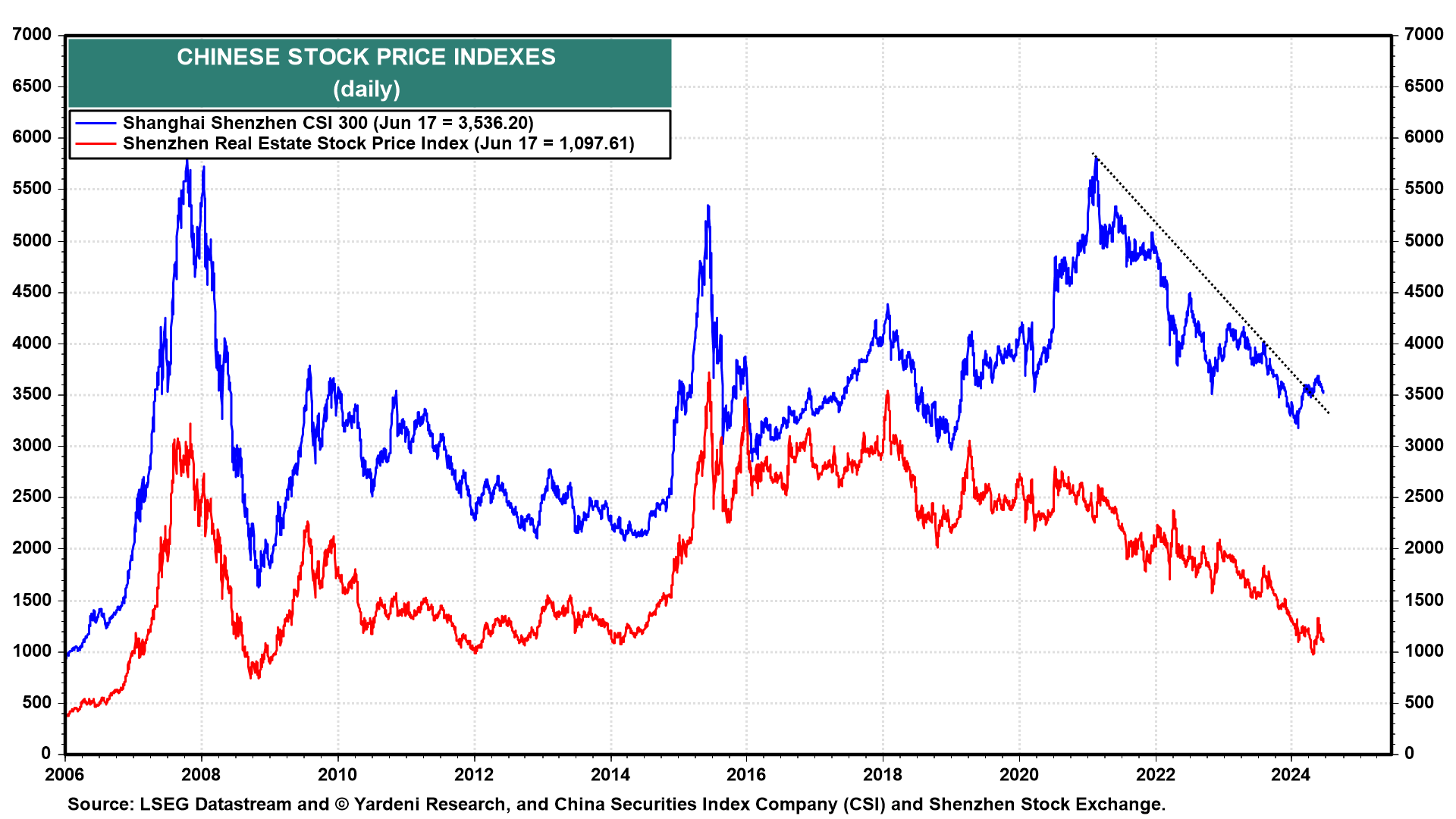

China’s May economic indicators were broadly negative, as evidenced by the recent weakness in Chinese stock prices as well as the price of copper, which is very sensitive to economic developments in China (chart). The bursting of China's property bubble continues to weigh on the economy despite the government's lame measures to support property prices. Weak home sales and property investment data sent Chinese real estate stocks tumbling. The recent rally in the CSI 300 seems to be faltering too.

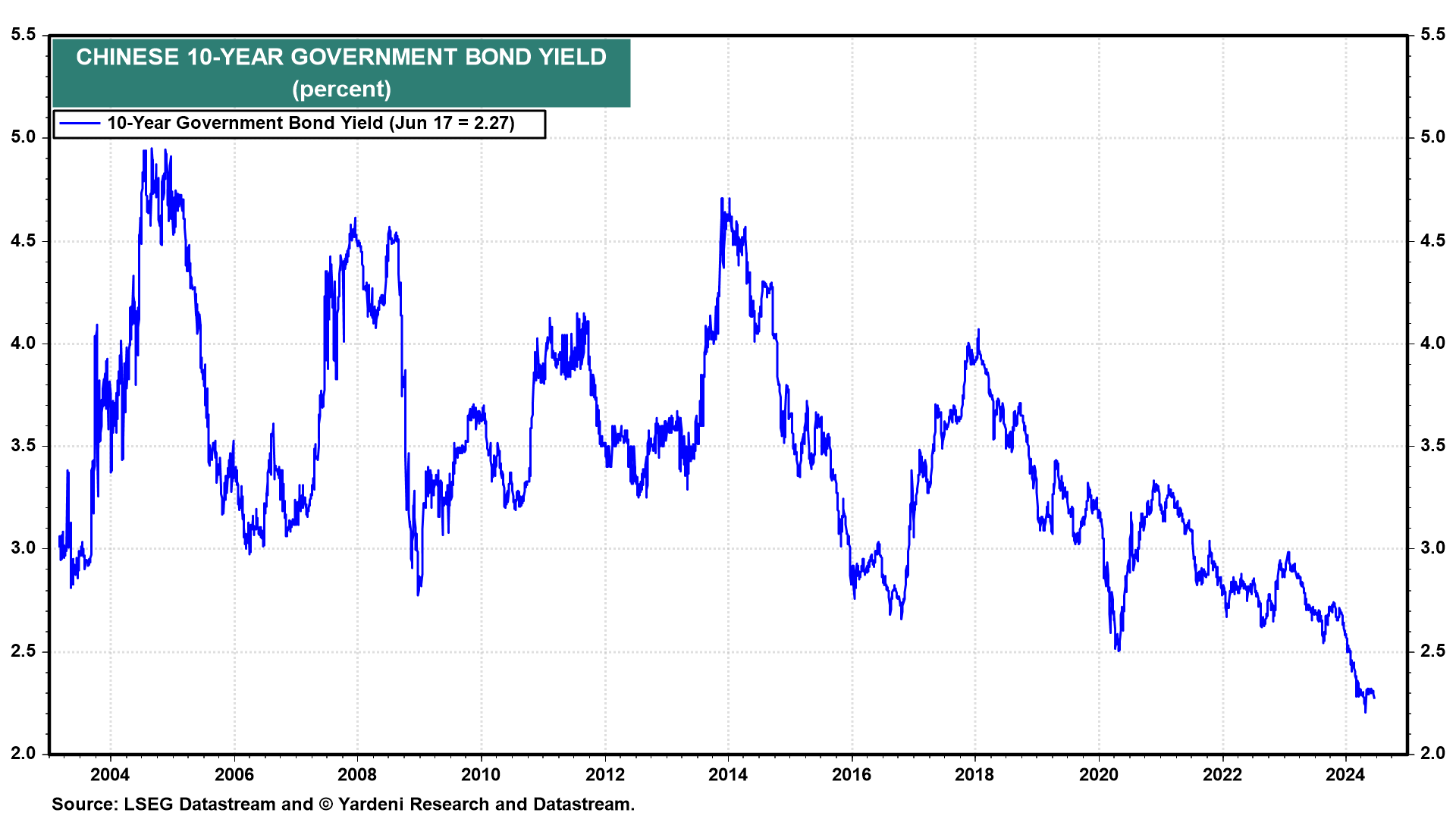

The PBOC left a key interest rate steady for the 10th straight month on Monday. The central bank is attempting to avoid a bubble in the government bond market, according to state-run financial media cited by Bloomberg (chart). The PBOC may also be trying to limit weakness in the yuan now that it has fallen -2.1% against the US dollar this year.

China's sluggish growth could continue to keep foreign stock buyers away as long as the government's stimulus response is viewed as timid. In any event, we don't recommend investing in an economy so tightly controlled by the government. Here's a brief review of China's latest data:

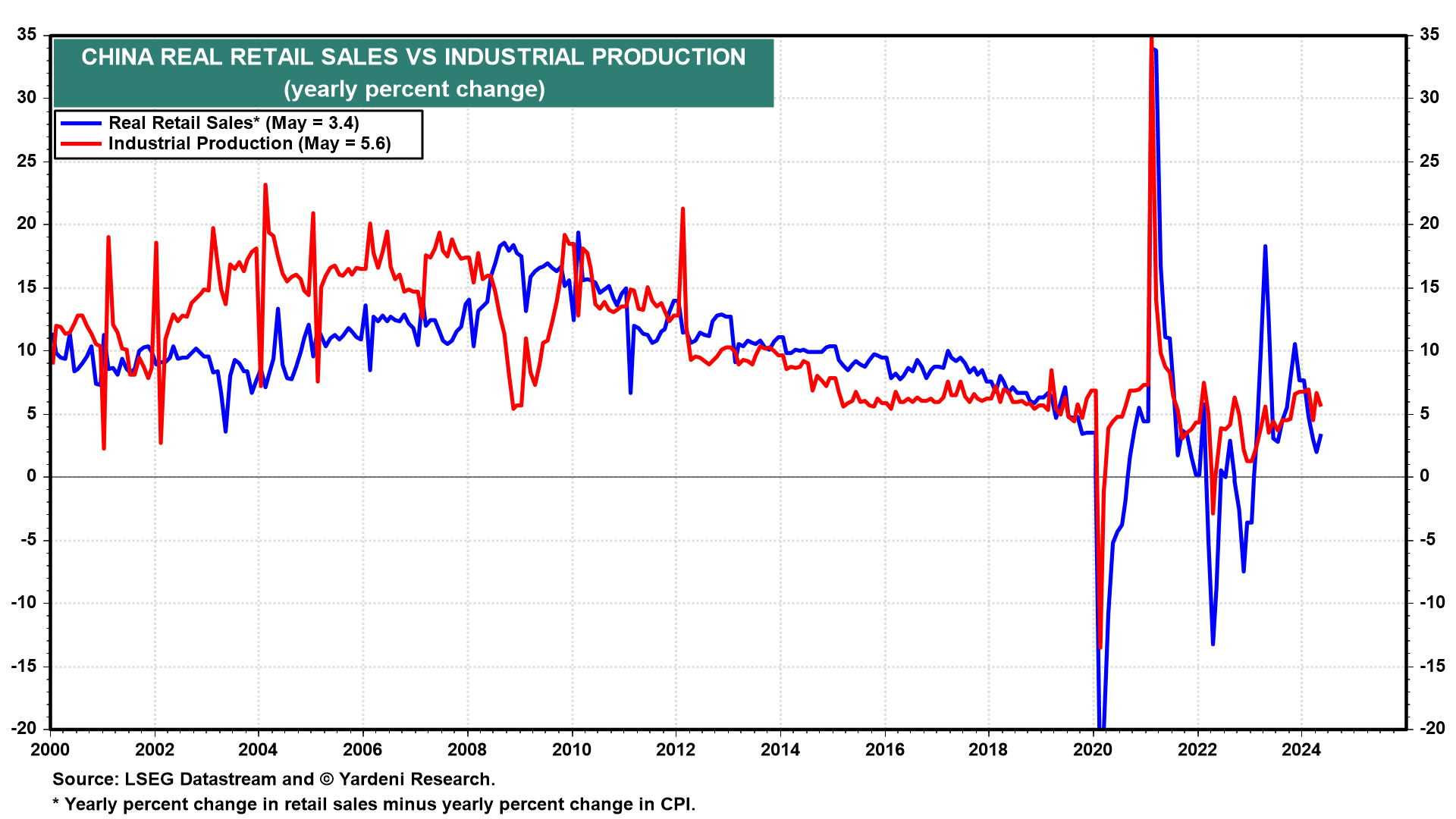

(1) Consumption & production. The one bright spot for China was that real retail sales rose 3.4% y/y in May, up from 2.0% in April. That's still relatively slow. Furthermore, the country's industrial production weakened to a 5.6% y/y pace from 6.7%.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a