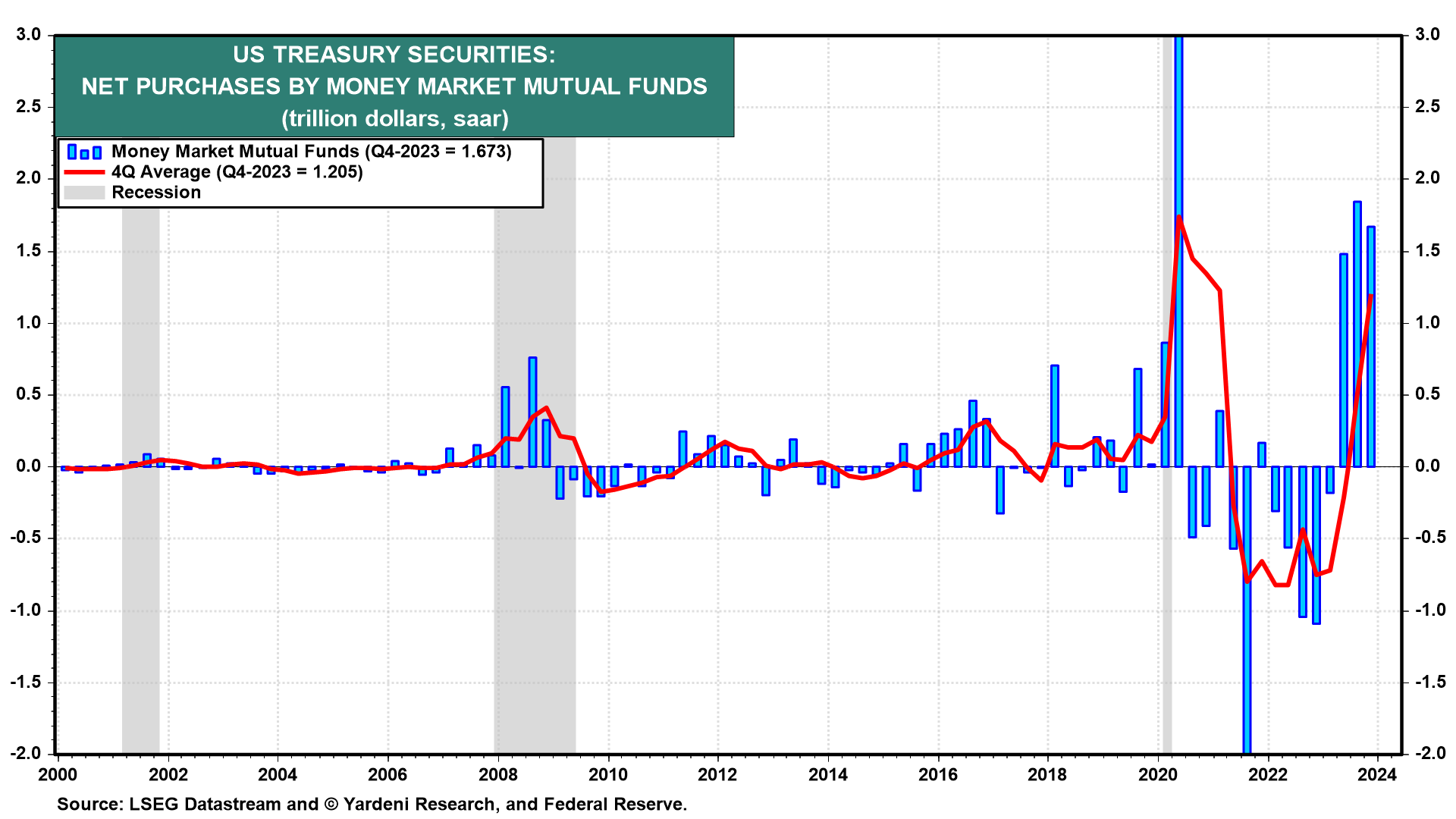

Last year, money market mutual funds purchased $1.21 trillion of Treasury bills (chart).