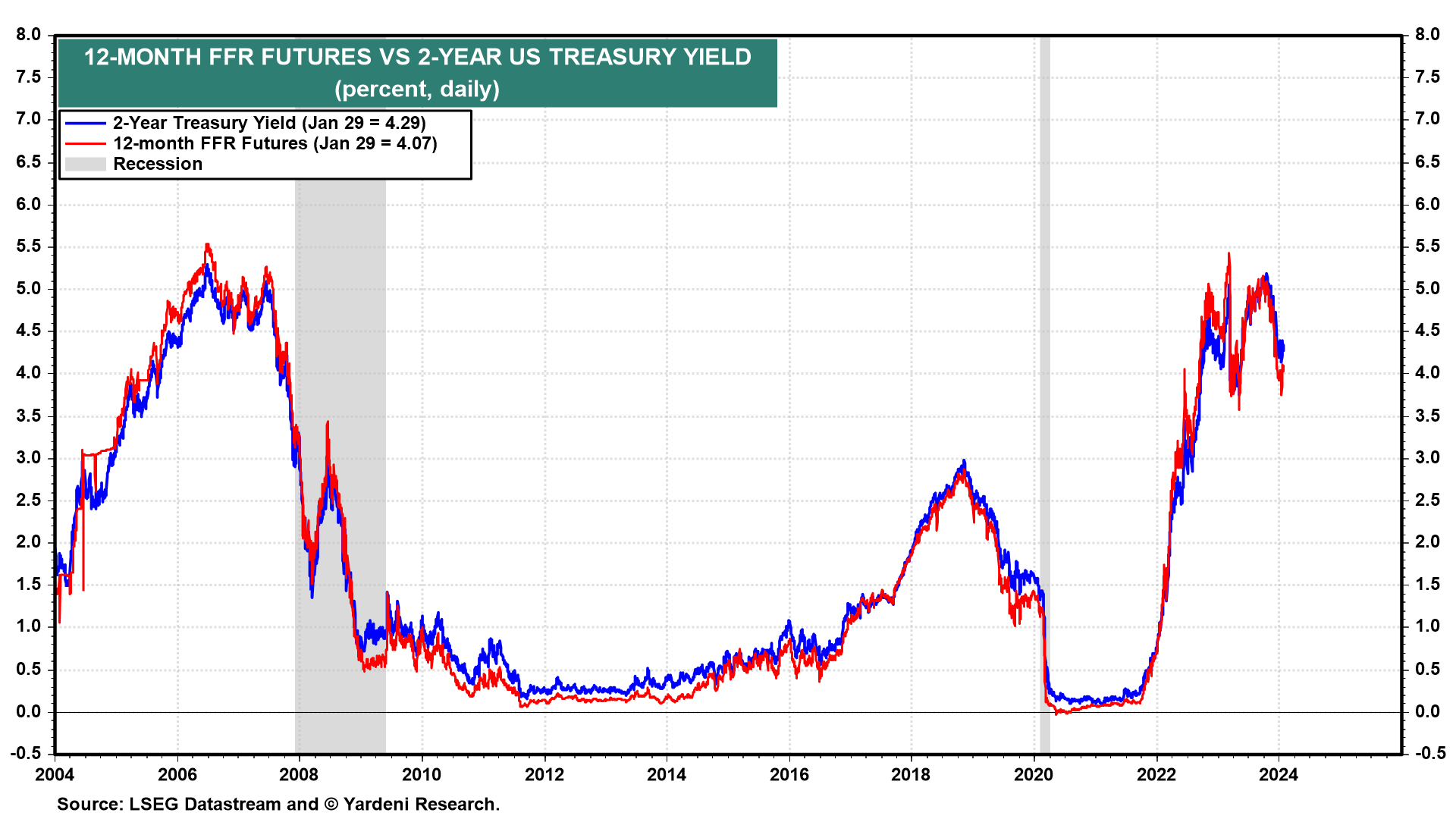

Fed Chair Jerome Powell might disappoint the markets on Wednesday, when he conducts his press conference to discuss the decision of the latest FOMC meeting. He will say that economic growth has been better than expected and that inflation seems to be falling towards the Fed's 2.0% target faster than expected as well. He knows that the markets are expecting five 25bps cuts in the federal funds rate over the next 12 months. That's according to today's 12-month federal funds rate futures at 4.07% (chart).

He is likely to push back against this notion by observing that financial conditions have eased significantly since late last year. That is evident in the yield spread between high-yield corporate bonds and the 10-year US Treasury bond (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a