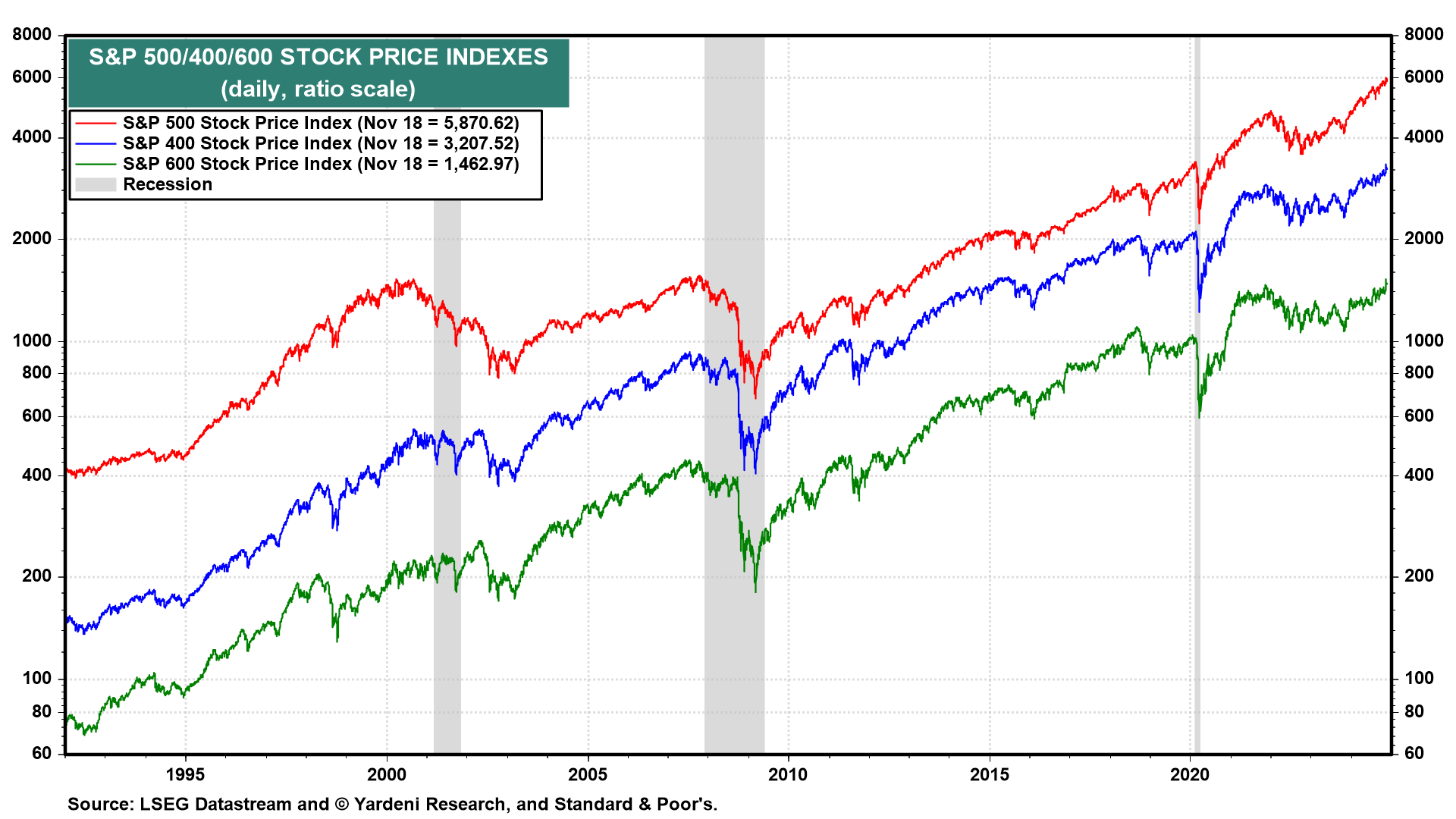

The rally in the S&P 1500 has certainly broadened in recent weeks as the Fed started to cut the federal funds rate (FFR) by 50bps on September 18 and again on November 7 by 25bps. The S&P 400 MidCaps and S&P 600 SmallCaps have been rising in record high territory in recent weeks along with the S&P 500 which has been rising in record high territory since the start of this year (chart). Lower interest rates benefit smaller companies that have floating-rate debt and don't have too many other options for raising money in the capital markets as do larger companies. Lower interest rates have also reduced concerns that the so-called "long-and-variable lags" of monetary policy will finally cause a recession.

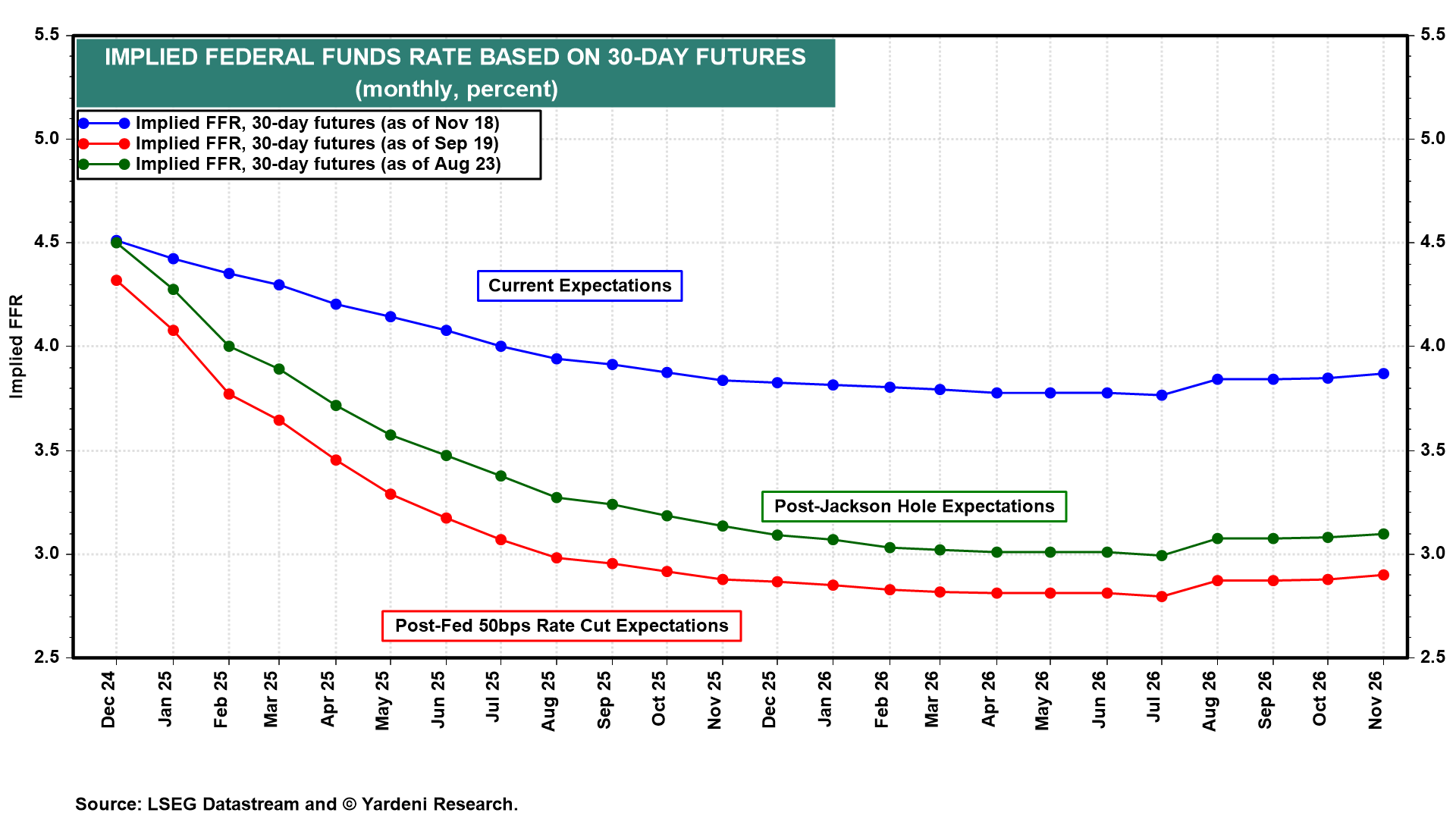

The problem is that while the FFR is down 75bps, interest rates have been mostly rising along with the US Treasury yield curve (chart).

Another problem is that the forward operating earnings per share of the S&P 400 & 600 have been flatlining since the Fed started raising the FFR in early 2022 (chart). They are both still doing so. We aren't sure why. It may be that many of the best SMidCap earners are getting bought out by larger companies before they have a chance to grow into LargeCaps on their own.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a