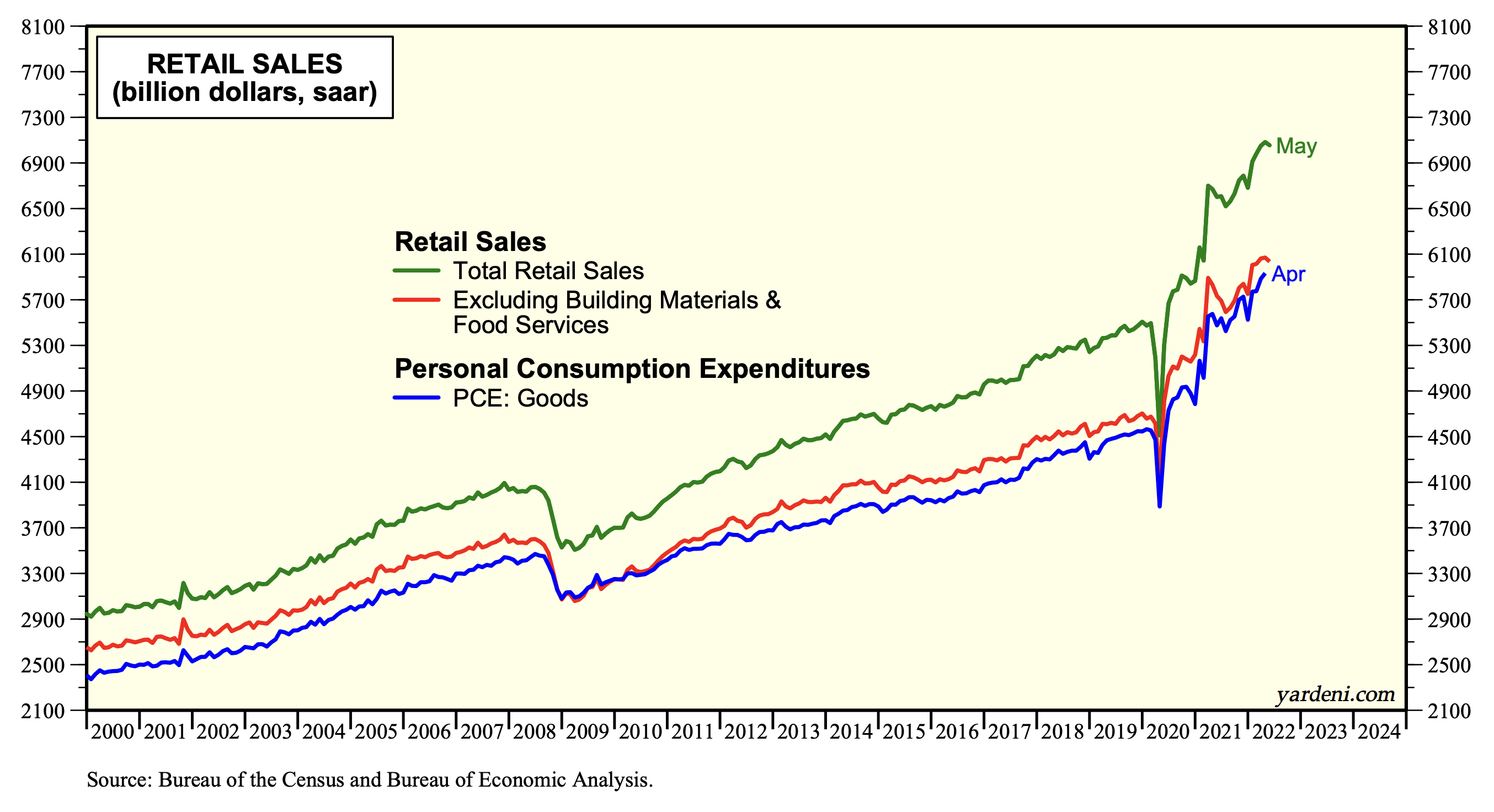

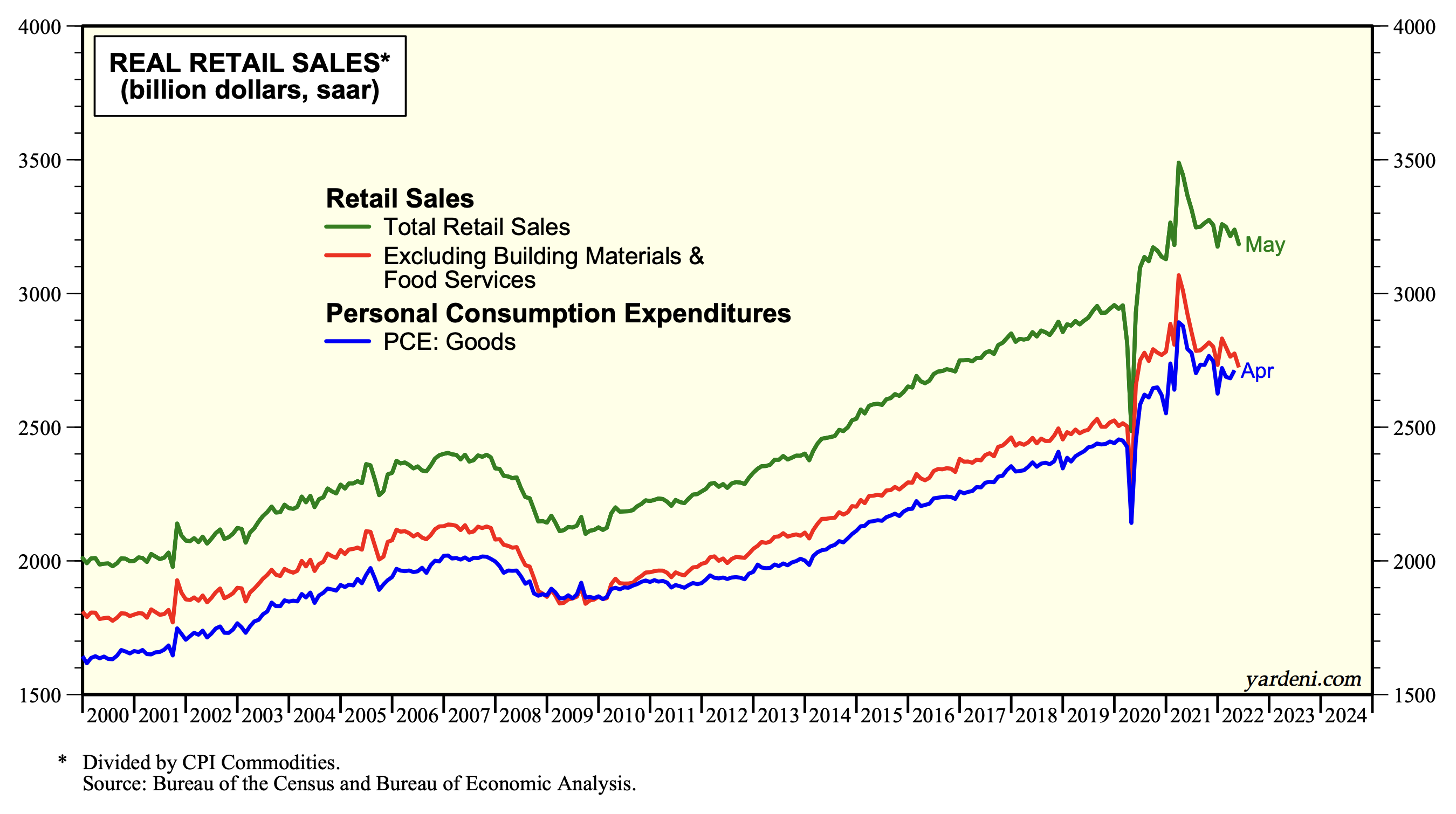

May's retail sales was weak in current dollars (-0.3% m/m) and even weaker in real dollars (-1.6%). The question is whether consumers have more than satisfied their post-lockdown, pent-up demand for goods, and are now spending more on services? Consider the following:

(1) The three rounds of stimulus checks provided by Uncle Sam (actually Uncles Don and Joe) during the pandemic certainly stimulated retail sales. Indeed, they caused a demand shock which overwhelmed the supply of goods. That triggered a remarkable jump in inflation, led by rapidly rising consumer durable goods prices.

(2) Consumer spending on services was held back by the pandemic, but has been making a big comeback in recent months. Indeed, retail sales includes an item for food services and drinking places, which is up 17.5% y/y through May.

(3) Excluding food services and retail sales of building material (which is included in residential investment in the GDP accounts) shows that retail sales (on a comparable basis to personal consumption expenditures in GDP) fell during May by 0.4% m/m and by 1.7% on an inflation-adjusted basis.

This contributed to the downward revision in Q2's real GDP growth from 0.9% (saar) to 0.0%, according to the Atlanta Fed's GDPNow tracking model as of June 15. Real consumer spending is still up by 2.6% (but revised down from 3.7%). Residential investment is now -8.5% (revised down from -8.0%).

(4) The Fed has just started tightening as economic growth has slowed appreciably. Today's FOMC projections show that the committee now expects real GDP to grow only 1.7% this year, down from their March projection of 2.8%. They also revised their headline PCED inflation rate up from 4.3% to 5.2%.