So far, September isn't living up to its bad reputation for the stock market now that the S&P 500 and the DJIA are at record highs. At the start of the month, on September 2, we asked, "What Could Possibly Go Wrong?" We wrote: "We are hard pressed to find what could possibly go wrong in September. So perhaps, the path of least resistance will continue to drive stock prices higher. We are still expecting a yearend rally to 5800 on the S&P 500, but it could already be underway."

So far, the big surprise has been a positive one for the stock market: The Fed cut the federal funds rate (FFR) by 50bps rather than 25bps on September 18. On September 2, we wrote that better-than-expected economic indicators are likely to rattle bonds more than stocks. That seems to be happening. Consider the following developments:

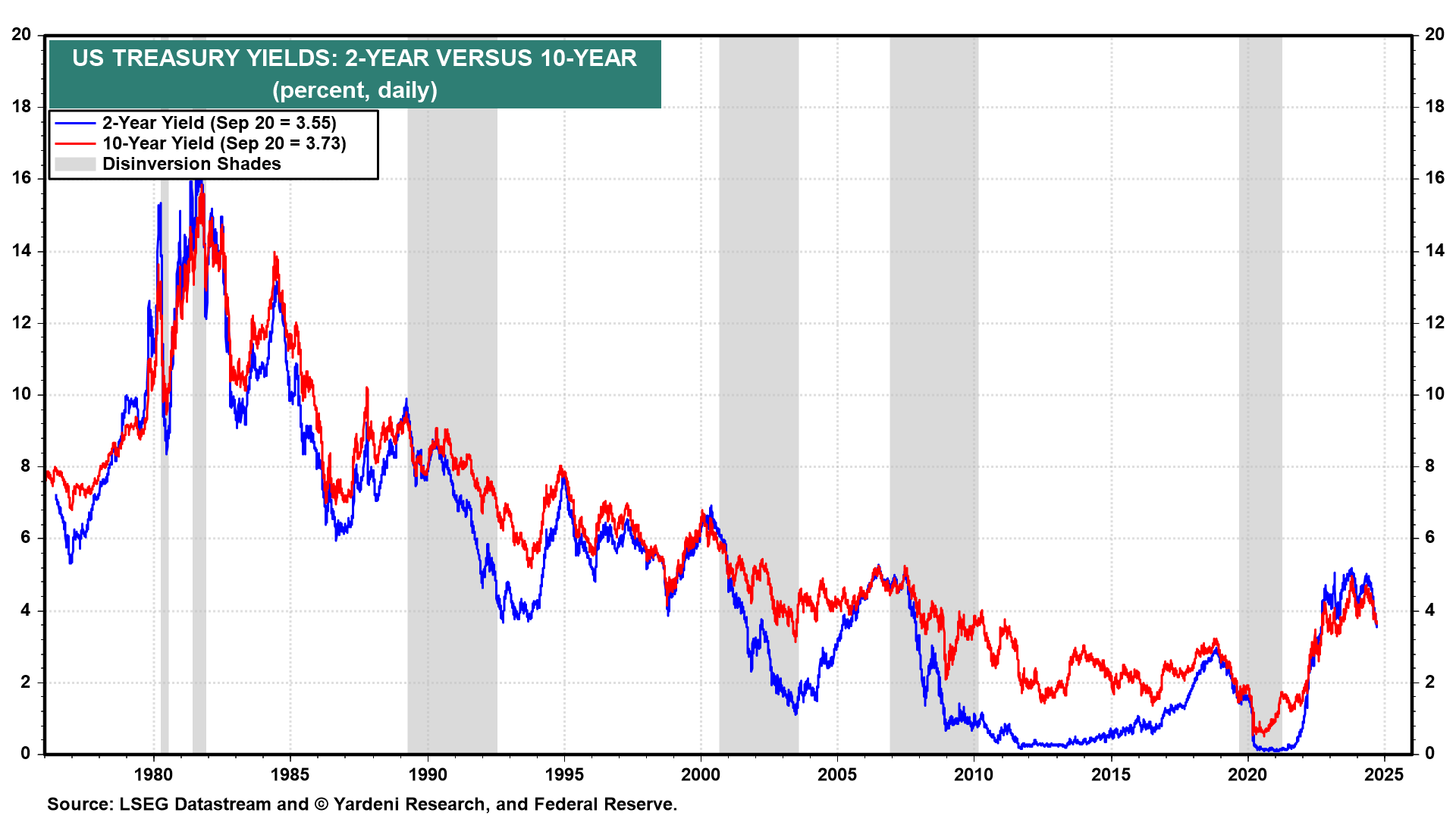

(1) Disinversions. During the previous four periods of yield curve disinversions, the 2-year Treasury yield fell faster than the 10-year Treasury yield (chart). All four coincided with recessions. This time, there's no recession. So now investors must consider the possibility that the Fed's easing will continue to drive the 2-year yield lower, but the 10-year yield might move higher on concerns that the Fed might heat up a warm economy. That seems to have been the initial reaction to the Fed's 50bps cut in the FFR last Wednesday.

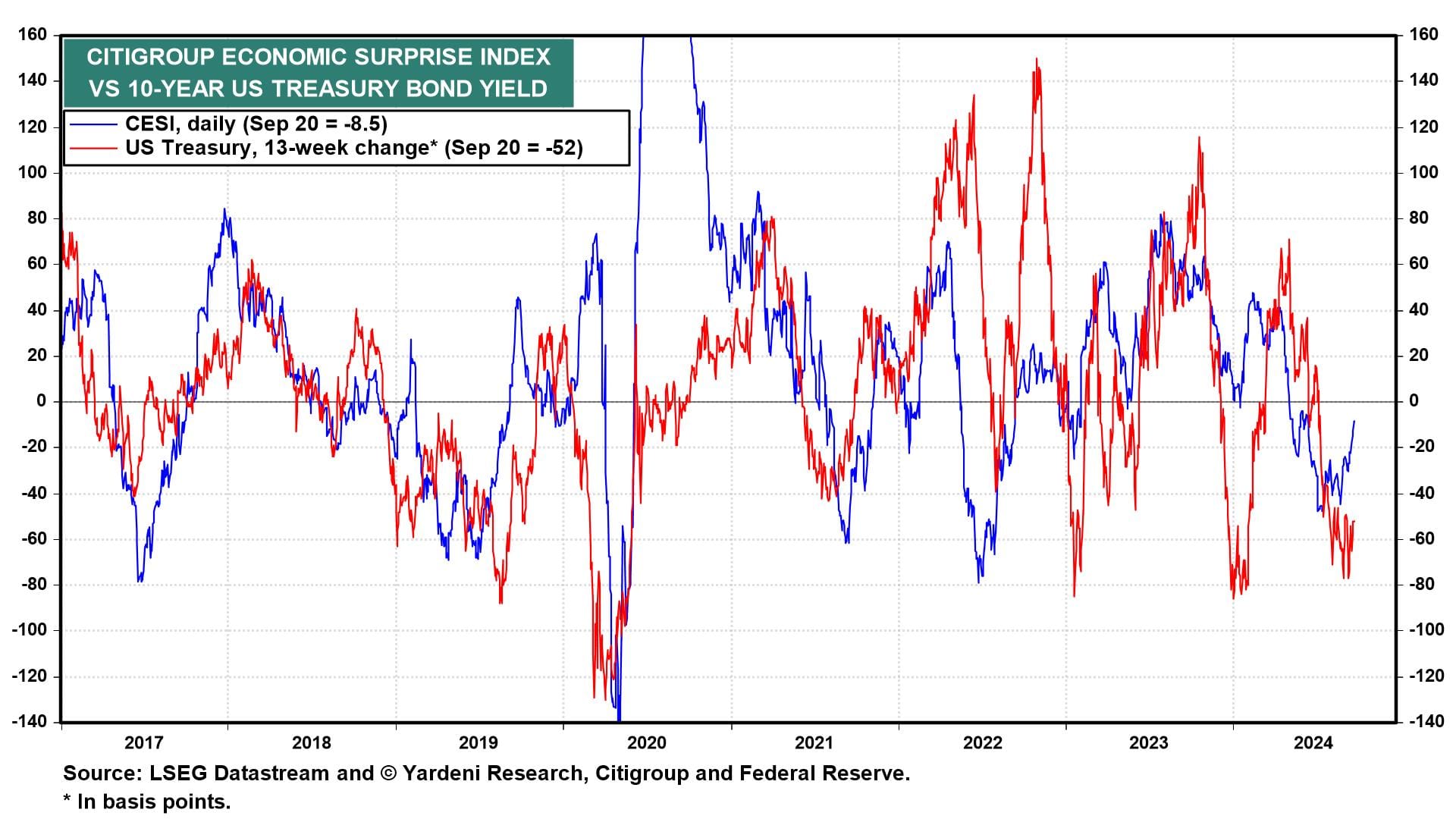

(2) Economic surprises. The 13-week change in the 10-year Treasury yield is highly correlated with the Citigroup Economic Surprise Index (CESI) (chart). The CESI hit a soft patch from May through August. It has been firming up so far in September, though it is still slightly negative. We think it could strengthen further into positive territory through October, which could send the 10-year yield back to 4.00%.

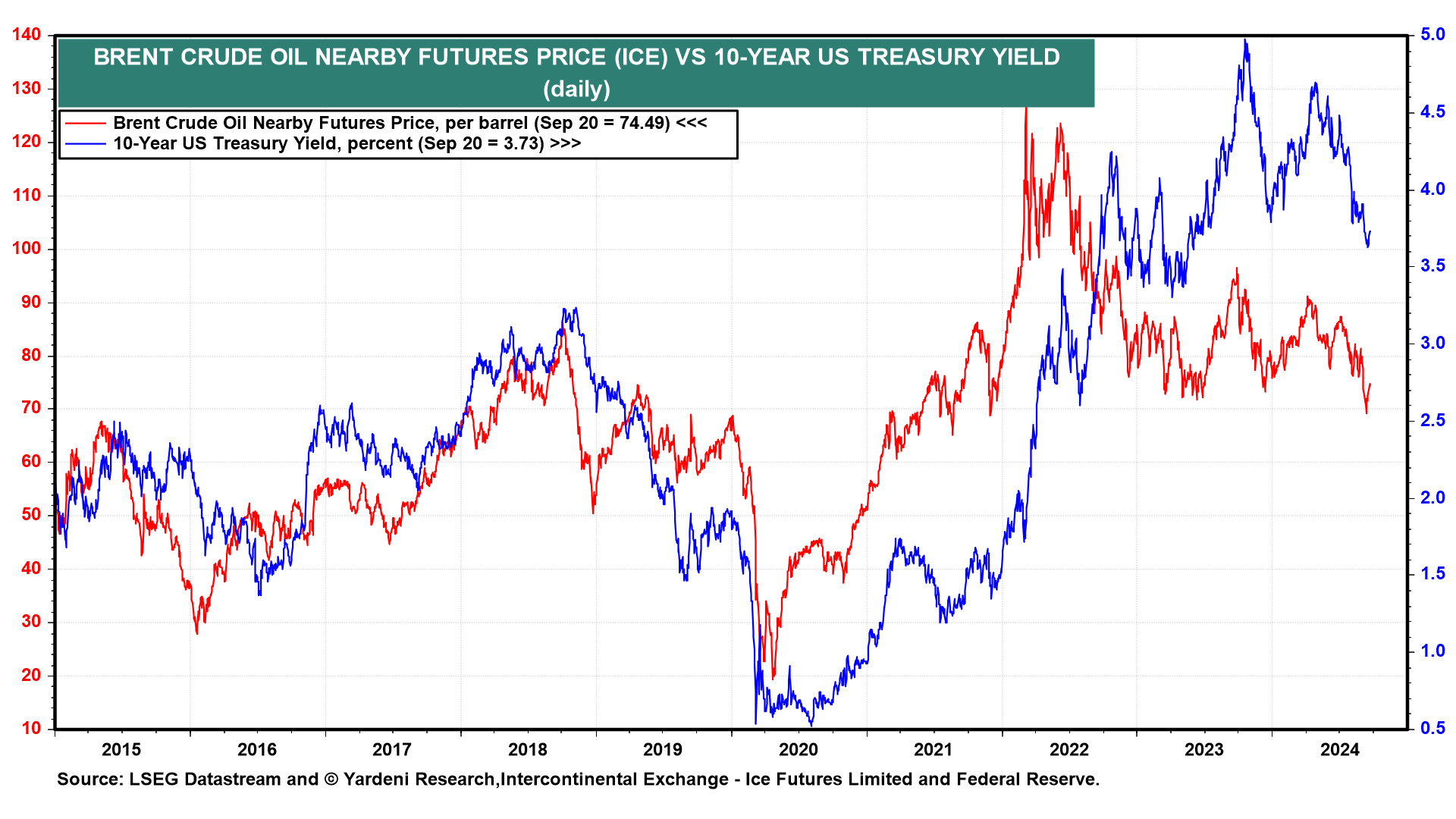

(3) Crude oil. Another correlation worth watching is the one between the price of crude oil and the bond yield (chart). If the US economy shows signs of strengthening that might lift oil prices. In addition, the Chinese government might respond to its rapidly weakening economy with a big stimulus package. The 10-year Chinese government bond yield was down to 2.05% on Friday. Reuters reported that "China could issue ultra-long-term treasury bonds within two years to generate at least 10 trillion yuan ($1.4 trillion) worth of stimulus to the economy, a former central bank adviser said on Saturday, according to state media."

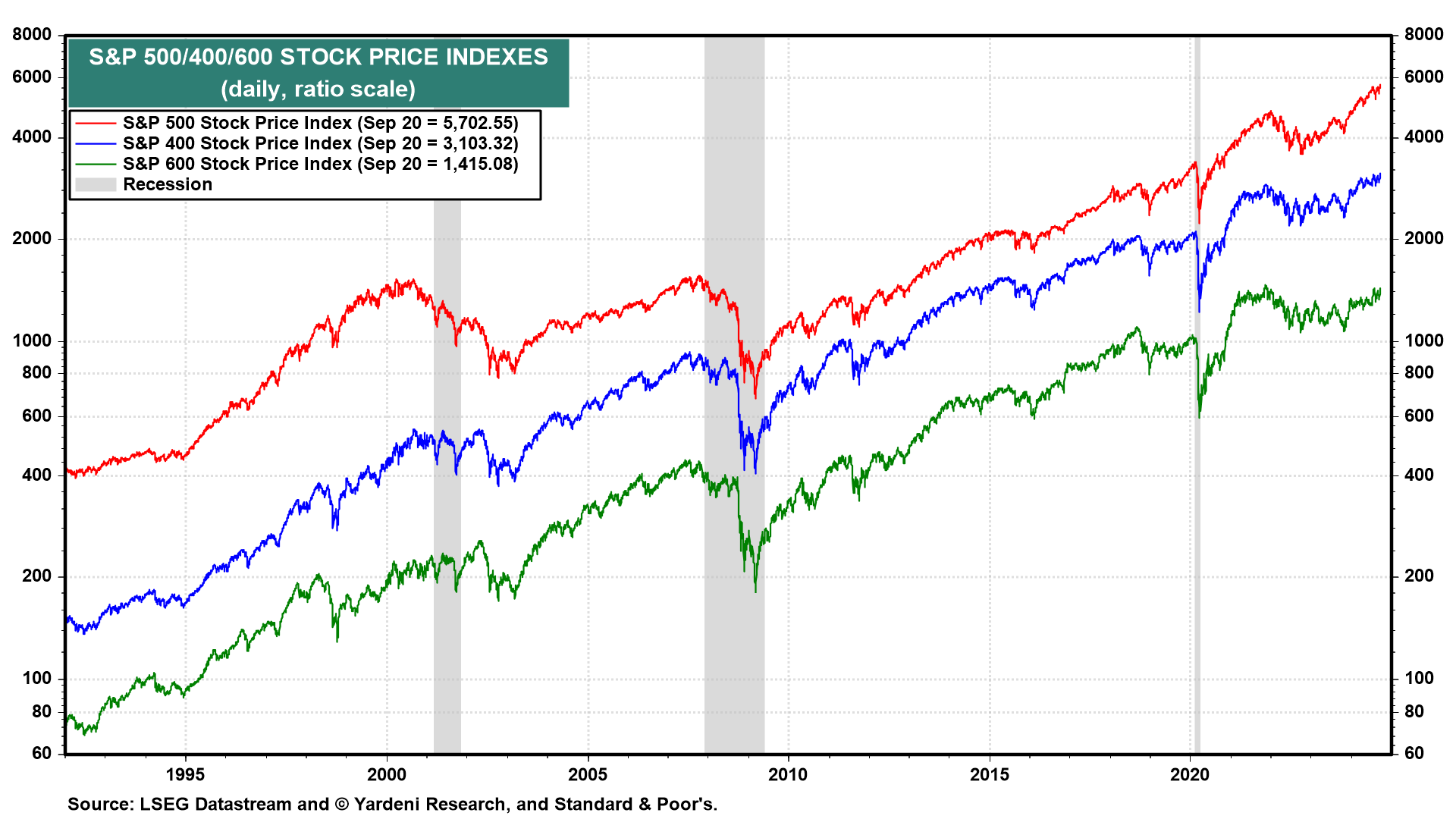

(4) Breadth. A combination of a more-dovish-than-expected Fed and better-than-expected economic growth suggests that the bull market is likely to continue to broaden, as we've been expecting (chart).

Finally, we asked Michael Brush for an update on insider activity: "Unlike investors, insiders did not really step up their stock purchases in response to the Fed's rate cut. Insiders remain neutral on stocks overall. But energy continues to be a favored sector. Energy stocks are arguably cheap compared to their 10-year averages, especially considering the newfound capital discipline over the past few years. Insiders are also buying biotech in size, including biotech IPOs." Thanks, Michael!