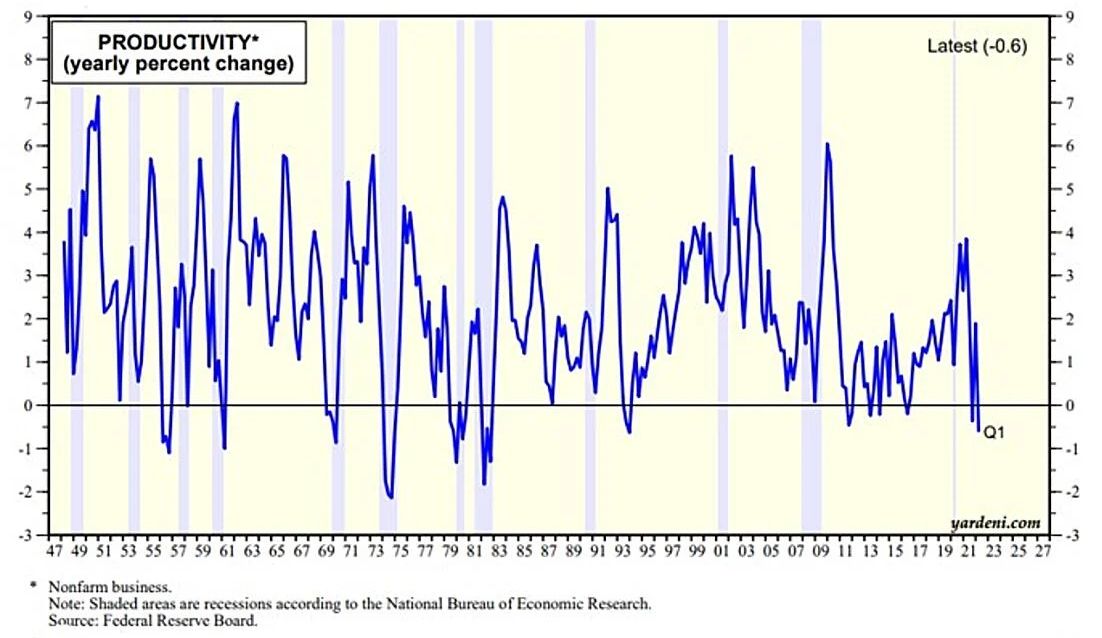

Contributing to the stock market selloff today was more bad news on the inflation front. Nonfarm business (NFB) productivity dropped 7.5% (saar) during Q1. It wasn’t as bad on a y/y basis, falling just 0.6%. It’s a very volatile series on a q/q basis and even on a y/y basis.

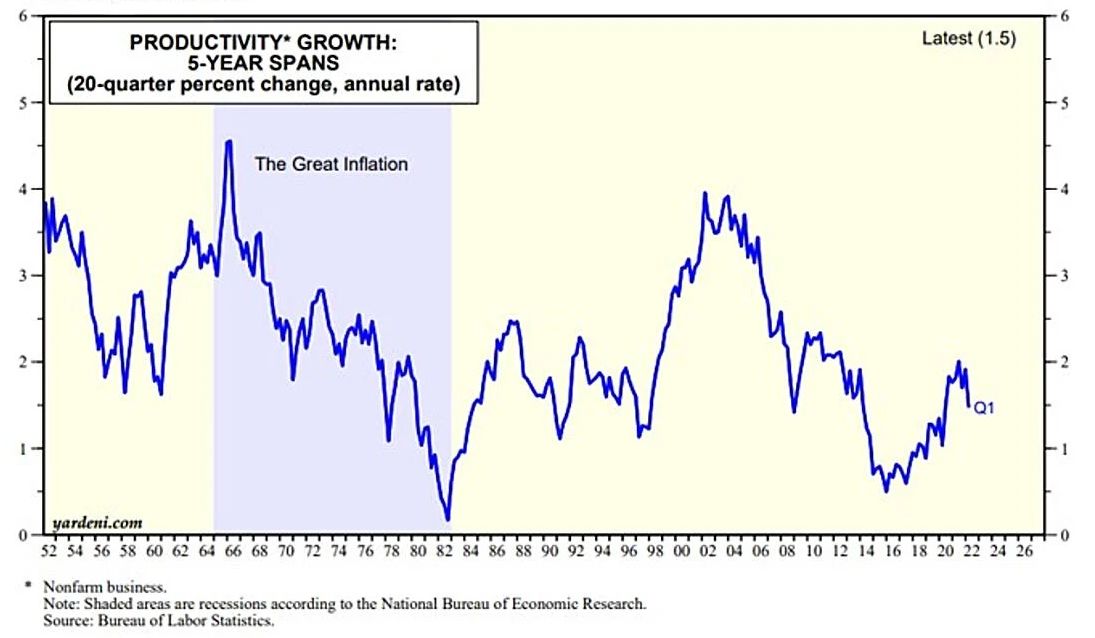

It was a setback for our Roaring 2020s scenario of a technology-led productivity growth boom offsetting the chronic shortage of labor. However, the 20-quarter growth rate was 1.5% at an annual rate during Q1, well above the 0.5% trough at the end of 2015. We still think it is heading to 3.5%-4.5% by the second half of the decade.

Here is more on the latest productivity and labor cost data:

(1) Widely missed was the good news on NFB hourly compensation. It was up just 3.2% (saar) during Q1, following three quarters of gains exceeding 6.0%. However, it was up a lot more on a y/y basis, 6.5%.

(2) Nevertheless, the modest q/q compensation increase was more than offset by the large q/q productivity drop—together resulting in an 11.6% (saar) q/q jump in NFB unit labor costs (ULC). ULC was up 7.2% y/y during Q1. The ULC inflation rate tends to determine the underlying trend in consumer price inflation. So far, neither of them show any sign of peaking.