Yesterday's FOMC minutes confirmed that Fed officials are in no rush to lower the federal funds rate (FFR) and some are considering the possibility that they might have to raise it if inflation stalls above the Fed's 2.0% target. The 2-year Treasury yield is back up to 4.94% implying one 25bps rate cut over the next 12 months. So stocks sold off on fears of "even-higher-for-even longer" interest rates. We still don't expect any FFR increases or decreases in our "normal-for-longer" outlook for interest rates over the rest of this year through at least the first half of next year.

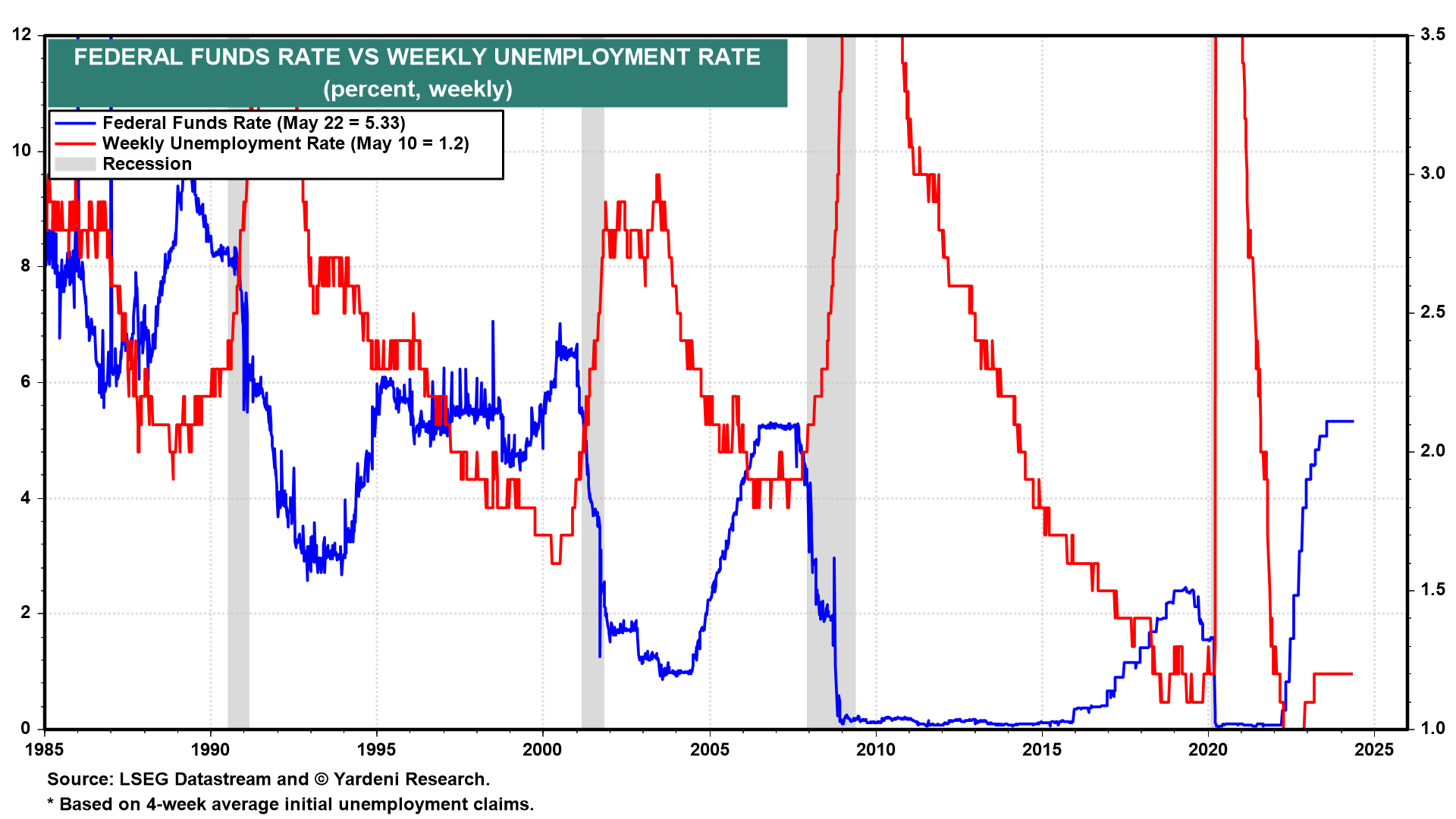

Today's initial unemployment insurance claims report (215,000 during the May 17 week) confirms that the labor market remains strong. In the past, the Fed usually lowered the FFR when the weekly insured unemployment rate moved higher (chart). It has been flat at 1.2% since the week of March 14.

In our Roaring 2020s scenario, the technology boom should continue to shrug off the Fed and power productivity, economic growth, and the stock market higher. The Fed's monetary policy is just one of many drivers of the economy, and the Fed won't need to cut rates to shore up economic growth if productivity is boosting it, as it did last year.

Today, Nvidia’s incredible earnings report (quarterly net income rose to $14.9 billion, from $2.0 billion a year earlier) further confirmed our thesis. Here's more:

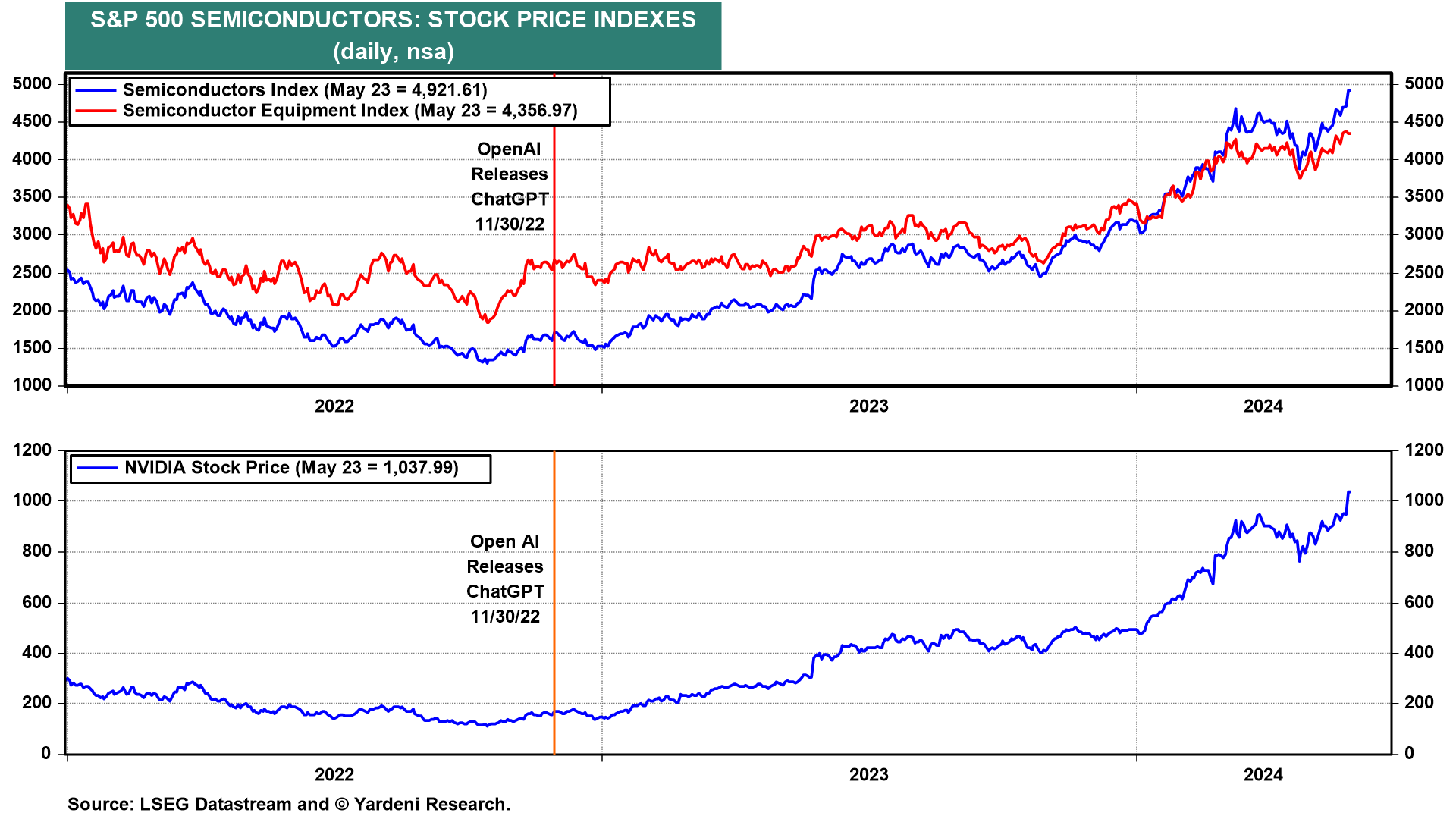

(1) In our opinion, the stock market first started to discount our Roaring 2020s scenario on November 30, 2022 when Open AI released ChatGPT. The S&P 500's semiconductor indexes have soared along with Nvidia since then (chart).

2) Analysts are turning increasingly bullish on the prospects for semis, raising earnings growth forecasts for this year and the following two (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a