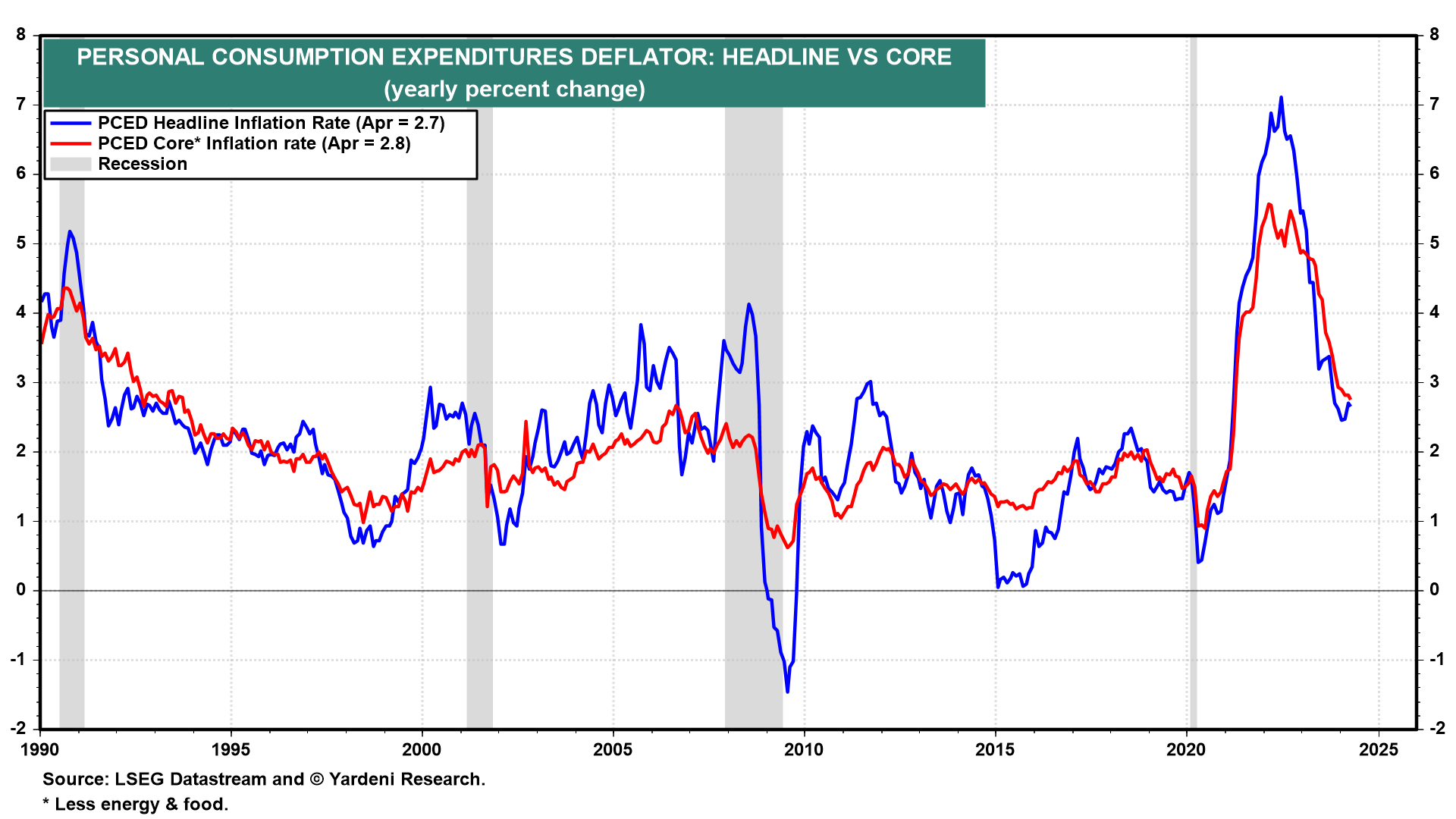

We still expect that the Fed's preferred core PCED inflation measure will fall to the Fed's 2.0% target by the end of this year (chart). It was already down to 2.8% y/y in April. May's number will be released on Friday, and should show further progress.

We don't see the Fed cutting the federal funds rate (FFR) this year, which should keep the 10-year yield above 4.00% in the second half of 2024. Here's our take on the latest relevant developments and Fedspeak:

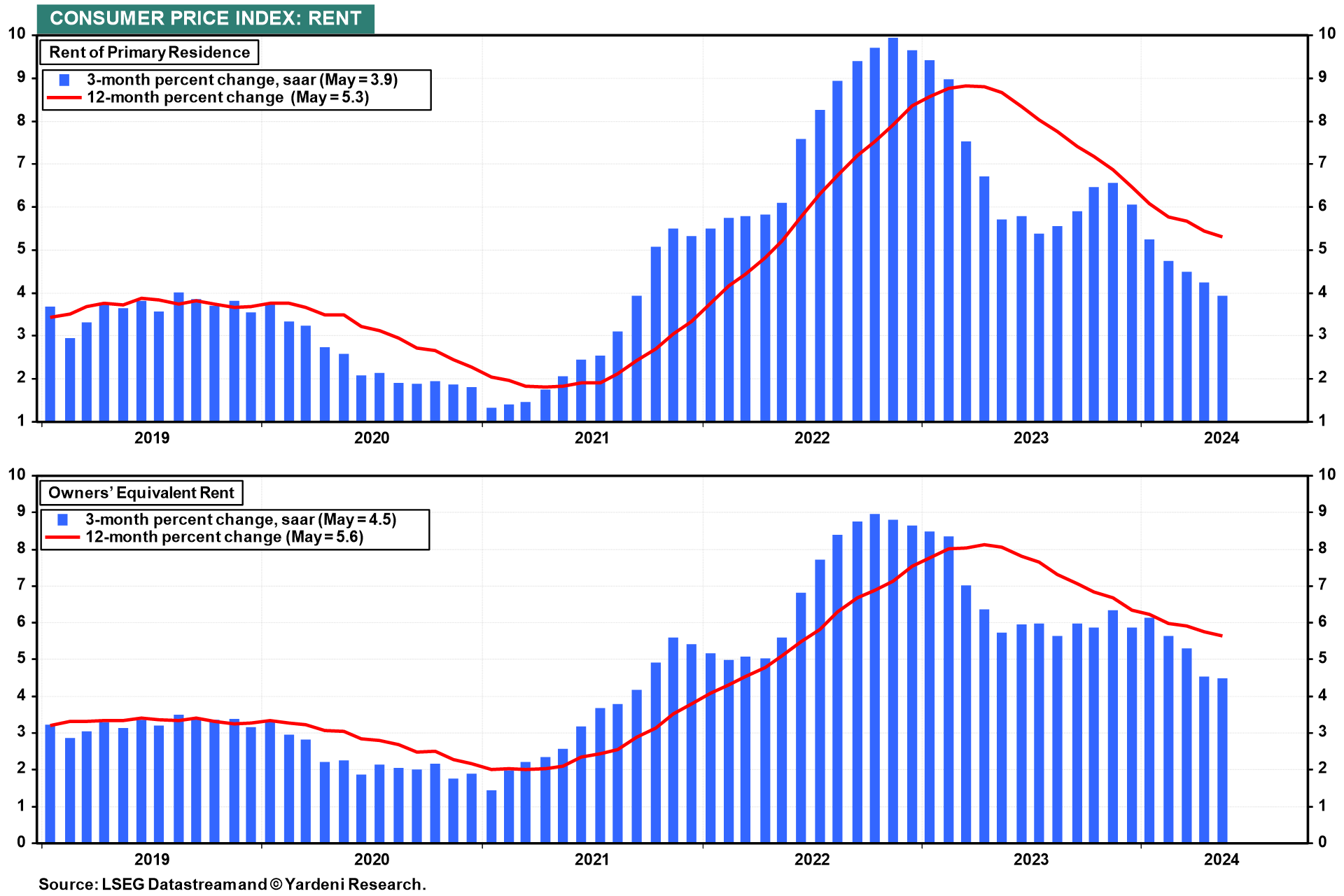

(1) Rent inflation. Rent inflation continued to moderate through May in the CPI (chart). It should do the same in May's PCED report on Friday.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a

¿Ya tiene una cuenta?

Iniciar sesión