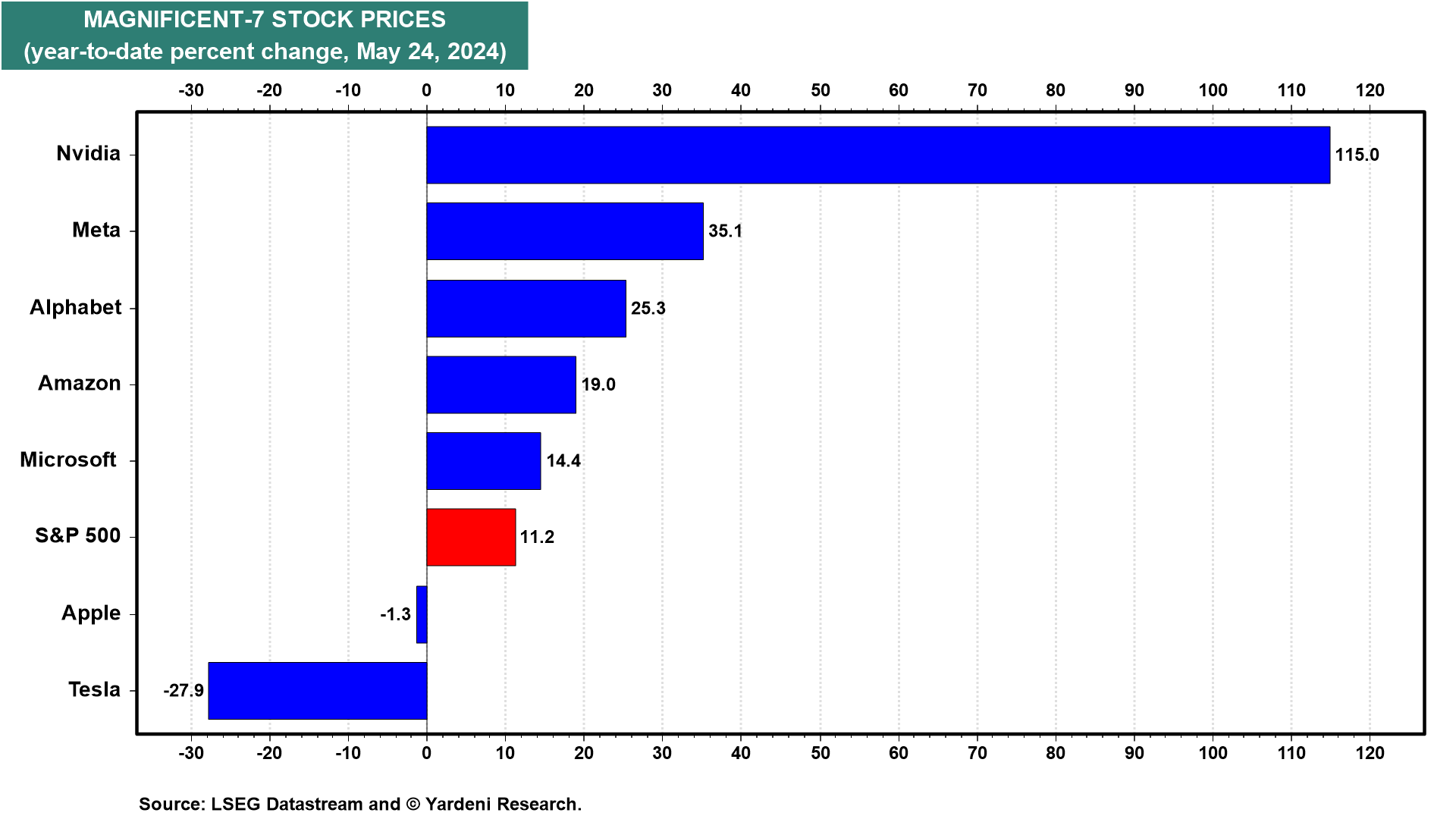

Stock market pundits have been bemoaning the narrowness of the current bull market that started on October 12, 2022. It has been led by the Magnificent-7. Now the pundits are fretting that it is being led by just Nvidia, which is up 115.0% ytd versus 11.2% for the S&P 500 (chart). It is also significantly outperforming the Magnificent-6 so far this year.

Nvidia is the only clear beneficiary of the AI boom currently because everyone who wants to play has to pay for the company's expensive GPU chips. All that capital spending will weigh on the profits of Nvidia's customers who may or may not be among the winners of the AI arms race.

Our response to the bad-breadth crowd has been that while the Magnificent-7 stocks have hugely outperformed the rest of the market, the rest of the market has had plenty of big winners with gains exceeding 20% since the start of the bull market (table).

We've been recommending overweighting Financials, Industrials, Technology (i.e., Information Technology and Communications Services), and Energy (FITE). The first two have done well without the assistance of any of the Mag-7. The latter has underperformed, but we continue to favor Energy as a shock absorber for the geopolitical risks that could send oil prices soaring.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a