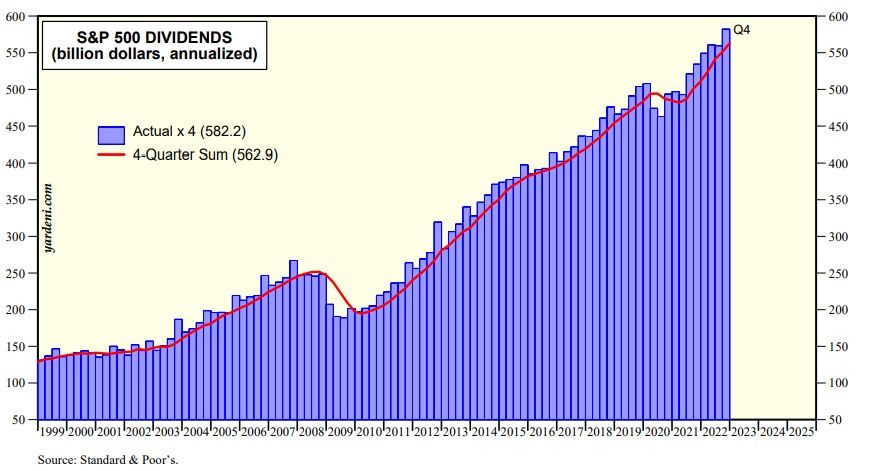

Dividends are like plants. Both grow. But dividends can grow forever, while the size of plants is limited. Notwithstanding last year's bear market, S&P 500 dividends grew to a record high of $562.9 billion during 2022 (chart). Dividends tend to fall during recessions along with profits. There was no recession last year. There may not be one this year.

Money invested in the S&P 500 during 2010, 2000, 1990, 1980, and 1970 would have a current dividend yield of 5.3%, 5.1%, 20.2%, 49.3%, and 77.6% on the original amounts invested at those times (chart). And, of course, the value of the investment purchased at those times would have appreciated along the way too.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a