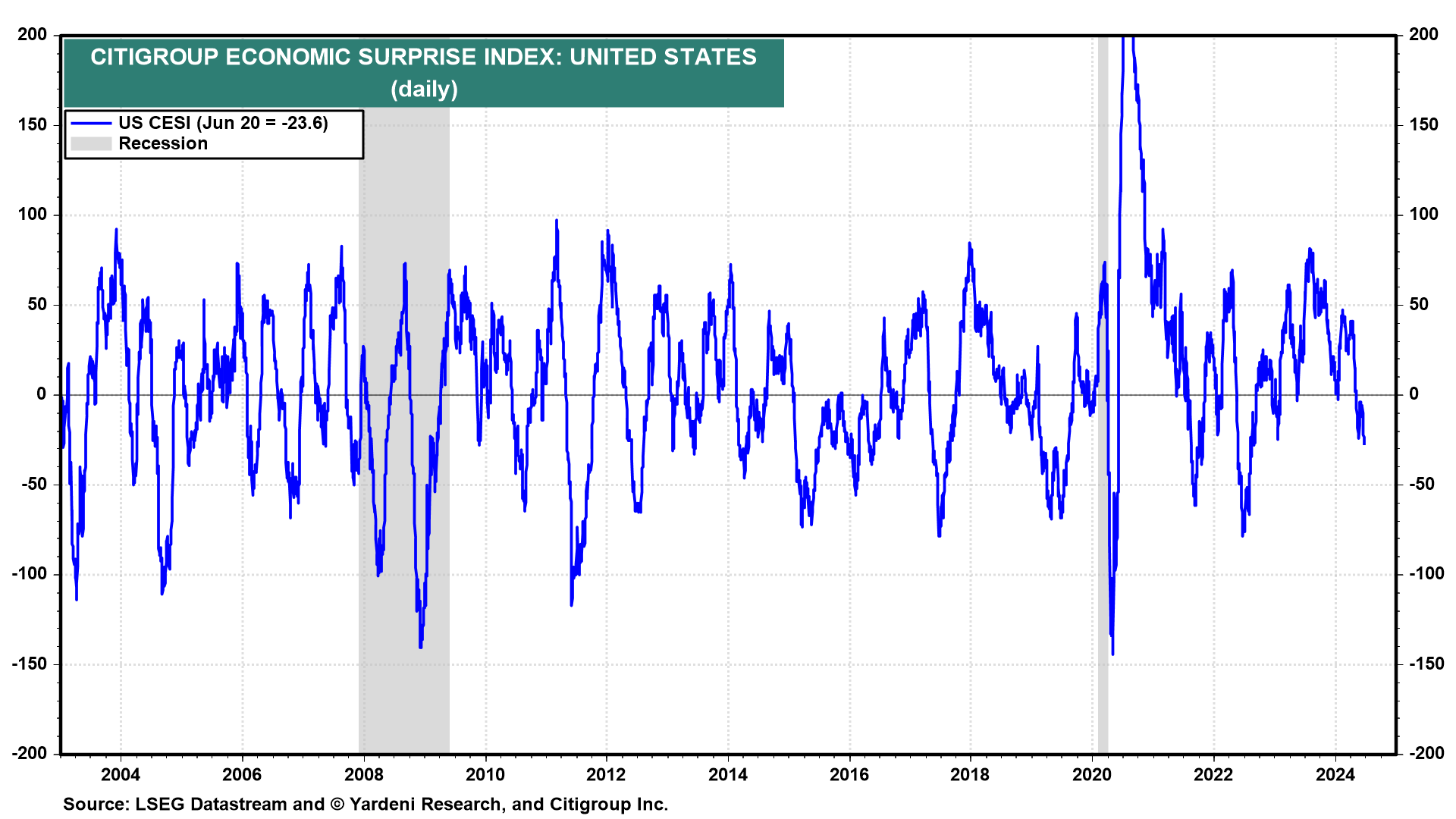

Today's batch of economic indicators was on the weak side. Indeed, the Citigroup Economic Surprise Index fell deeper into negative territory today (chart). Does this suggest that the odds of a recession are increasing? Nope: The Atlanta Fed's GDPNow tracking model is now projecting 3.0% real growth in Q2, down from 3.1% on June 18.

The stock market held its ground: The S&P 500 briefly crossed 5,500 for the first time in its history, before Nvidia's -3.5% breather helped drag the index a bit lower into the close. The 10-year Treasury bond yield remained around 4.25% as investors concluded that the Fed's higher-for-longer interest rate policy remained intact.

Today's batch of economic indicators included housing starts, two regional business surveys for June, and initial unemployment claims. Let's review the data:

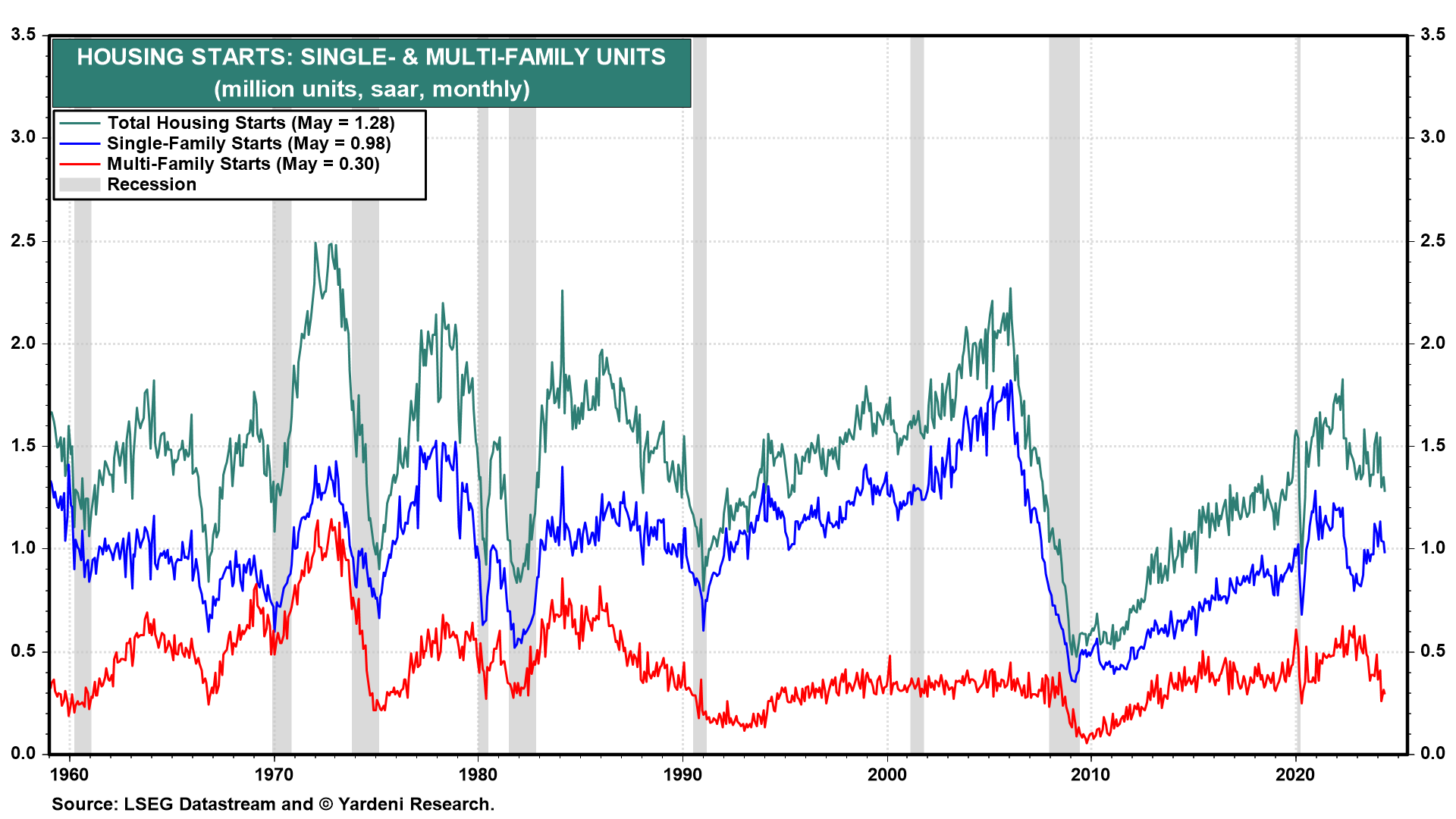

(1) Housing starts & permits. Recent housing starts reports including May's released today showed that the rolling recession in housing has spread to the construction of multi-family units. Over the past 12 months through May, total, single-family, and multi-family housing starts are down 19.3%, 1.7%, and 49.5% (chart).

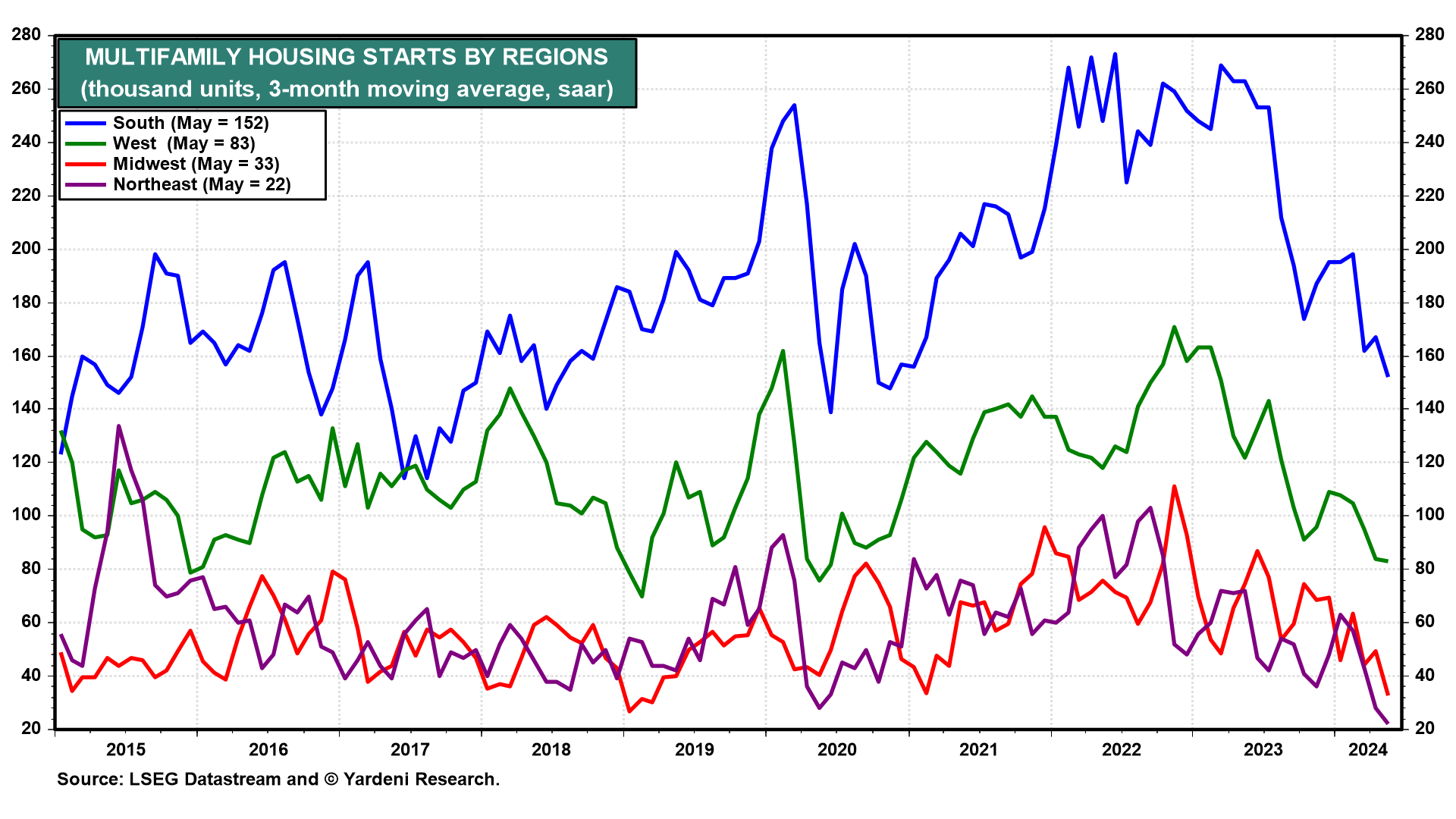

Builders raced to put up multi-family housing units in southern states like Florida, North Carolina, and Texas to meet the post-pandemic demand boom. In recent months, multi-family starts has plunged there and across the country (chart). This suggests that there has been overbuilding, which should continue to depress rent inflation.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a