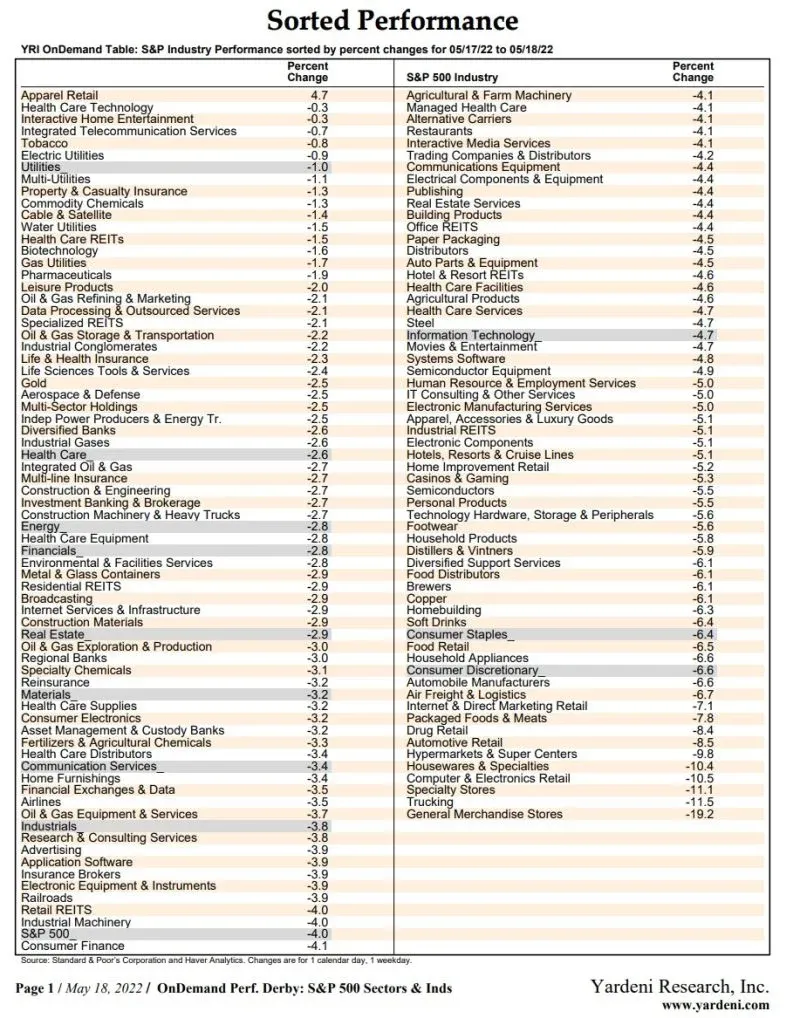

Today's 4.0% plunge in the S&P 500 was more of the same pain experienced by most of the 11 sectors of the S&P 500 so far this year.

The only sector that's up ytd is Energy with a gain of 46.2%, though it was down 2.8% today. (We continue to recommend overweighting it.)

The worst performing sector is now Consumer Discretionary, which is down 30.8% ytd after having lost 6.6% just today. Retailers were especially hard hit today after Target's disappointing Q1 earnings report. Year-over-year comps are challenging because consumers received a third round of stimulus checks last March. This year, the resulting inflation is weighing on consumers' purchasing power.

In addition, costs are squeezing margins. It may be getting harder for retailers to raise some of their prices. There is mounting evidence that consumers are resisting price increases of discretionary merchandise because they have to pay more for groceries and gasoline. As a result, retailers have been forced to discount to reduce swelling retail inventories of some discretionary items.

The only good news in all this bad news is that inflation might show more signs of abating for consumer durable goods and other discretionary merchandise in coming months.