Today's PPI report threw some cold water on yesterday's hotter-than-expected CPI. Our opinion is that the Fed won't be lowering interest rates this year because the economy and labor market will remain strong. Yesterday's CPI confirmed our conclusion based on the wrong premise. We aren't expecting inflation to get stuck above the Fed's 2.0% target. We think it will continue to moderate closer to that goal by the end of this year. So we don't expect that the Fed will have to start thinking about thinking about raising interest rates again. Consider the following:

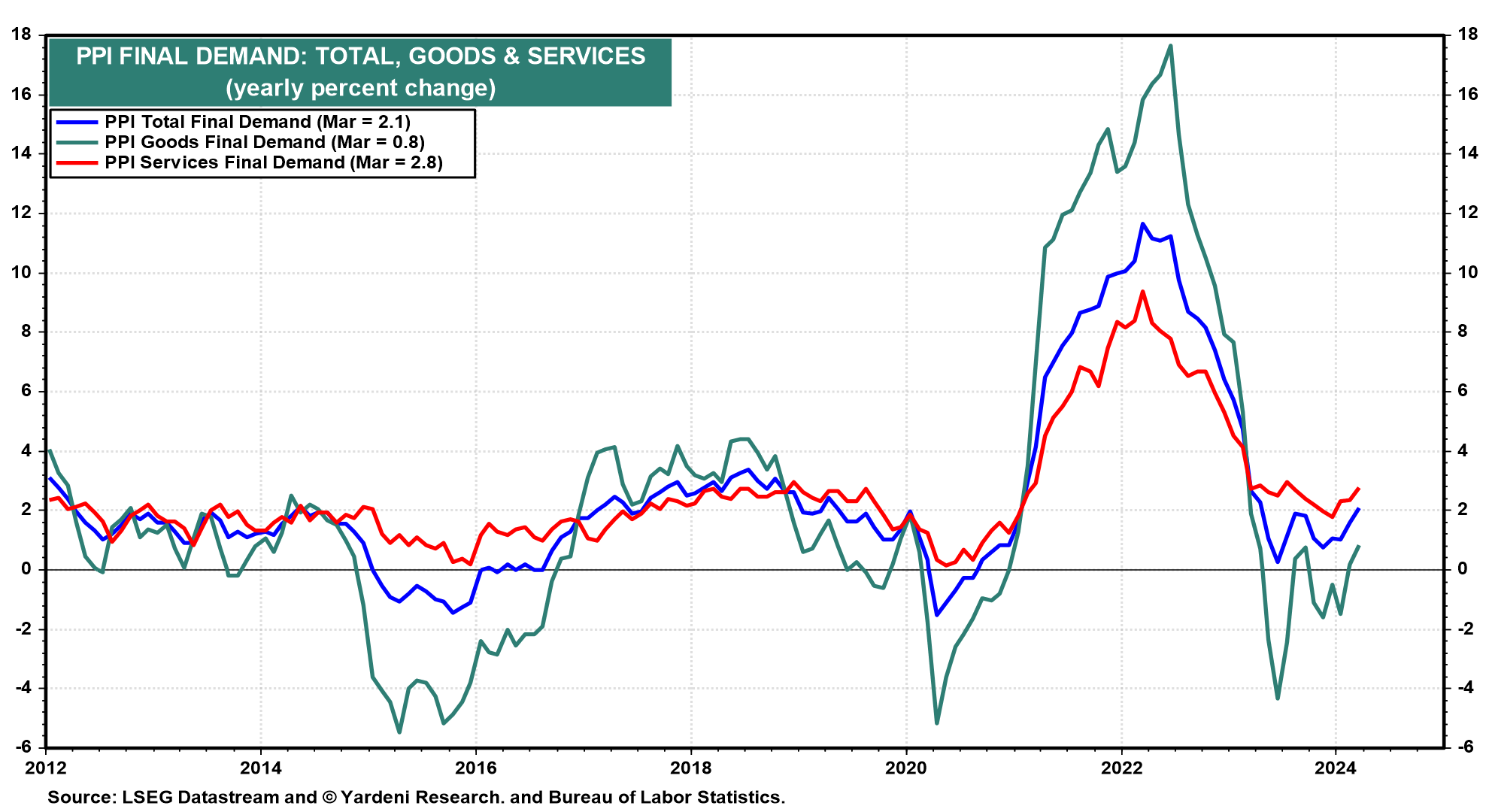

(1) PPI final demand. For the past year through March, the PPI final demand inflation rate has been hovering around 1.0% y/y with goods up only 0.8% and services up 2.8% (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a