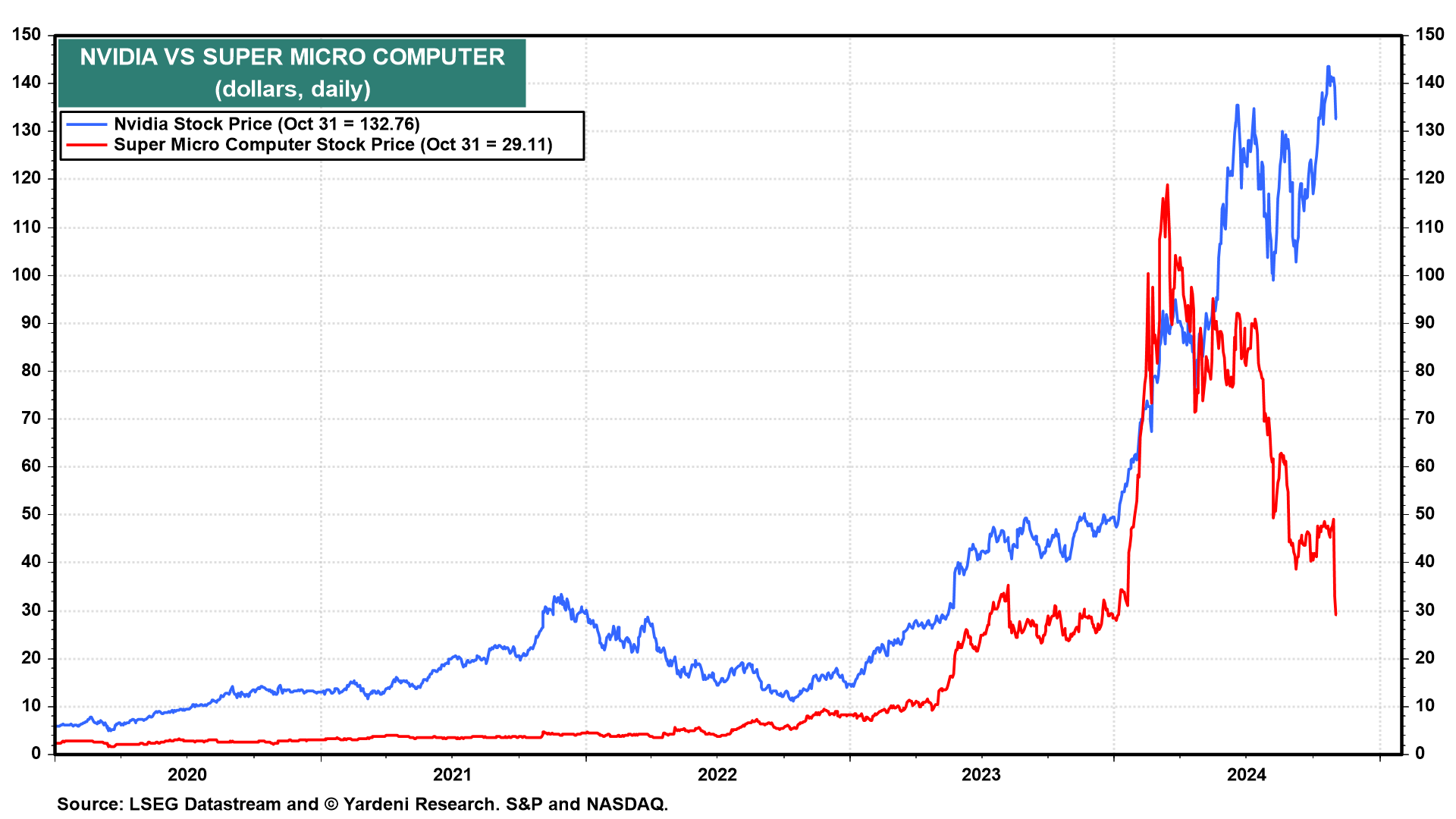

Some of the air is coming out of the AI trade. Super Micro Computer hasn't been super recently. It fell 12% today after auditor Ernst & Young resigned due to inaccurate financial reporting, and is now down 66% over the past six months (chart). Super Micro Computer is a key vendor for building out Nvidia-based clusters of servers used for training and deploying AI models

Meta and Microsoft fell 4.1% and 6.0% today, respectively. Yesterday's earnings calls show that Meta's AI-related capex continues to grow while the ROI isn't obvious. Microsoft is struggling to add more cloud computing capacity to meet surging AI demand. This is a case of companies not keeping up with lofty growth expectations and valuations rather than a slowdown in AI spending, cloud computing, or the broader economy. On the macro front, things look super, in our opinion.

Here's our takeaways from today's key macro data:

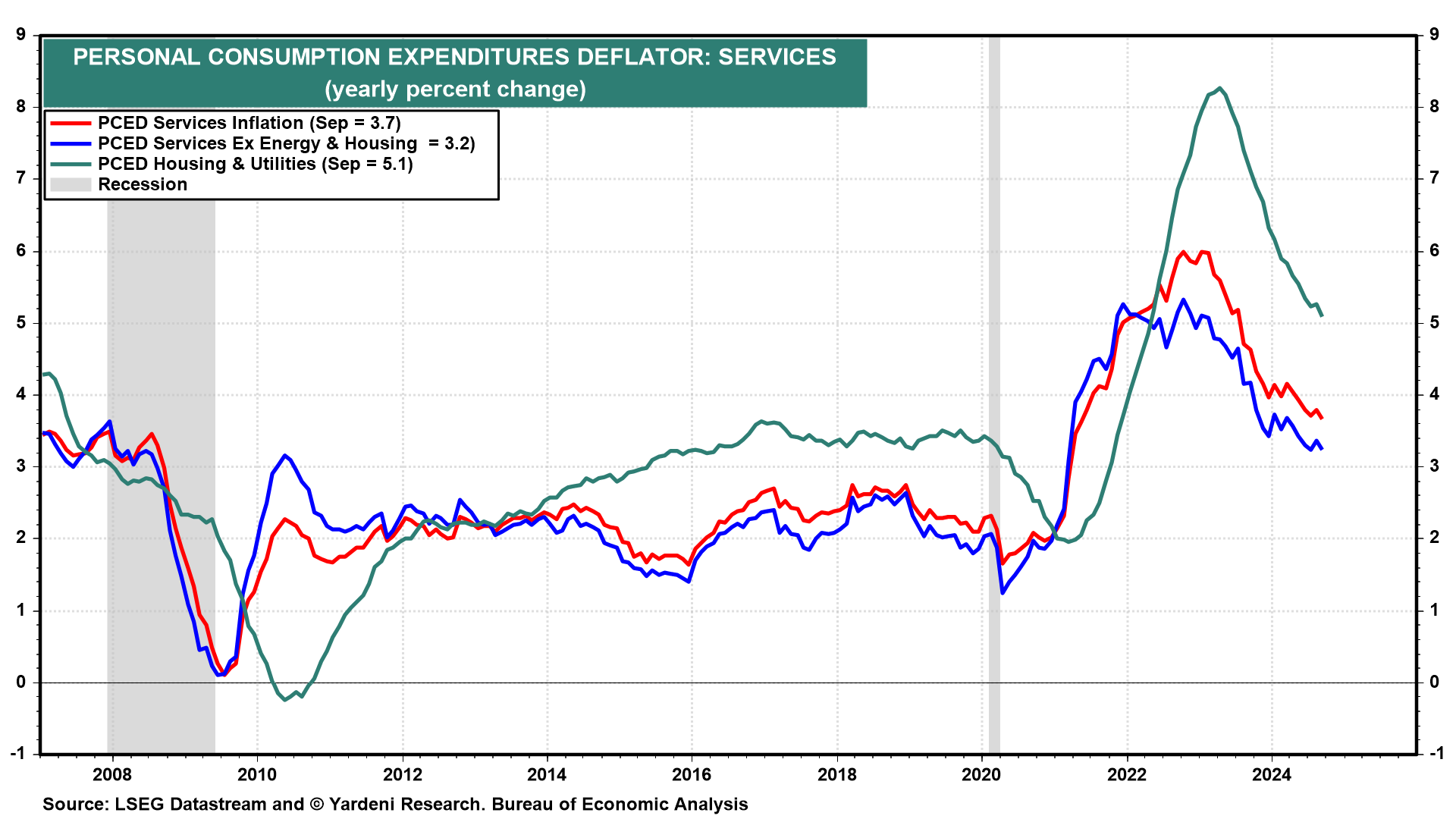

(1) Inflation. The headline PCED inflation rate fell to 2.1% y/y in September. That's good news! But US Treasury yields remained elevated. That's likely because the core PCED rate was 2.7% y/y while the "supercore" rate (core services less housing) remained sticky and relatively high at 3.2% (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a