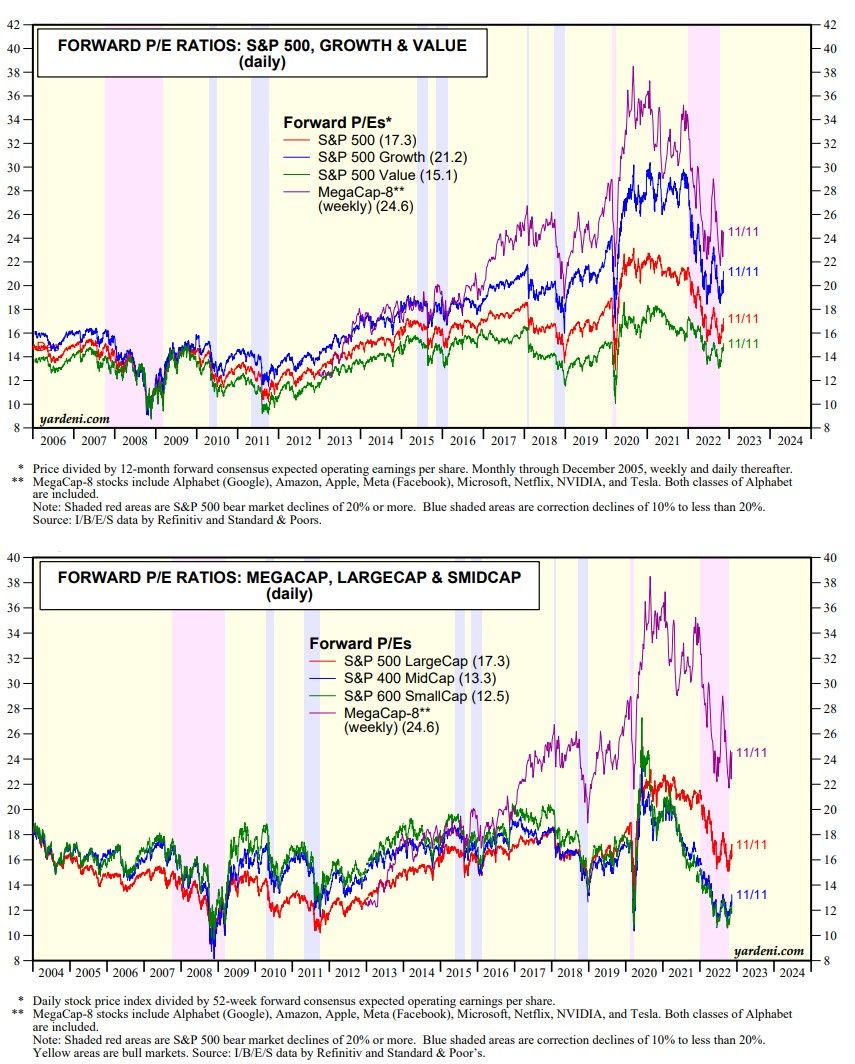

There are no guarantees in life. Outcomes are usually contingent on a number of other outcomes, and so on. This certainly applies to the forward P/Es of the major S&P stock indexes shown below. If we continue to see better-than-expected inflation prints in coming months, like October's CPI on Thursday, then these valuation multiples most likely bottomed on October 12, when the S&P fell to the year's low.

Some might argue that they've typically bottomed in the single digits, not in the double digits at the end of bear markets. That's true. However, in our opinion, the market is currently anticipating a soft landing, not a hard one. We agree with that outlook.

We've been expecting that 15.0 would hold as the low for the S&P 500 forward P/E, which it did on October 12. On Friday, it was already back to 17.3. It was lifted by the forward P/Es of the MegaCap-8 (24.6), Growth (21.2), and Value (15.1) components of the index. S&P 400 MidCaps and S&P 600 SmallCaps remain relatively cheap at 13.3 and 12.5.