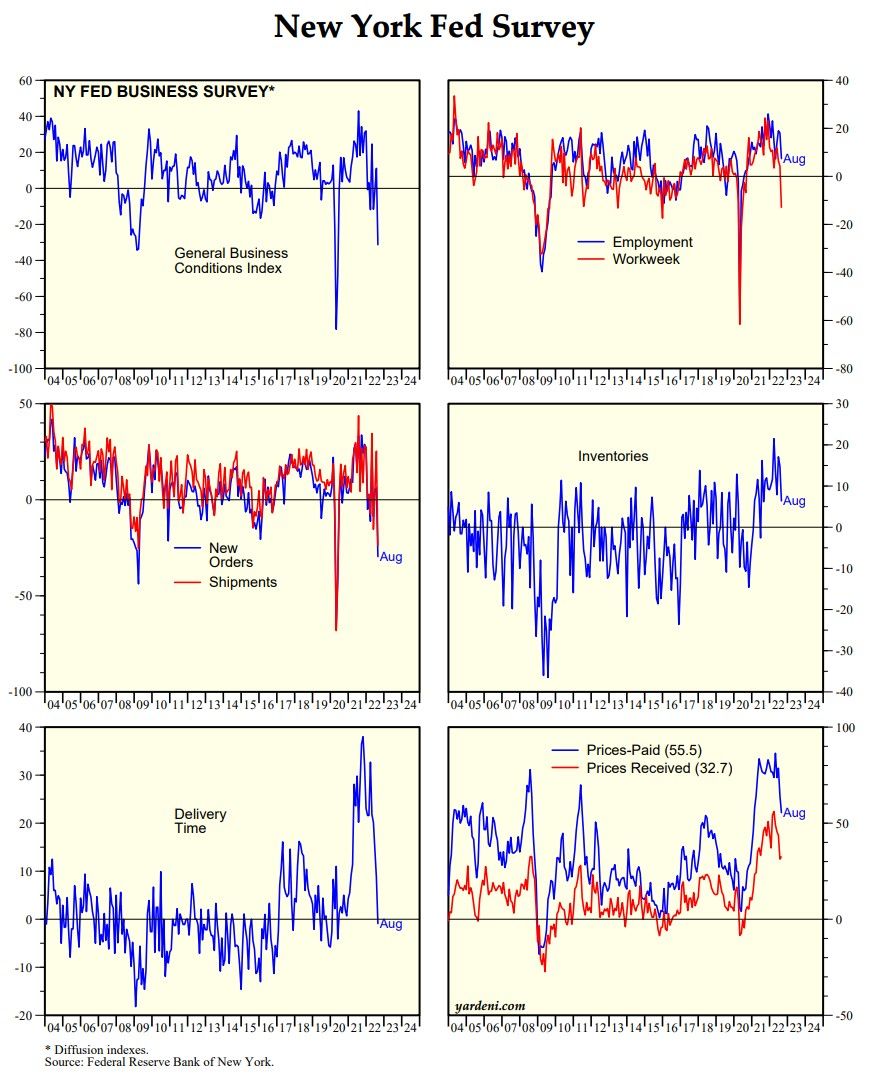

The charts below show that business activity plunged during August, according to the monthly survey of the Fed's NY district. It's a shocker. Here are the details:

"Business activity declined sharply in New York State, according to firms responding to the August 2022 Empire State Manufacturing Survey. The headline general business conditions index plummeted forty-two points to -31.3. New orders and shipments plunged, and unfilled orders declined. Delivery times held steady for the first time in nearly two years, and inventories edged higher. Labor market indicators pointed to a small increase in employment, but a decline in the average workweek. While still elevated, the prices paid index moved lower, and the prices received index held steady. Looking ahead, firms did not expect much improvement in business conditions over the next six months."

Let's see August's business survey for the Fed's Philly district on Thursday before jumping to any conclusions. If it is as bad as NY, recession fears could make a fast comeback, which would weigh on stock prices, commodity prices, bond yields, and the dollar.

The average of the two surveys is a good coincident indicator of the national manufacturing purchasing managers index, which is highly correlated with the S&P 500 on a y/y basis.