The Silicon Valley Bank imploded on Friday, March 10. To avert a widespread bank run, the Fed announced, on Sunday, March 12, that liquidity would be provided by the Bank Term Funding Program (BTFP). The Fed's press release stated that this new liquidity facility will offer loans of up to one year in length to financial intermediaries pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. "The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution's need to quickly sell those securities in times of stress," which is what caused SVB's downfall.

In effect, the Fed Put is back, though it is aimed at backstopping the banks this time, which indirectly supports the stock market. The question is whether that will do the trick to stop a credit crunch and a stock market crash.

The jury is out, but so far so good:

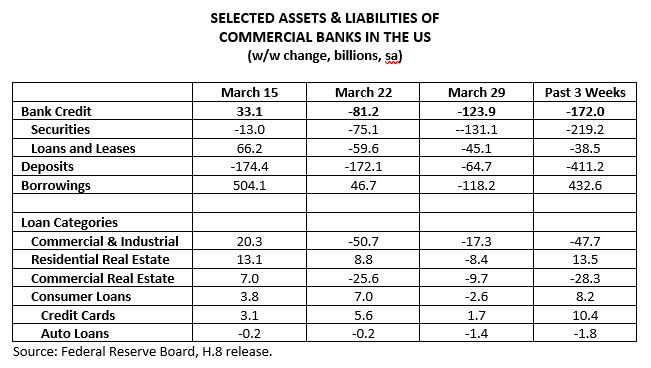

(1) H.8 release. The table below shows selected assets and liabilities of all commercial banks in the US. The latest weekly data are from the Fed's H.8 release. The last column shows the changes in each item over the past three weeks from March 8 (just before the SVB debacle) through March 29. Total bank credit fell $172 .0 billion over this period led by a $219.2 billion drop in securities. Loans fell $38.5 billion. The drop in securities probably mostly reflected maturing issues that weren't rolled over. The $411.2 billion drop in deposits was offset by a $432.6 billion increase in borrowings. The weakness in loans was in commercial & industrial loans and commercial real estate loans. The good news: During the March 29 week, deposit outflows slowed somewhat and the level of borrowings declined.

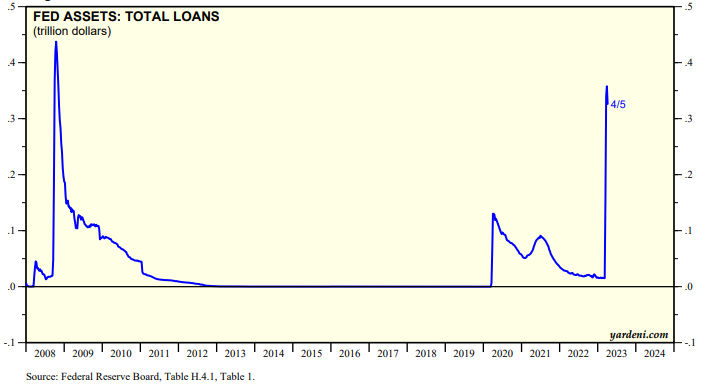

(2) H.4.1 release. According to the Fed's latest H.4.1 release, showing averages of daily figures through Wednesdays, loans by the Fed totaled $326.4 billion as of the week ended April 5, up $311.0 billion since the week ended March 1. That’s down by $31.6 billion versus the week before (chart). That’s a bit of a relief, but still disturbing to see that this category is reminiscent of the 2008 spike.

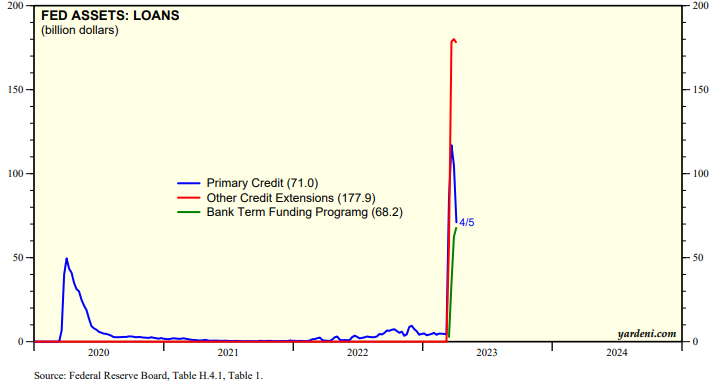

Over this same period, the H.4.1 release shows that “primary credit loans” (i.e., borrowing by banks from the discount window) rose by $66.4 billion to $71.0 billion, which was down $33.9 billion from the week before. Loans by the BTFP rose to $68.2 billion (chart).

“Other credit extensions” by the Fed jumped from zero before the SVB crisis to $177.9 billion during the April 5 week. This item consists of loans that were extended to depository institutions established by the FDIC, namely SVB and Signature Bank. The Federal Reserve Banks’ loans to these depository institutions are secured by collateral and the FDIC provides repayment guarantees.