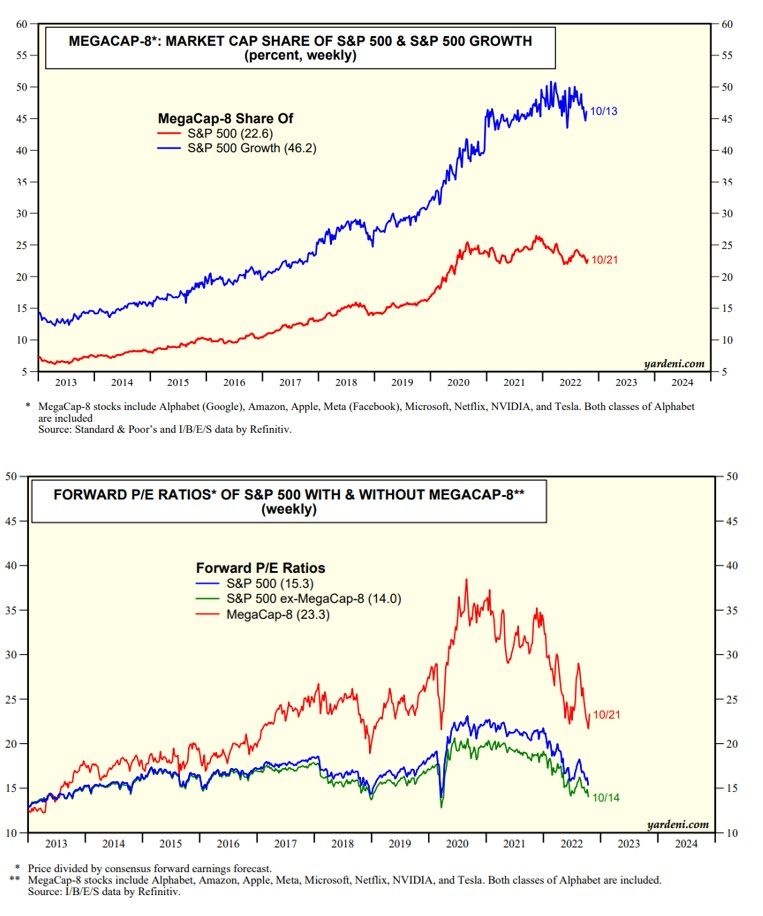

The MegaCap-8 are still the largest yachts in the ocean. These eight stocks currently account for 23% of the market capitalization of the S&P 500 index and 46% of the S&P 500 Growth index (chart). This week, five of them--Microsoft, Alphabet, Meta, Apple, and Amazon--are set to report their earnings. (The other three are Netflix, Nvidia, and Tesla.)

Their managements will provide insights into how the strong dollar has weighed on their results and whether the cloud continues to be a source of growth for them. Advertising is likely to be a weak point for the ones that get substantial revenues from this space. US consumers seem to be hanging in there for Amazon, but are they buying Apple's new phones? And what about China? That market seems to be a source of only bad news recently.

The MegaCap-8 are still relatively expensive with a collective forward P/E of around 23. The rest of the S&P 500 is relatively cheap at 14 now (chart).

I asked Joe Feshbach for his latest trading view of the S&P 500. This morning, he told me that the short term charts remain bullish and the prior high at 3762 should be exceeded. However, the put/call ratio has started to fall into neutral territory and breadth remains awful--which has been true for a while. Joe noted that the "market is definitely not in as strong a position as it was before the last 17% rally. I initially said I thought this rally had potential to around 3850-3900 and I still think that's a fair target, but that really is all I see for now."