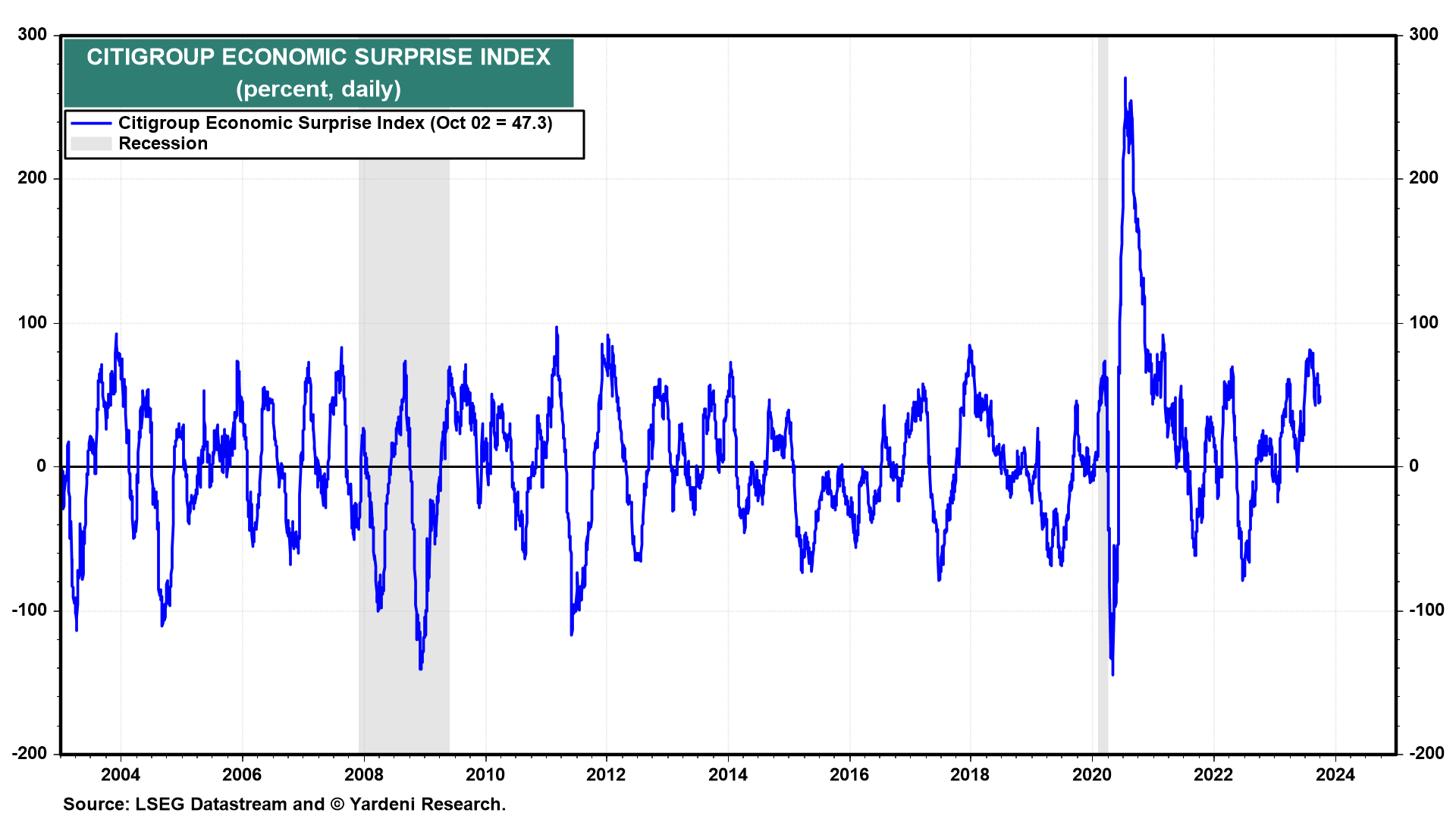

The latest batch of economic indicators was weaker than expected. On Friday, we learned that real personal consumption expenditures rose just 0.1% during August. The core PCED edged up by only 0.1% during the month. September’s Consumer Sentiment Index fell 1.4 points to 68.1. As a result, the Citigroup Economic Surprise Index (CESI) is down to 47.3% from a recent high of 81.9% on July 27 (chart).

The 10-year Treasury bond yield should have declined on the news since its 13-week change tends to track the CESI closely. Instead, the yield has continued to march higher, up to 4.70% this morning.

This morning's relatively weak readings for September's M-PMI (still below 50 at 49.0) and a weak prices-paid sub-index (43.8) didn't stop the yield from moving higher (chart). The latter suggests that September's CPI inflation rate for goods remained subdued.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a