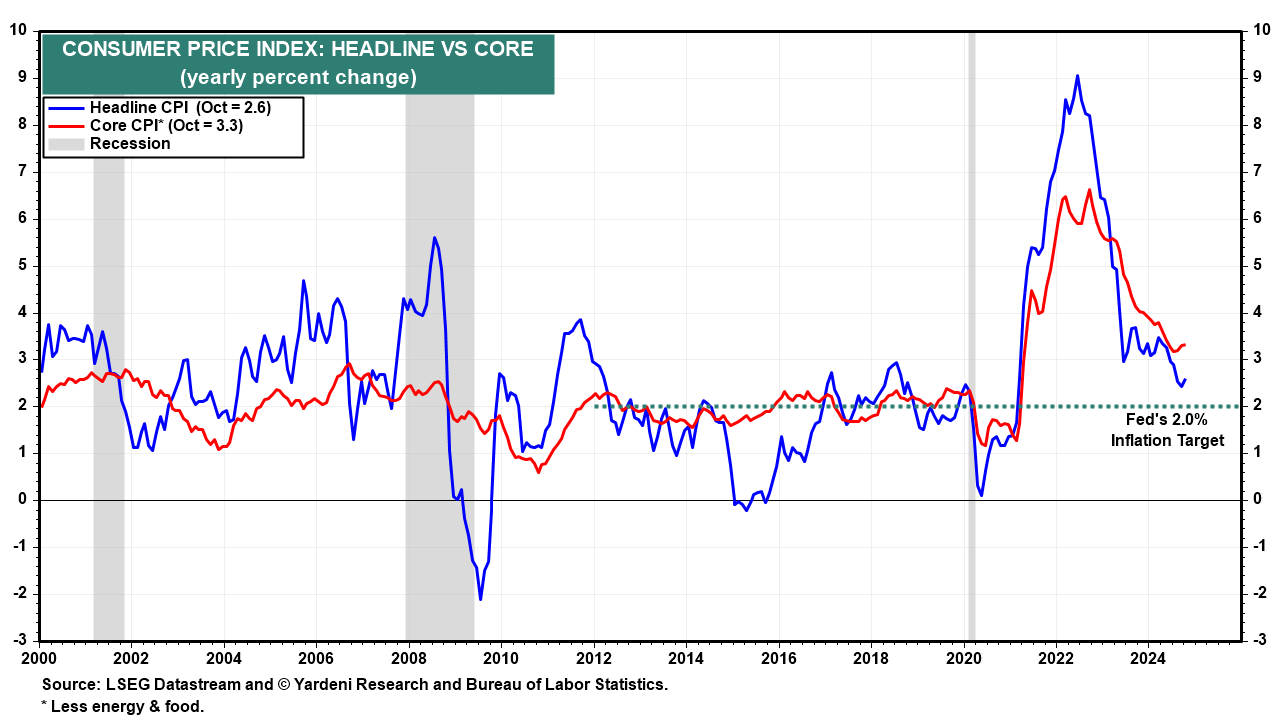

Today's CPI report suggests that inflation may be getting stuck north of the Fed's 2.0% target. The headline and core CPI inflation rates rose 2.6% and 3.3% y/y during October. Goods prices are still deflating. But supercore inflation, rent inflation, and wage growth all rose last month suggesting they are getting sticky at relatively high rates. This along with strong economic growth confirms our view that the Fed has eased too much too soon. Our view is confirmed by rising bond yields, which are challenging the wisdom of the Fed's rate cutting.

We're not worried about a second wave of inflation because we believe that productivity is already boosting real GDP, while keeping a lid on unit labor costs inflation. Recent upward revisions in productivity confirm this view. However, we think that the Fed needs to give consumer price inflation more time to get unstuck before even considering whether any more rate cuts are necessary.

Let's review today's CPI report and the recent productivity revision:

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a