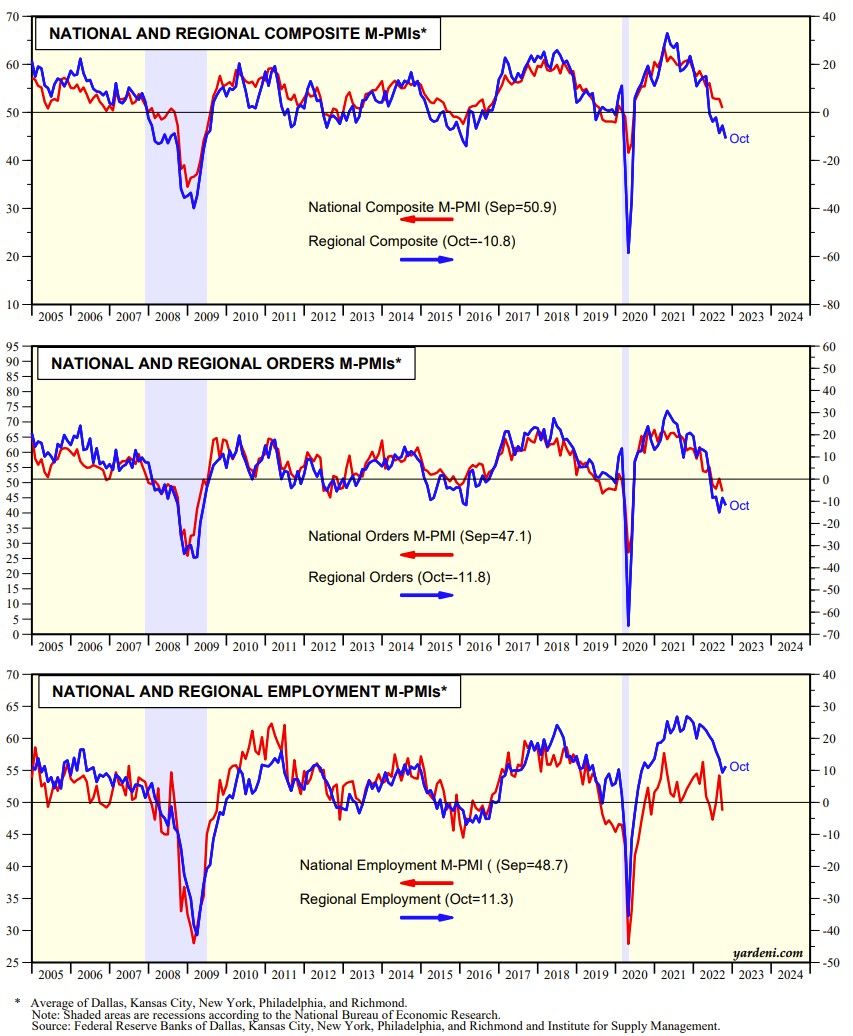

Bonds and stocks might rally tomorrow if the M-PMI is as weak as suggested by the regional business surveys conducted by five of the 12 regional Federal Reserve Banks. The average of the five composite indexes dropped deeper into negative territory during October (chart). The average of the new orders indexes remained near recent negative readings, while the average for the employment indexes remained solidly positive. All three are highly correlated with their comparable national PMIs.

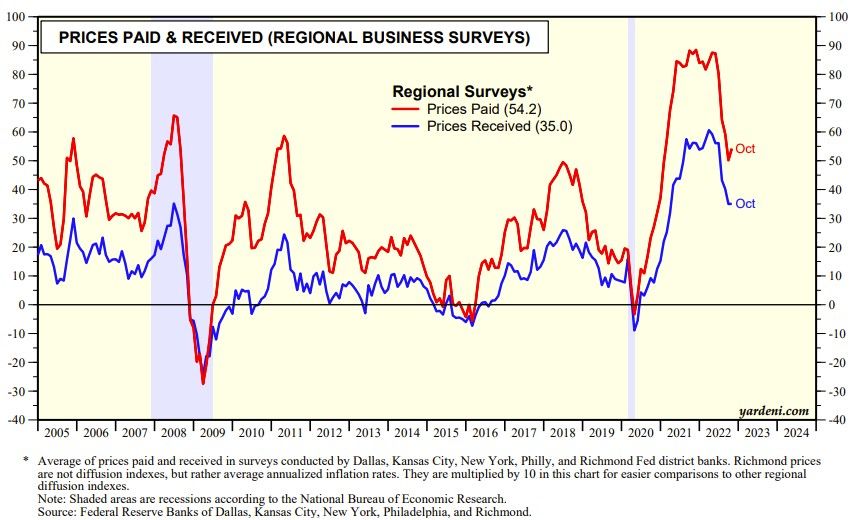

A weak set of M-PMI numbers might increase the likelihood that the Fed will pause rate hiking early next year after two more hikes this year. Then again, the Fed might welcome weak business cycle indicators as long as inflation remains persistently high. The averages of the prices-paid and prices-received regional indexes have been declining for the past few months, but stopped doing so in October at relatively high levels (chart).