Rapidly rising inflation since early last year has forced the Fed to raise interest rates significantly this year. That's been bad news for stock and bond investors, particularly this year. From the end of the Great Financial Crisis through the end of the Great Virus Crisis (i.e., 2009-2021), the winning investment strategy was to own both assets. Investors' mantra was: "Don't fight the Fed when the Fed is fighting deflation with easy monetary policies." This year, the winning strategy has been to hold lots of cash. Investors' mantra has been: "Don't fight the Fed when the Fed is fighting inflation with tight monetary policies."

The second version of that adage will still make sense until inflation shows clear signs of moderating. The next important reading on inflation will be October's CPI, which will be released on Thursday, November 10. October's PMIs suggest that inflation should moderate in coming months:

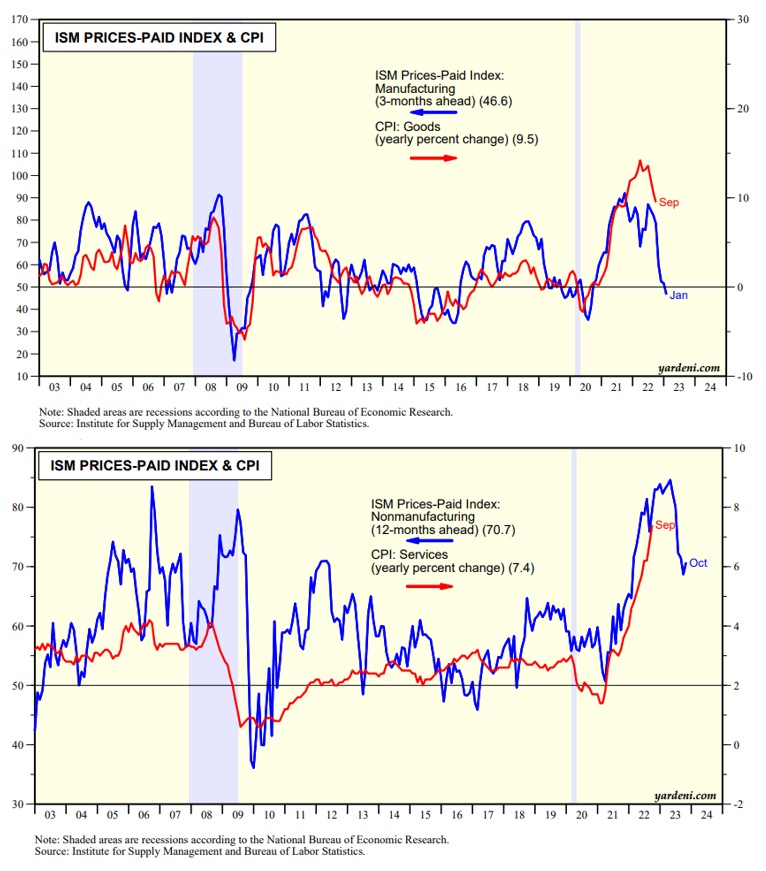

(1) CPI Goods. October's M-PMI leads the CPI goods inflation rate by about three months (chart). The former confirms that the latter peaked earlier this year and should moderate significantly in coming months.

(2) CPI Services. The NM-PMI leads the CPI services inflation rate by about 12 months (chart). The former suggests that the latter, which hasn't peaked yet, should do so over the next few months before dropping sharply in the spring and summer of next year.