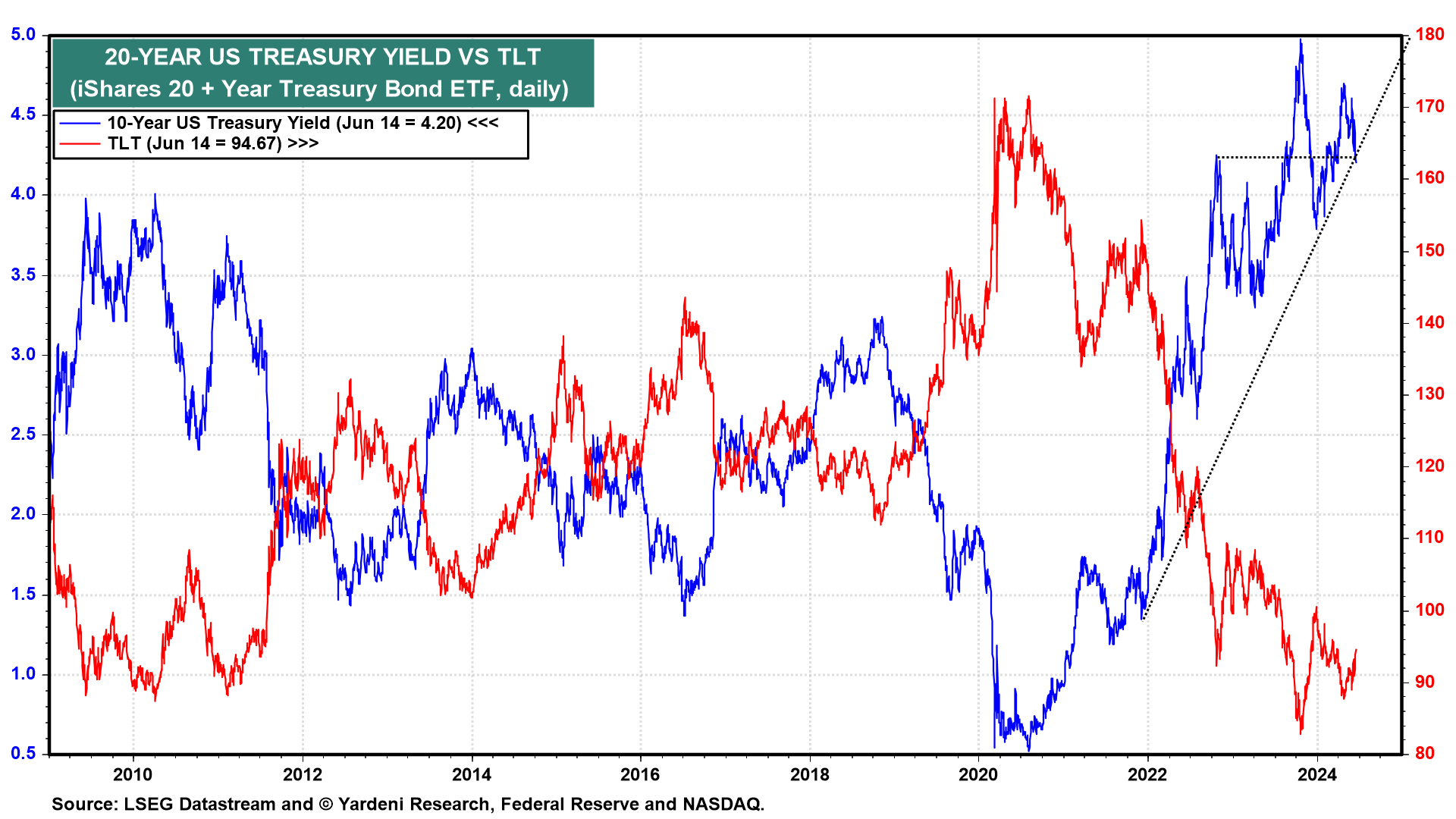

Consumer price disinflation is raising expectations for a Fed rate cut, which is fueling a meltup in stock prices. This morning on CBS' "Face the Nation," Minneapolis Fed President Neel Kashkari said that a rate cut by year-end is a “reasonable prediction.” On Friday, the 10-year Treasury bond yield fell below 4.25% to 4.20%. The technical picture is signaling that it might continue to fall down to 4.00% in coming days (chart).

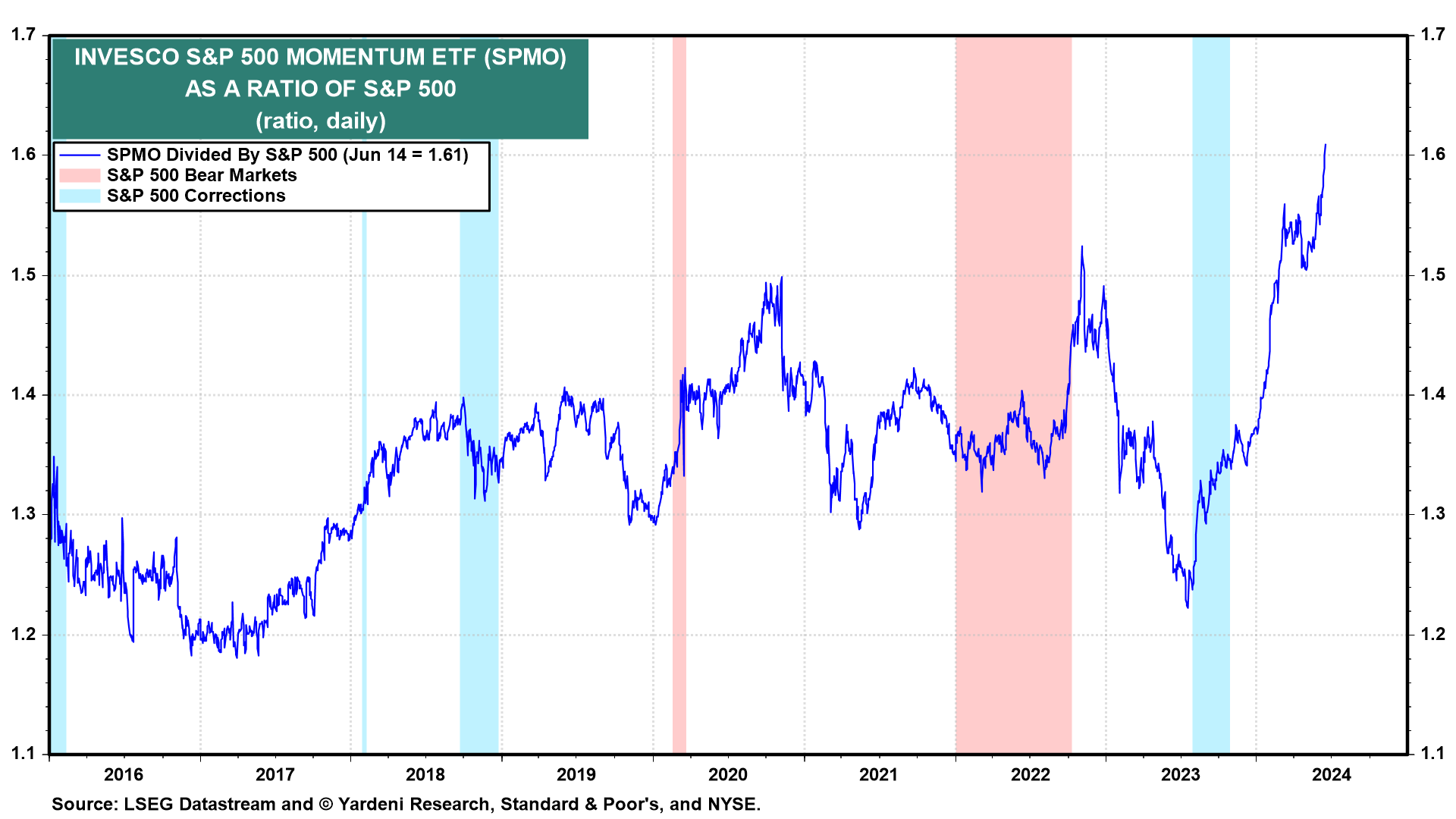

The prospect of lower interest rates is fueling momentum investing (chart). Leading the momentum meltup are technology companies that are associated with artificial intelligence.

The S&P 500 rose 1.6% last week, led by an astonishing 6.4% increase in the S&P 500 Information Technology sector (chart). It was the only sector to beat the S&P 500 this week. Joe Abbott, YRI's Chief Quantitative Strategist, reports that this has happened only four times before since January 1991.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a