History shows that the Santa Claus rally usually starts during October. This year, the S&P 500 had a terrible September, falling 9.3%. Since the end of that month through today's close, the index is up 7.6%.

It could be tough sledding for Santa over the rest of this week. After the close, Google missed earnings as YouTube's ad revenue disappointed. In addition, Microsoft beat expectations on the top and bottom lines, but cloud revenue was lower than expected, and the company's quarterly guidance fell short of expectations as well. Both companies are planning to cut costs.

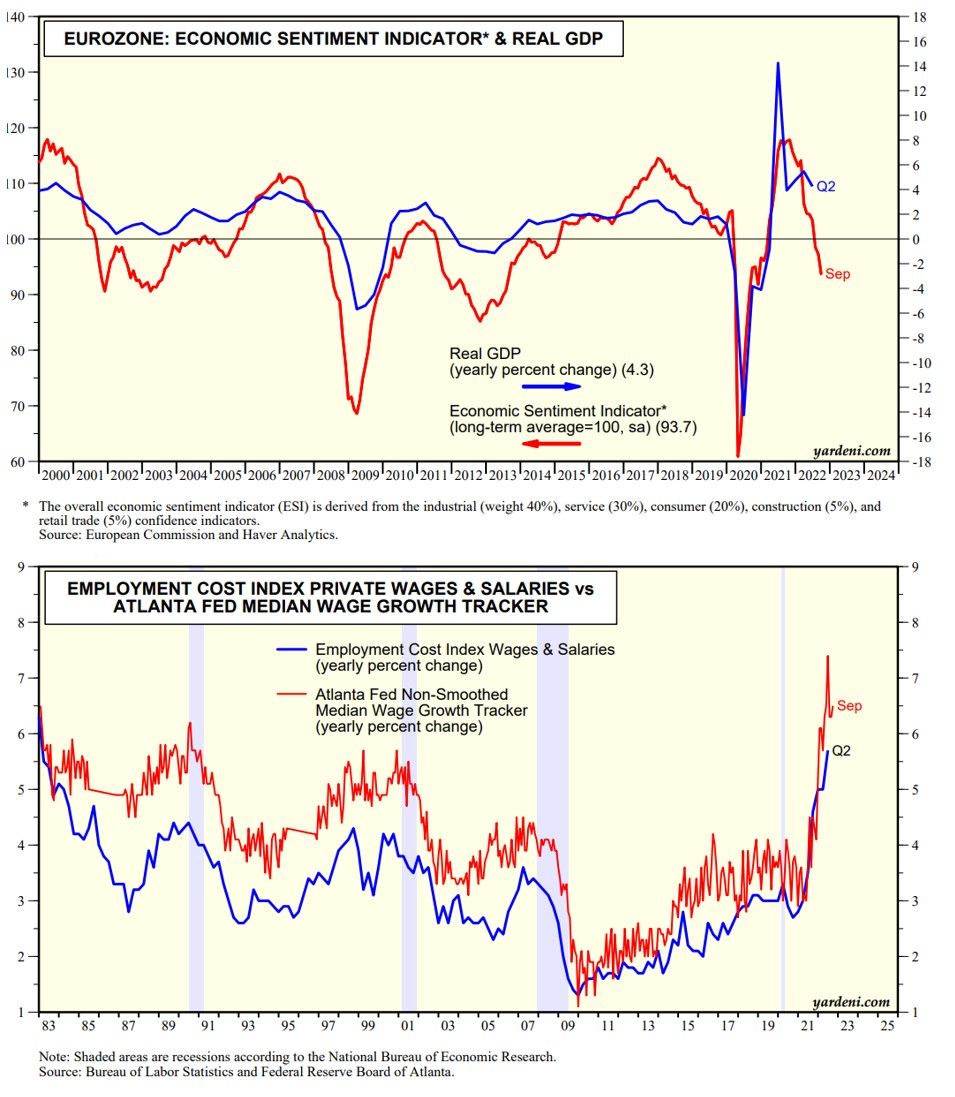

On Thursday, the ECB is expected to raise its official deposit rate again by 75bps to 1.50% to fight inflation even though the Eurozone is falling into a recession as a result of an energy crisis that could worsen this winter. The region's Economic Sentiment Indicator has been in a free fall since Russia attacked Ukraine (chart).

On Friday, all eyes will be on Q3's Employment Cost Index (ECI) in the US. The Fed pays close attention to the ECI because it shows the underlying trend of inflation in the labor market. It was up 5.7% during Q2 (chart). Monthly wage indicators suggest a slightly slower pace for Q3. September's PCED inflation rate also comes out on Friday.

The FOMC meets next week on November 1 and 2. No one will be surprised by another 75bps hike in the federal funds rate. The question is whether Friday's inflation numbers will cause the Fed's hawks to squawk louder or to tone it down regarding what they might do in December and early next year.