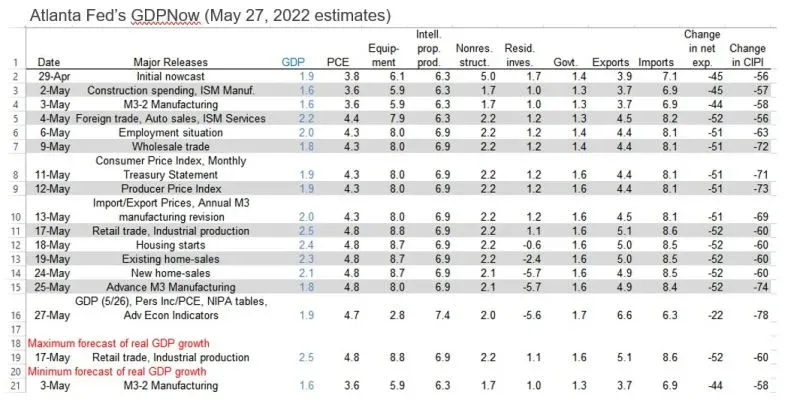

There’s no recession apparent in the May 27 update of the Atlanta Fed’s GDPNow tracking model for Q2. The real GDP growth “nowcast” was revised up slightly to 1.9% (saar). Consumer spending is tracking at a solid 4.8%. Business spending on equipment was revised down sharply to only 2.8%.

Weighing most on Q2 economic activity in the Atlanta Fed model is a 5.6% decline in residential investment. That’s likely to depress spending on housing-related purchases of appliances and furniture in coming months. (The good news is that the hot price inflation in these consumer discretionary goods should cool off.)

Separately, the Bureau of Economic Analysis revised Q1 real GDP down to -1.5%. However, real consumer spending growth was revised up from 2.7% to 3.1% in the Q1 real GDP report. A record widening of the trade deficit weighed on the Q1 growth rate.