The Fed cut the federal funds rate (FFR) by 50bps today. This marks the end of the Fed’s monetary policy tightening cycle that started during March 2022, which was aimed at bringing inflation back down to 2.0% even if that caused a recession. Inflation isn't quite there yet, but it is close enough. So today, in his presser, Fed Chair Jerome Powell reiterated that the Fed's main focus now is to keep a lid on the unemployment rate.

In response to the Fed's statement at 2:00 p.m., the S&P 500 rallied to a new record high of 5674 by 2:30 p.m. when Powell's presser started. As he spoke, however, stocks turned down and closed lower on the day as the 10-year Treasury yield rose above 3.70%. We still expect the stock market to climb to new record highs after the November presidential election. Now that the Fed is stimulating the economy, the hard-landing crowd should disperse.

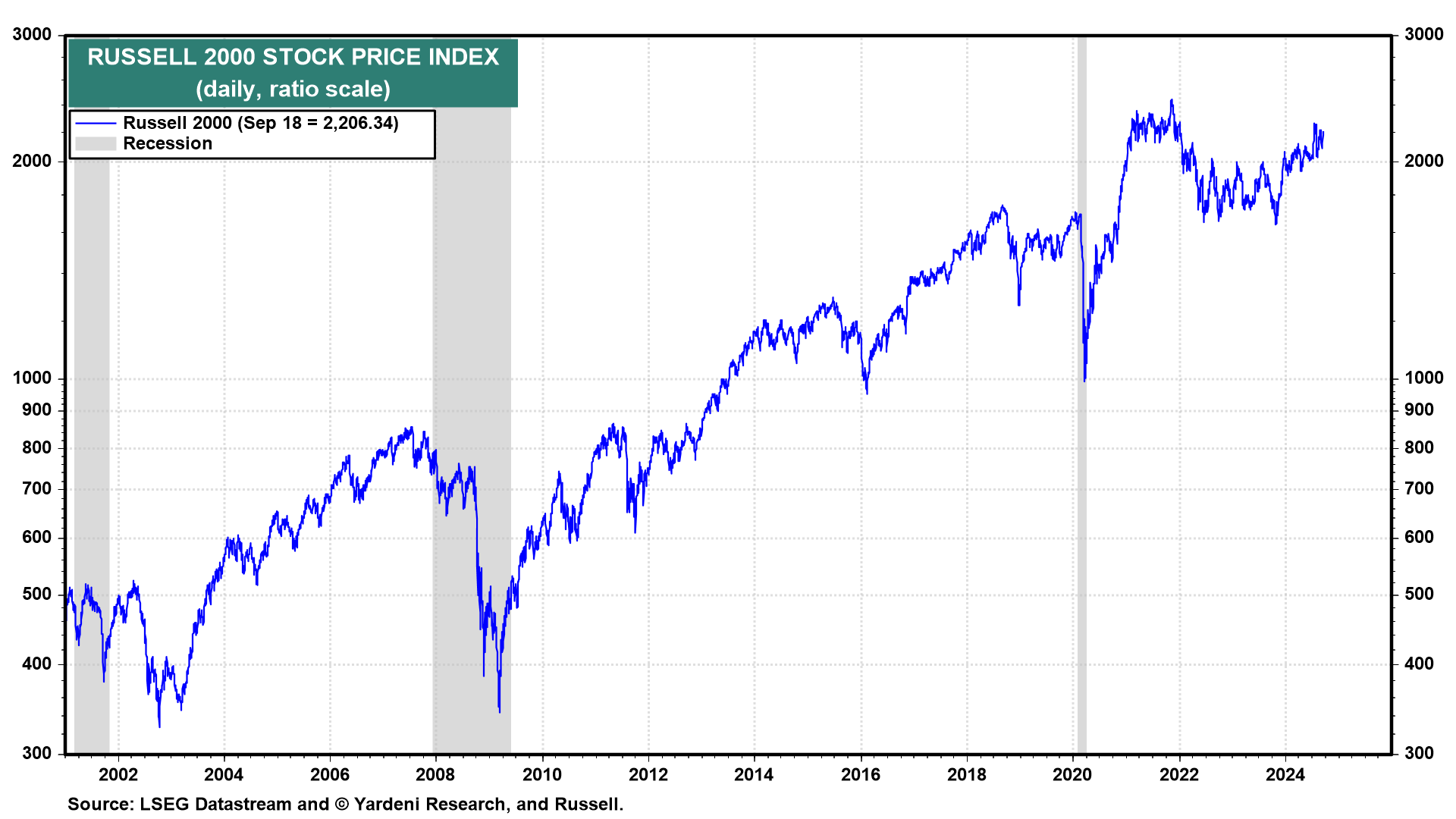

Leveraged companies that rely on floating rate debt now have cheaper debt servicing costs. The Russell 2000 index of small companies finished the day higher (chart). The S&P 493—including value stocks and other sectors that missed out on the Tech-led bull market—should begin to catch up.

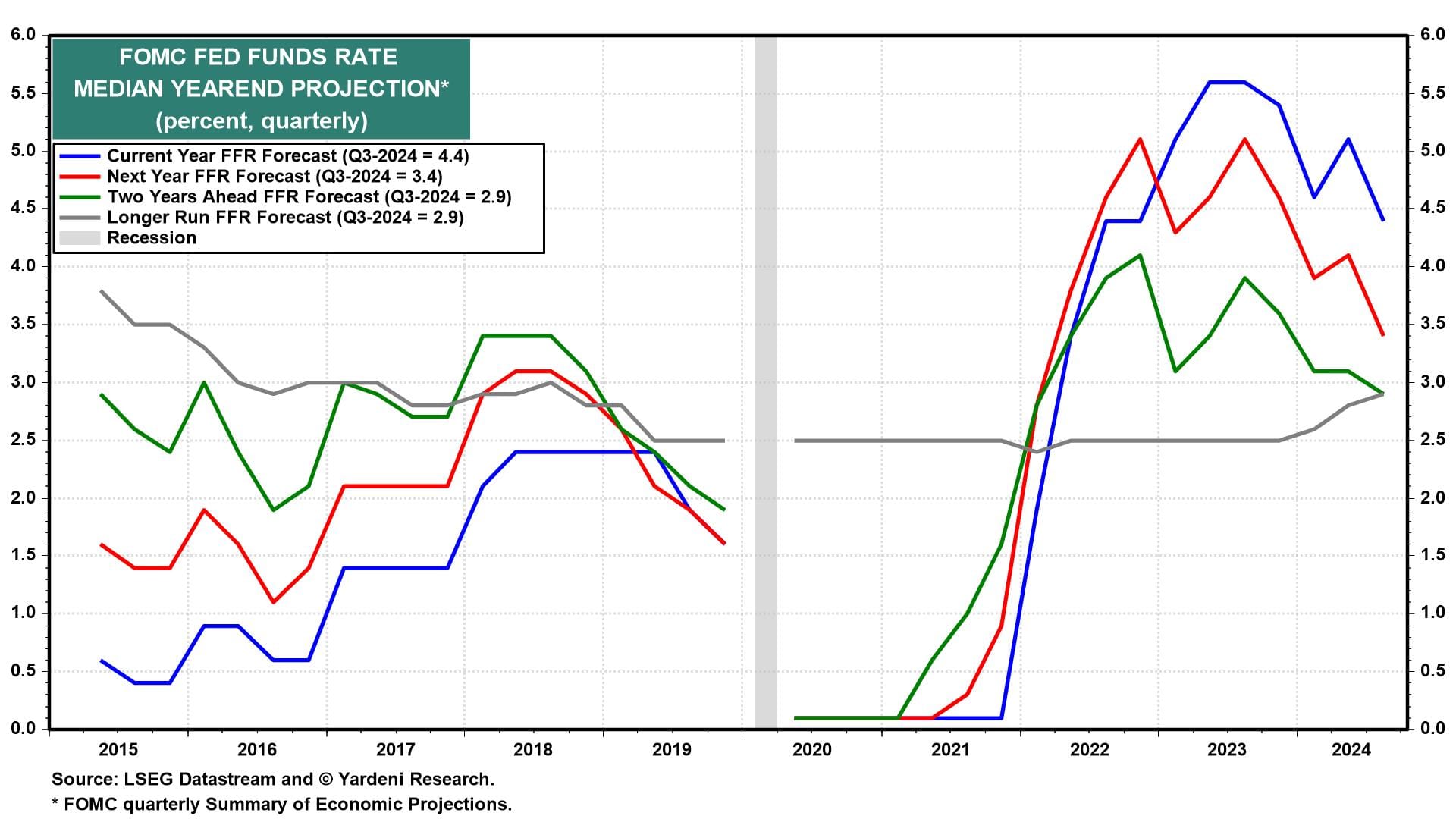

The bond market's initial reaction to the Fed rate cut seems to agree with our assessment that today's big cut could be more than the economy needs. The FOMC has signaled one or two more cuts this year in the updated Summary of Economic Projections (SEP) with another 100bps of cuts next year (chart).

The FOMC has a slower economic outlook than we do. The latest SEP shows that officials' forecast for the unemployment rate was raised 0.4 percent higher to 4.4% for 2024 and upped by 0.2 percent for 2025 to 4.4% and 2026 to 4.3%. Real GDP, meanwhile, is expected to grow just 2.0% this year and the next two. Current economic data suggest otherwise, and we expect that better-than-expected productivity growth will boost real economic growth through the end of the Roaring 2020s.

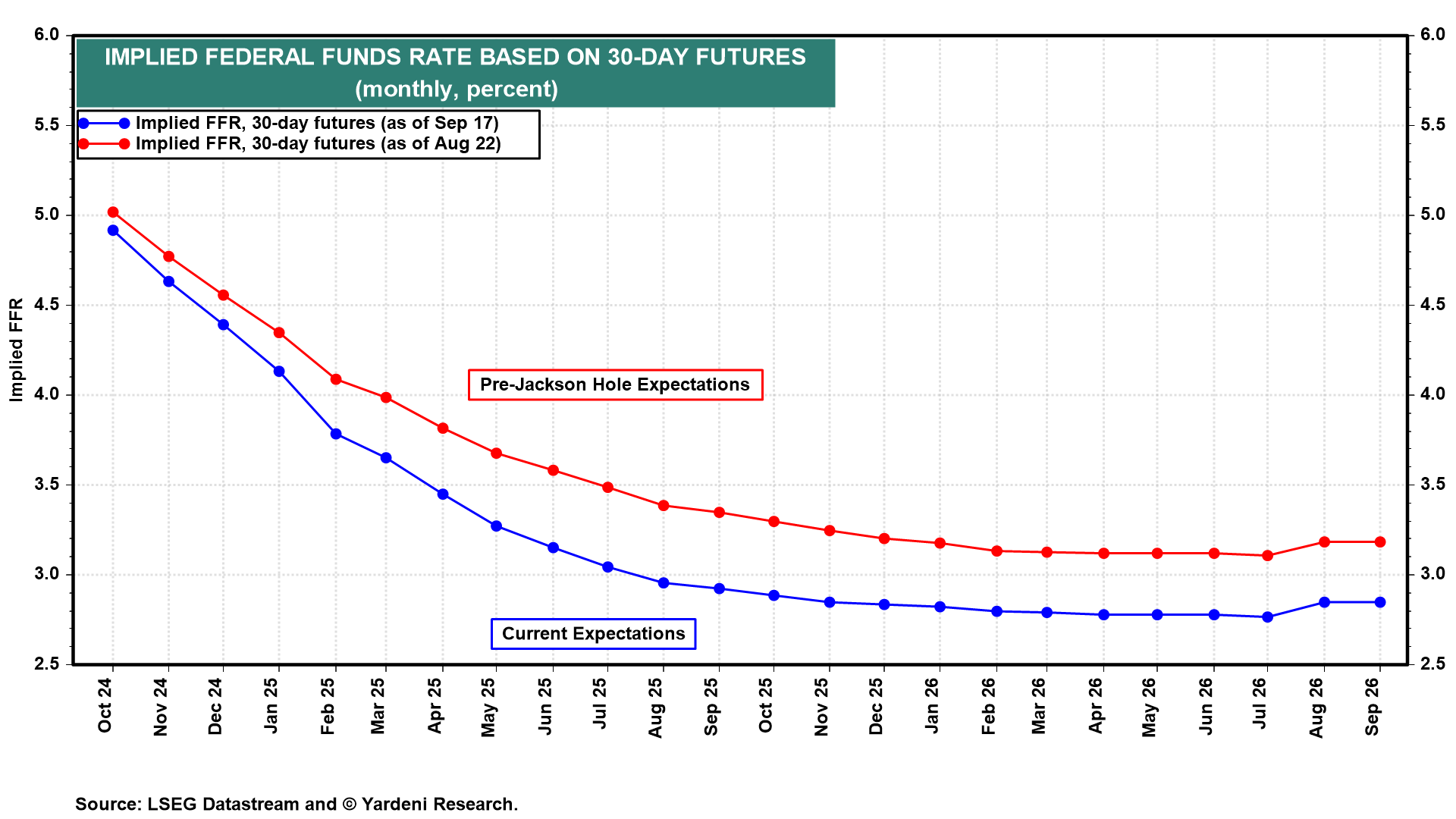

By the way, the FOMC's updated rate forecasts show the FFR falling to 2.9% in 2026. That implies a much slower pace of rate cuts than the FFR futures market, which expects 2.8% in the next 12 months (chart).

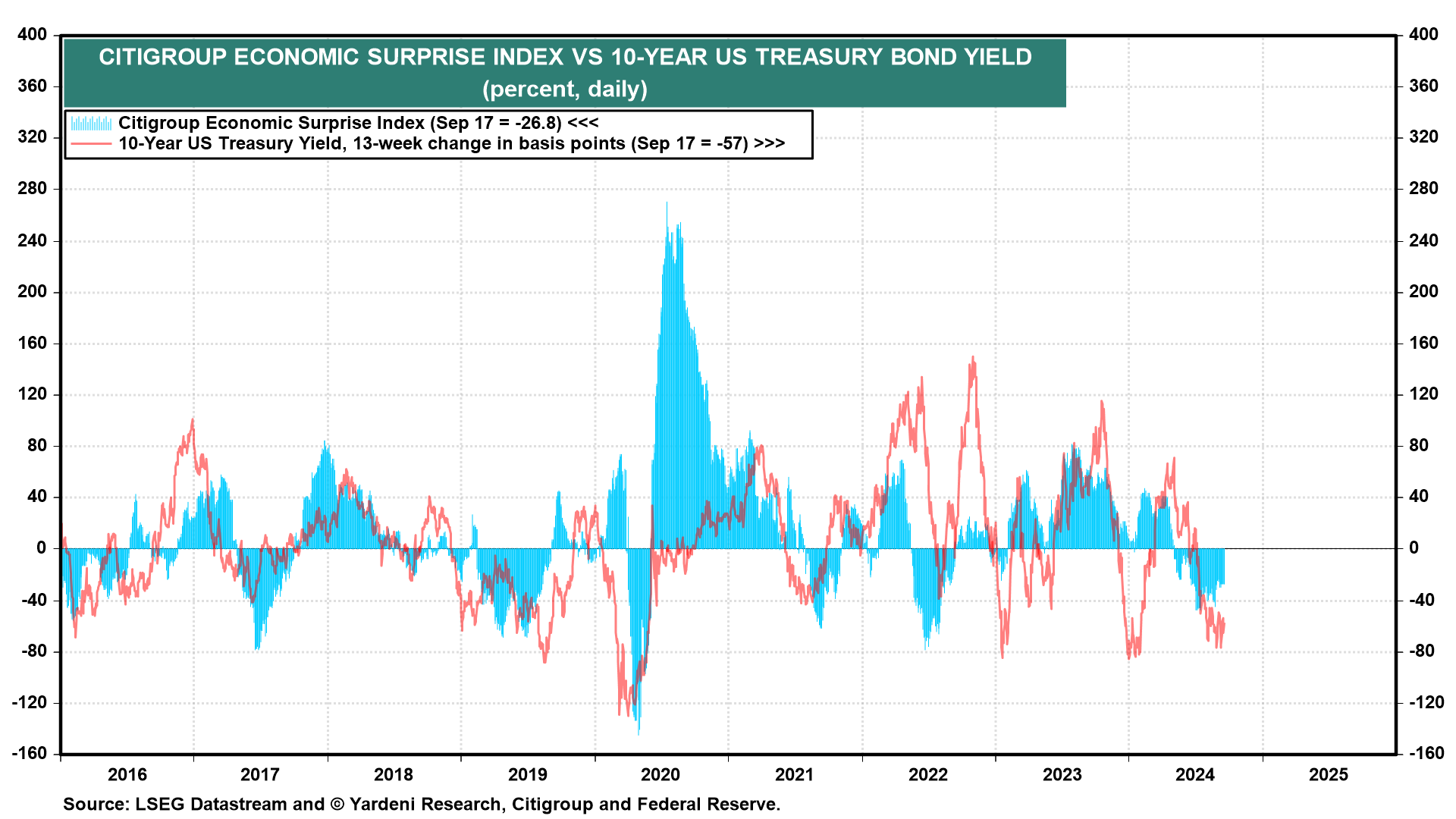

We are anticipating that the economic data will come in stronger than expected, especially now that the Fed has started to actually lower the FFR. In this scenario, the bond yield might have bottomed for a while and head back up closer to 4.00% (chart).

The FOMC had its first dissent since 2022 at this meeting. Fed Governor Michelle Bowman voted for a smaller 25bps rate cut. But the Fed's dot plot, updated in its new SEP, suggests dissent was much greater. Two participants favor not reducing rates again this year, and another seven see just one 25bps cut later this year.

Diverging views among Fed officials are likely to be evident in the meeting minutes which will be released in a few weeks. Powell's ability to cajole his fellow FOMC colleagues into his newly adopted dovish stance will be tested at the next two meetings.