Previously, we observed that industry analysts covering the S&P 500 (as well as the S&P 400 and S&P 600) shaved their 2022 and 2023 during the Q2 earnings reporting season that started in July and ended in August. That may be it for now until they get another round of guidance from company managements for Q3 starting in October.

Analysts remain mostly bullish on S&P 500 revenues in part because they go up along with inflation. Furthermore, very few industries (such as the S&P 500 Homebuilding) are showing signs of falling into a recession currently.

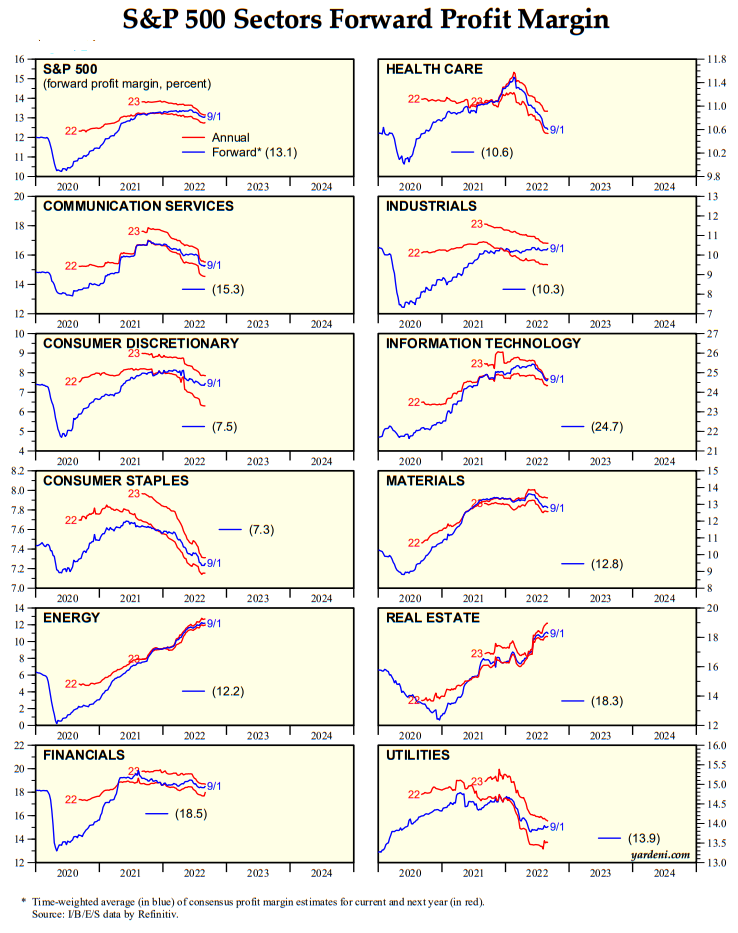

The charts below show that industry analysts have been shaving their profit margin estimates for nine of the 11 sectors in the S&P 500. Only Energy and Real Estate margins have been revised higher. We aren't expecting margin estimates to fall much further this year as long as there's no economy-wide recession. In addition, the recent weakness in oil prices could boost margins for many companies.