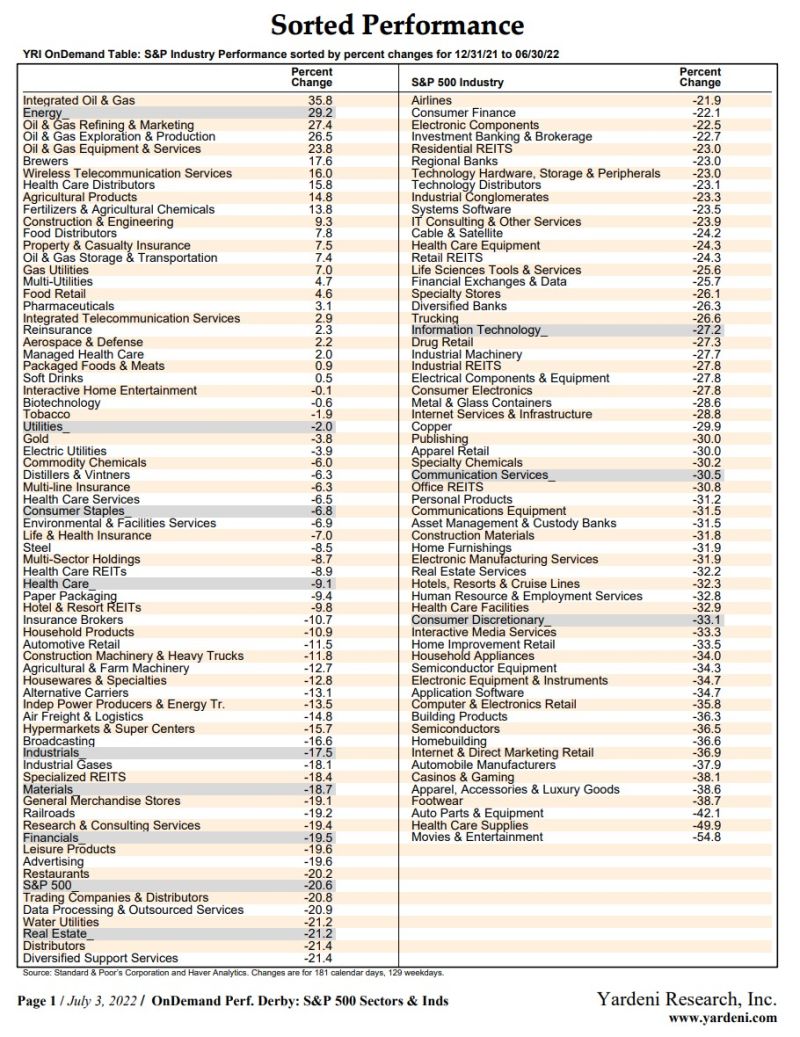

The S&P 500 fell 20.6% during H1-2022 (table below). That's on the edge of a bear market , which is defined as a 20%+ decline. Here are a few more quick takeaways:

(1) Of the 11 S&P 500 sectors, only Energy was up, and several industries were down by 30% or more: Energy (29.2), Utilities (-2.0), Consumer Staples (-6.8), Health Care (-9.1), Industrials (-17.5), Materials (-18.7), Financials (-19.5), S&P 500 (-20.6), Real Estate (-21.2), Information Technology (-27.2), Communication Services (-30.5), and Consumer Discretionary (-33.1).

(2) The latter three sectors were crushed by the selloff in the MegaCap-8 stocks. They are widely viewed as technology companies; but, in fact, only three of them are in the S&P 500’s Information Technology sector (Apple, Microsoft, and Nvidia), three are in the Communication Services sector (Alphabet, Meta, and Netflix), and two are in the Consumer Discretionary sector (Amazon and Tesla).

(3) Just for perspective, the S&P 500 has given back its 25% gain from February 8, 2021 through January 3, 2022. As of July 1, only 32% of the S&P 500 companies showed positive y/y stock price comparisons.