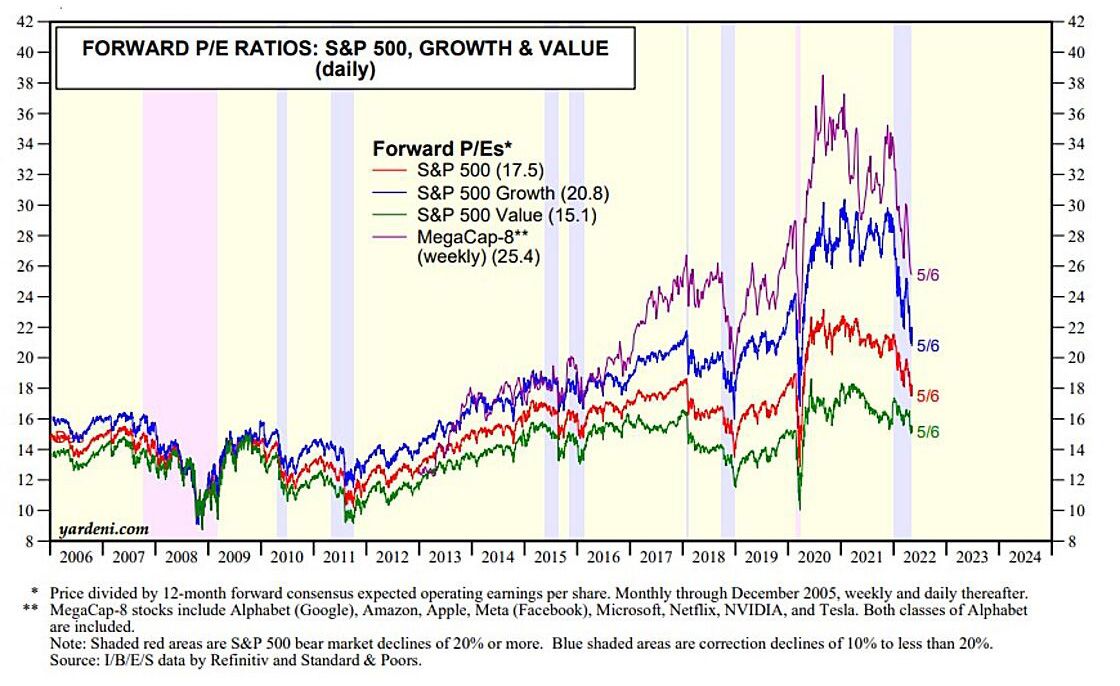

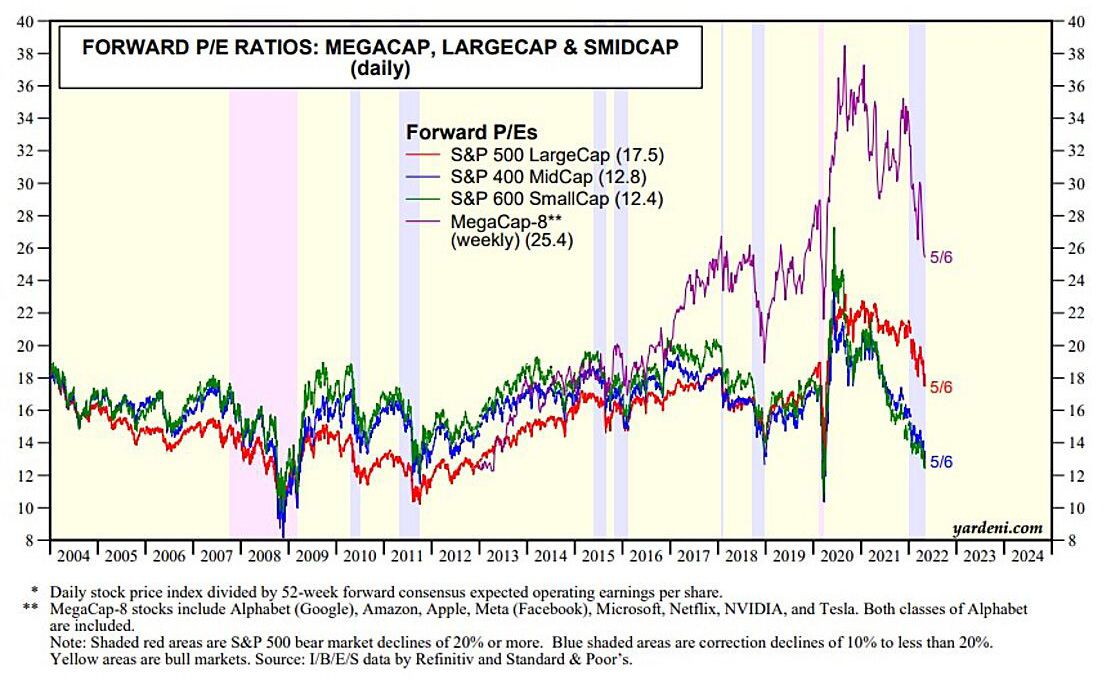

The air continued to come out of stock valuation multiples this past week. It has mostly been coming out of the S&P 500 Growth index’s MegaCap-8—i.e., Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, Nvidia, and Tesla. Consider the following:

(1) MEGACAP-8 - Their collective forward P/E was down to 25.4 on Friday. During 2020-21, it mostly ranged between 30.0-38.0. It is now below its pre-pandemic peak of 29.0. Its pandemic-lockdown-recession low was 21.5.

(2) S&P 500 GROWTH - The MegaCap-8 currently accounts for about 45% of the market cap of the S&P 500 Growth composite (down from a recent record high of 50%) and 22% of the S&P 500’s market cap (down from a recent record high of 25%). Growth’s forward P/E is down to 20.8.

(3) S&P 500 VALUE - The forward P/E of the S&P 500 Value composite may be finding a bottom around 15.0.

(4) SMIDCAPS - At 12.8 and 12.4, the forward P/Es of the S&P 400 MidCaps and S&P 600 SmallCaps remain very cheap, especially considering that their forward earnings continue to rise to record highs (as does the forward earnings of the S&P 500).

(5) BOTTOM LINE - There shouldn’t be much more near-term downside for forward P/Es unless the economy is on the verge of a recession. We don’t think so, although we do see a 30% risk of a mild recession over the next 18 months.