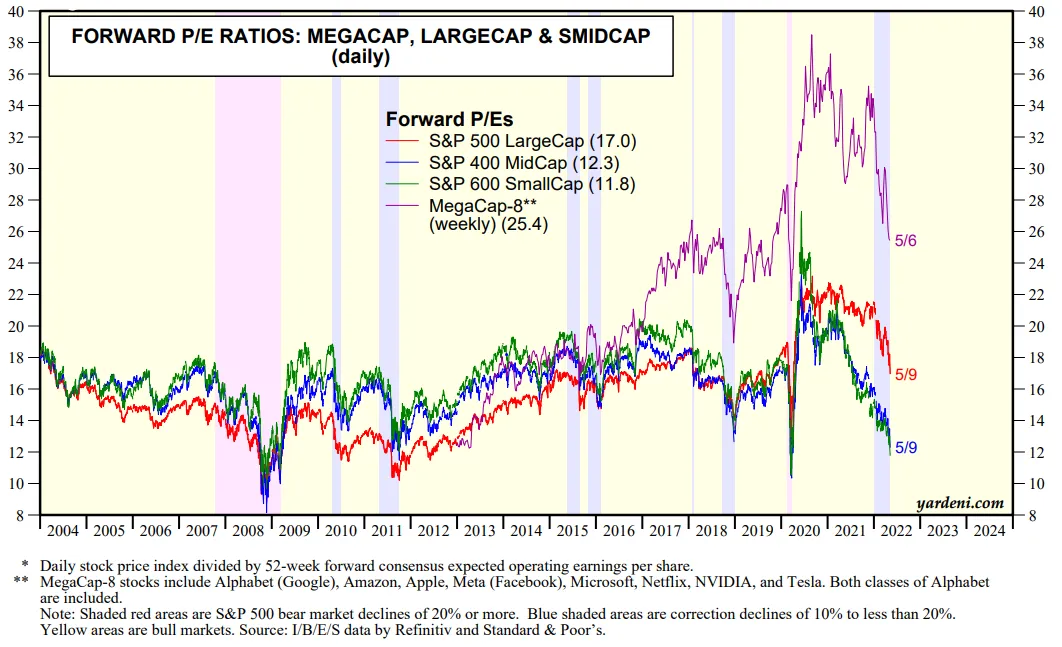

The meltdown in forward P/Es continued yesterday, while forward earnings continued to scale new heights.

In other words, there’s an epic tug-of-war between bearish investors who are lowering the valuation multiples they’ll pay and bullish industry analysts who are raising the earnings they forecast for this year and next year.

So far this year, investors have been winning the war. But it isn’t over just yet, as the S&P 500 remains in correction territory—though it has gotten closer to bear-market territory now that it is down 16.8% from its record high on January 3 through yesterday’s close.

The forward P/Es of the S&P 400 and 600 dropped to 12.3 and 11.8 yesterday. Those are extremely cheap valuation multiples if there’s to be no recession this year or next year, as we are still forecasting.

In this no-recession scenario, we expect the downside risk for the S&P 500 forward P/E (currently at 17.0) is to around 16.0.

Note: “Forward P/E” is price/earnings ratio using forward earnings as the denominator. “Forward earnings” is the time-weighted average of industry analysts’ consensus operating earnings per-share estimates for this year and next. The time weighting removes past periods from the estimates, making a useful proxy for expected results over the next 52 weeks.