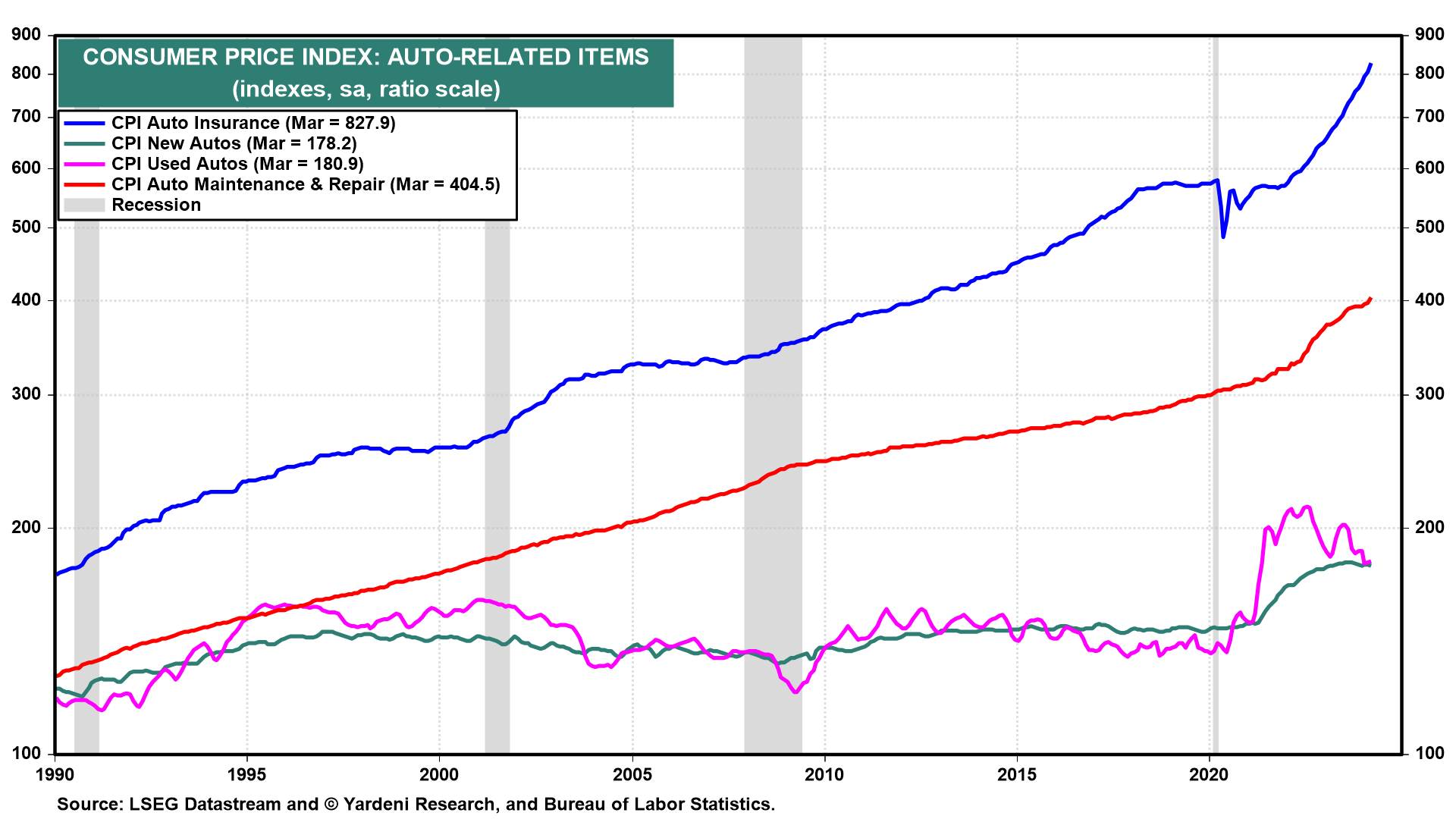

Since just before the pandemic during January 2020 through March of this year, the CPI indexes for new autos, auto maintenance & repairs, and auto insurance are up 21.0%, 34.8%, and 44.6% (chart). These all exceed the 20.6% increase in the headline CPI over this period. Why?

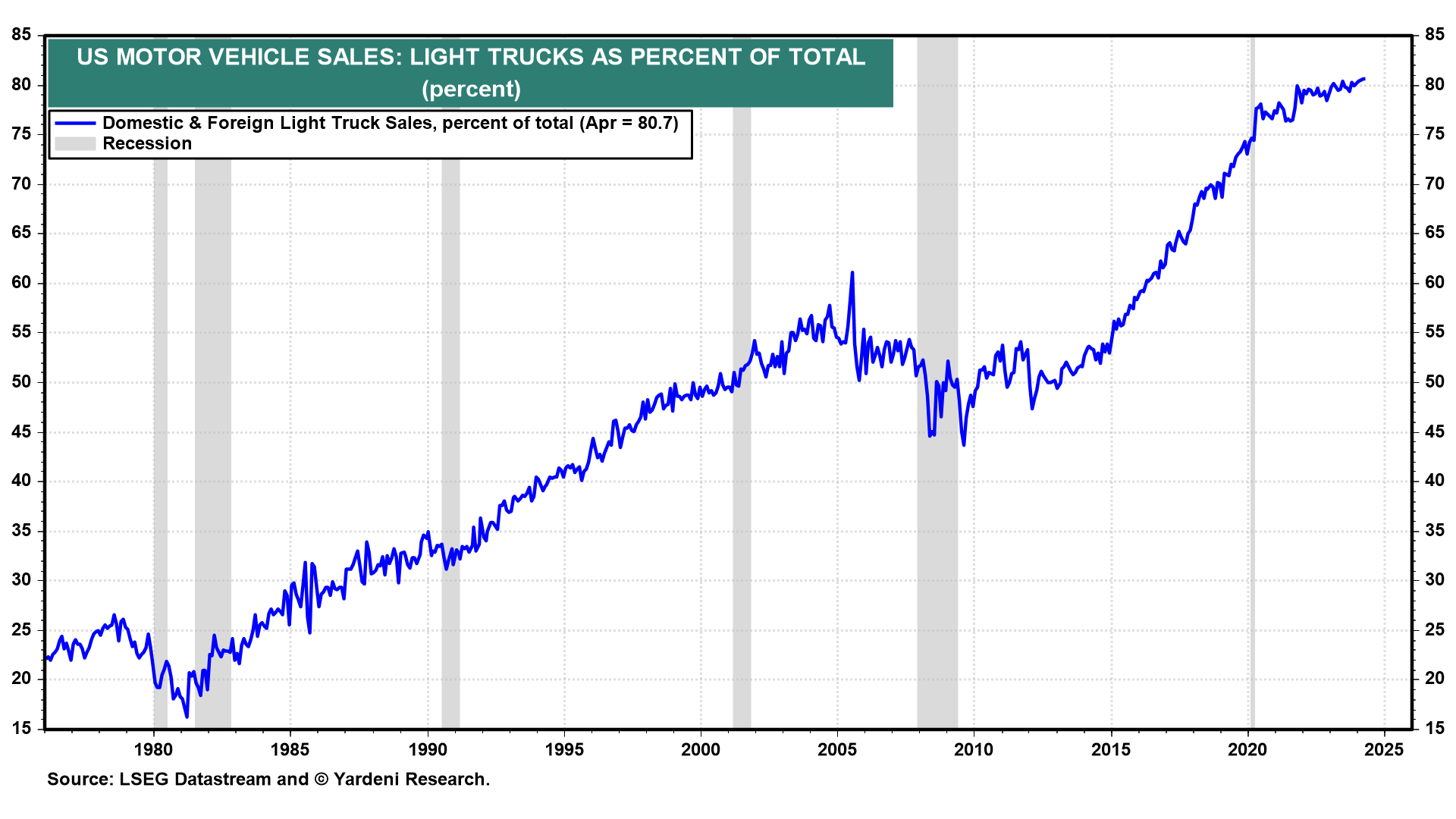

Americans are buying lots more expensive light trucks than passenger cars. They cost more to buy, maintain, repair, and insure than passenger cars. During February 2013, 50% of motor vehicle sales were light trucks. Their share of the market rose to a record 80.7% in April (chart). Is this really contributing to inflation? Or are more Americans prospering and choosing to splurge on their motor vehicles?

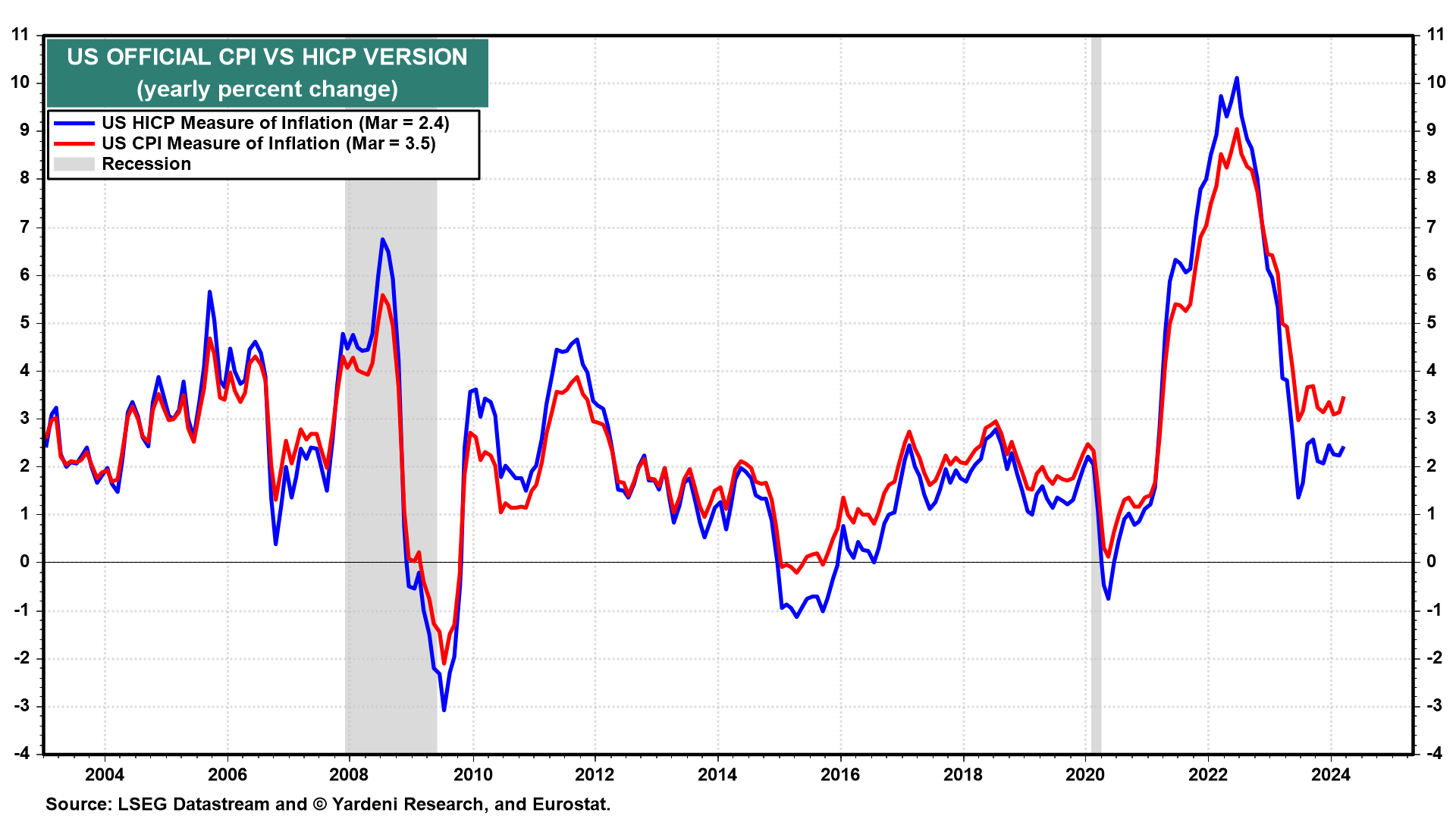

A big contributor to inflation remains owners' equivalent rent, a bizarre concept that is an estimate of how much rent homeowners would have to pay themselves if they were their own landlords. Without it, the inflation rate is already down almost to the Fed’s 2.0% target?

The Harmonized Index of Consumer Prices (HICP) is a measure of inflation in the Eurozone and the European Union. On its website, the Bureau of Labor Statistics (BLS) states: “The HICP differs from the U.S. Consumer Price Index (CPI) in two major respects. First, the HICP includes the rural population in its scope. Second, and probably more importantly, the HICP excludes owner-occupied housing. To construct the R-HICP, the CPI was narrowed to remove the owner-occupied housing costs that the HICP excludes from its scope. The CPI does not collect prices in rural areas, and the R-HICP uses price data collected for the CPI-U population, so this research index does not exactly match the population coverage of the HICP.”

The R-HICP measure of inflation has been closely tracking the headline CPI measure since the start of 2023 (chart). The former has been hovering between 2.1%-2.6% y/y since August 2023, while the latter has been hovering around 3.0%-3.7%.

Message to the Fed: Mission almost accomplished based on the HICP measure, which makes more sense than the CPI!