Following today's release of September's nonmanufacturing purchasing managers index (NM-PMI), the Atlanta Fed's GDPNow tracking model revised Q3's growth rate from 2.3% (saar) to 2.7%. Consumer spending and real-gross private domestic investment were revised higher from 0.7% to 1.1% and from -4.1% to -3.6%. The next recession might be the most widely anticipated recession that doesn't happen. It's like waiting for Godot.

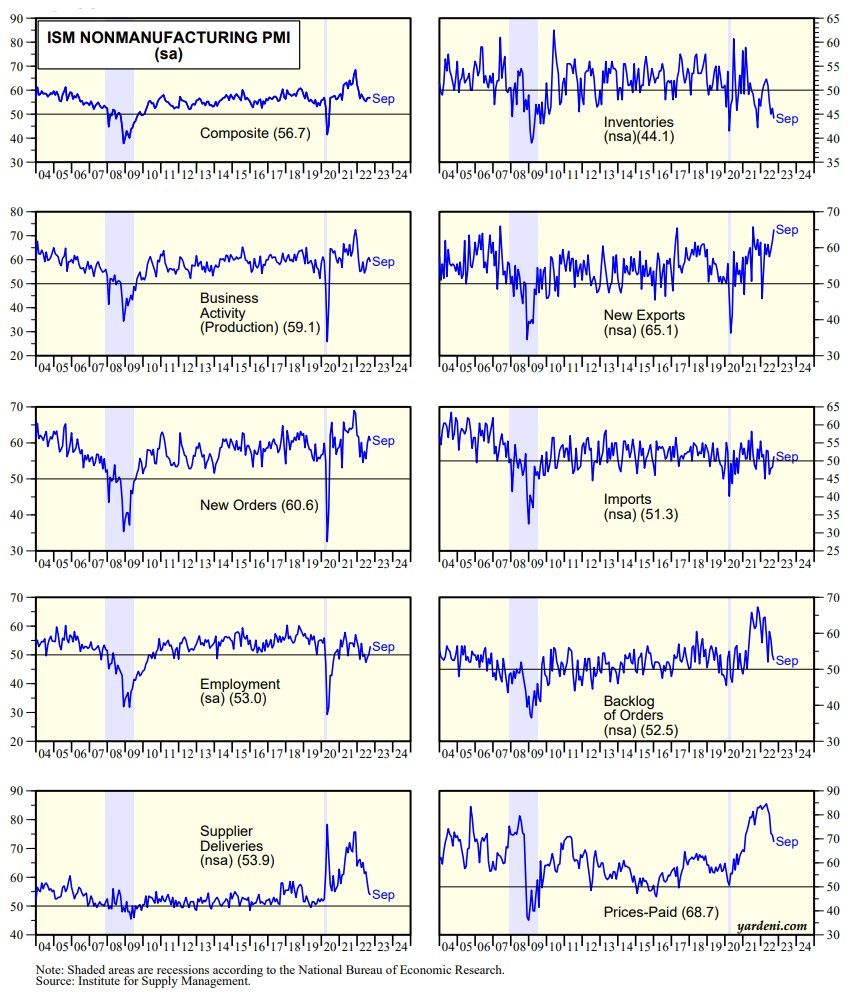

For the stock market, good news about the economy is supposed to be bad news because it means that the Fed will have to raise interest rates even higher to fight inflation. However, today's NM-PMI (56.7) showed that services are holding up well and better than manufacturing based on September's M-PMI (50.9). At the same time, the prices-paid indexes for both have moderated since the start of the year, less so in the former (68.7) than in the latter (51.7). In both surveys, supply-chain problems seem to have abated significantly as supplier deliveries and backlog of orders indexes have dropped sharply.

The stock market soared on Monday and Tuesday partly because the M-PMI was weaker than expected. The market had a remarkable upside reversal day today partly because the NM-PMI was stronger than expected. Or maybe because, on balance, there's no hard landing in the data so far. It still is looking more like a soft landing with moderating inflation which would be bullish for stocks.