We've been making the case that June 16 might have been the bear-market low in the S&P 500 when it closed at 3666.77. It was up 2.6% today to 4023.61, a 9.7% gain since last month's low. Today's performance was especially impressive. Instead of focusing on Fed Chair Jerome Powell's hawkishness on inflation at his press conference, the market may have rallied on his claim that the Fed might be able to subdue inflation without causing a hard landing.

The market was moving higher today even before Powell's 2:30pm presser . Economic indicators released in the morning showed that while the economy may be slowing, its not falling into a recession.

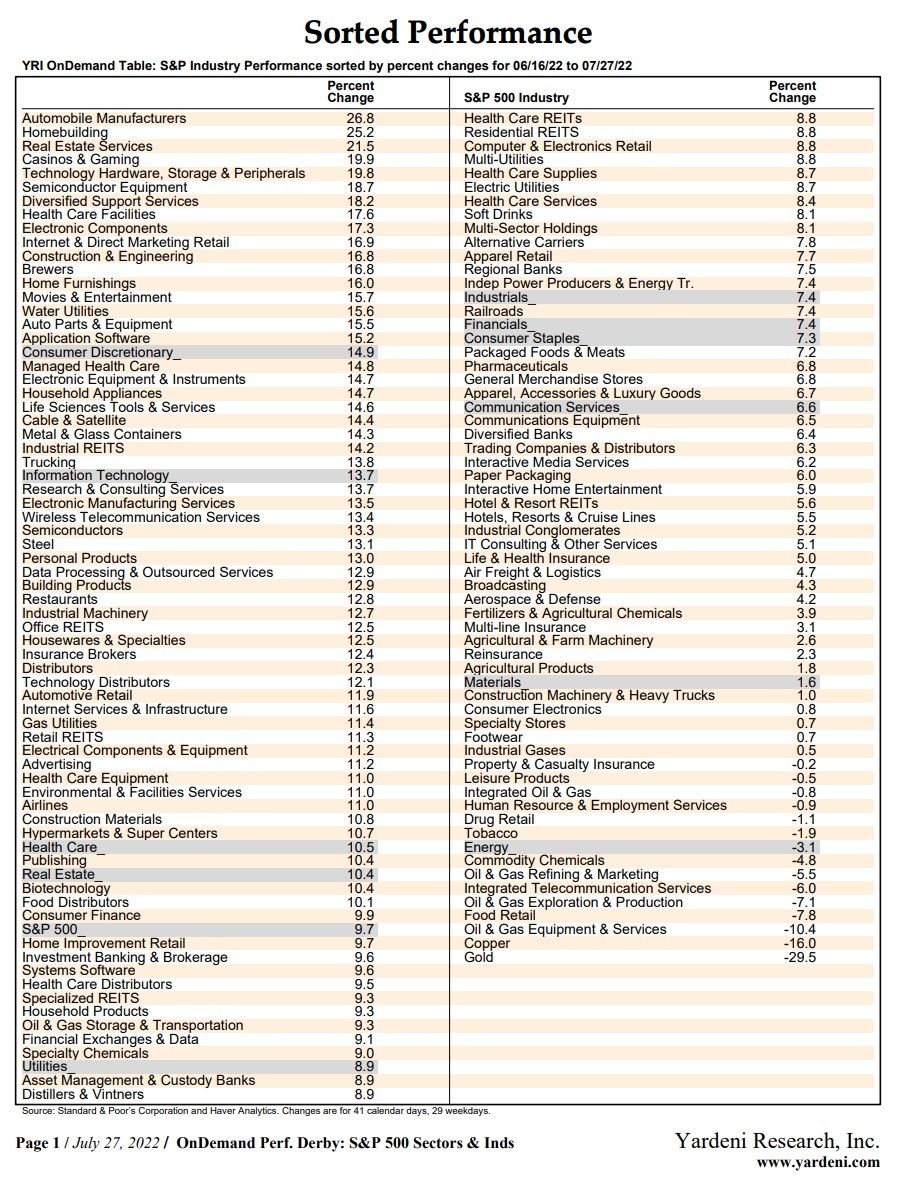

Here is the performance derby for the 11 sectors of the S&P 500 sorted from June 16 through today's close, and also showing from January 3 to June 16 and from January 3 through today's close:

Consumer Discretionary (14.9%, -36.4%, -27.0%), Information Technology (13.7, -30.2, -20.7), Health Care (10.5, -14.4, -5.5), Real Estate (10.4, -24.9, -17.1), S&P 500 (9.7, -23.6, -16.1), Utilities (8.9, -8.3, -0.1), Industrials (7.4, -18.6, -12.5), Financials (7.4, -22.4, -16.7), Consumer Staples (7.3, -11.3, -4.7), Communication Services (6.6, -32.7, -28.3), Materials (1.6, -16.5, -15.1), and Energy (-3.1, 35.0, 30.9).