We now see three possible historical precedents for the economy, the Fed, and the stock market's performance ahead:

(1) The 1920s (with a subjective probability of 60%). This is our base case "Roaring 2020s" scenario. We've been discussing it since the start of the current decade. Our basic premise is that a chronic shortage of labor is forcing companies to use technological innovations to boost their productivity growth, which started to improve last year according to the government's quarterly data. As a result, inflation remains subdued, while real GDP growth, real wage growth, and profit margins all get boosted. The Fed is likely to ease, but won't have to cut the federal funds rate by much. Stock investors do very well.

(2) The 1970s (with a subjective probability of 20%). We've also been discussing this alternative scenario over the past couple of years as inflation surged. Now that it has been moderating, there is still a risk of a second inflationary energy shock as occurred during the 1970s. This time, the first one resulted from Russia's invasion of Ukraine in early 2022. If the conflicts in the Middle East continue to spin out of control, oil prices could soar again. The Fed would be forced to raise interest rates in this scenario and cause a recession. Stock investors do very badly.

(3) The 1990s (with a subjective probability of 20%). This is a new scenario that we haven't discussed before. In this one, the Fed becomes concerned that inflation is falling below 2.0%, and responds by aggressively cutting interest rate even though the economy continues to perform well. The result is a meltup in the stock market with technology stocks leading the way. The resulting valuation bubble bursts when the Fed is forced to raise interest rates because asset inflation shows signs of turning into another round of price inflation.

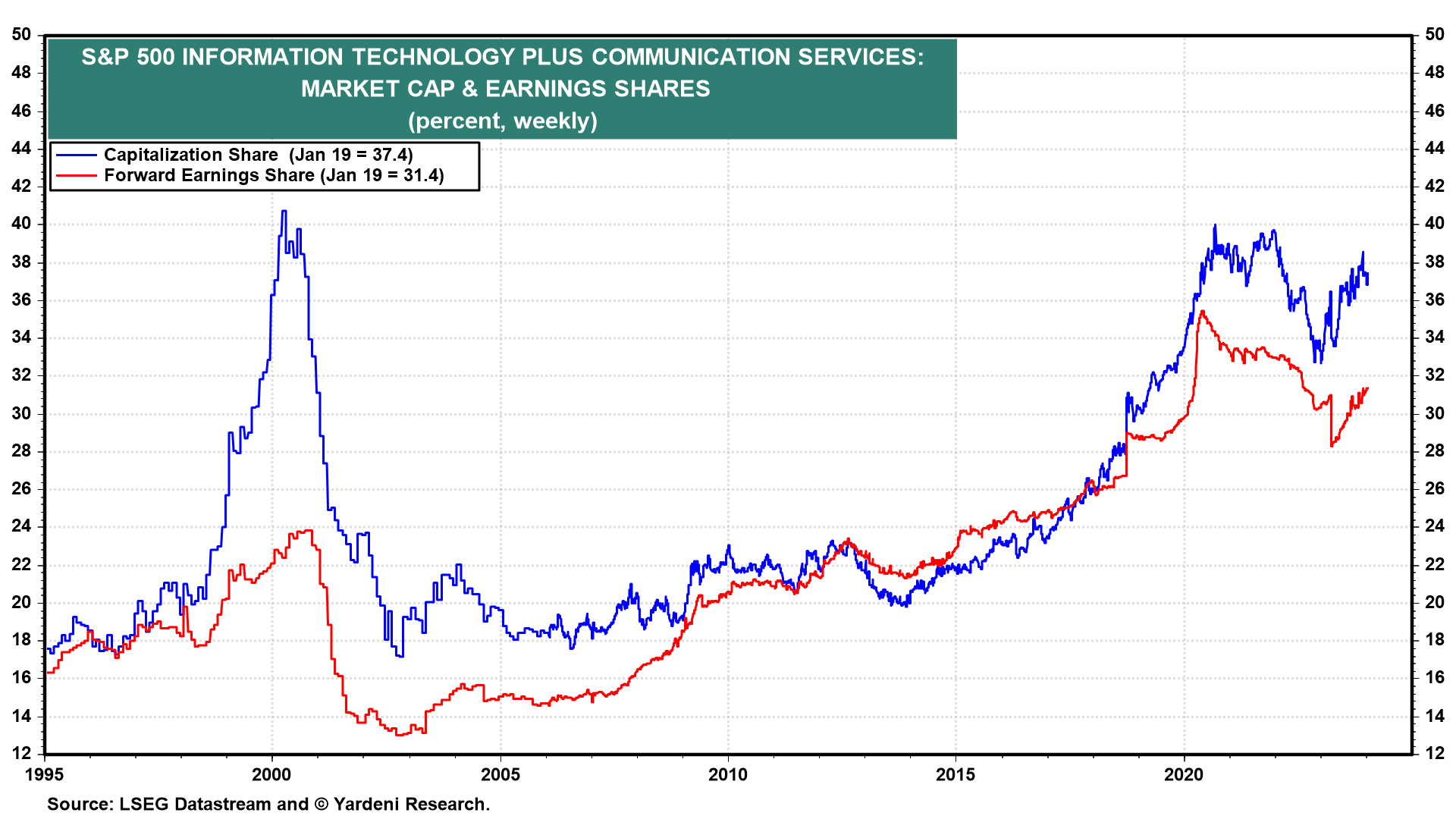

The market capitalization of the S&P 500 Information Technology and Communication sectors together currently account for 37.4% of the S&P 500's market capitalization (chart). This measure soared during the 1990s and peaked in early 2000 at 40.7%. That could be surpassed this time because the sectors' combined earnings share is higher.

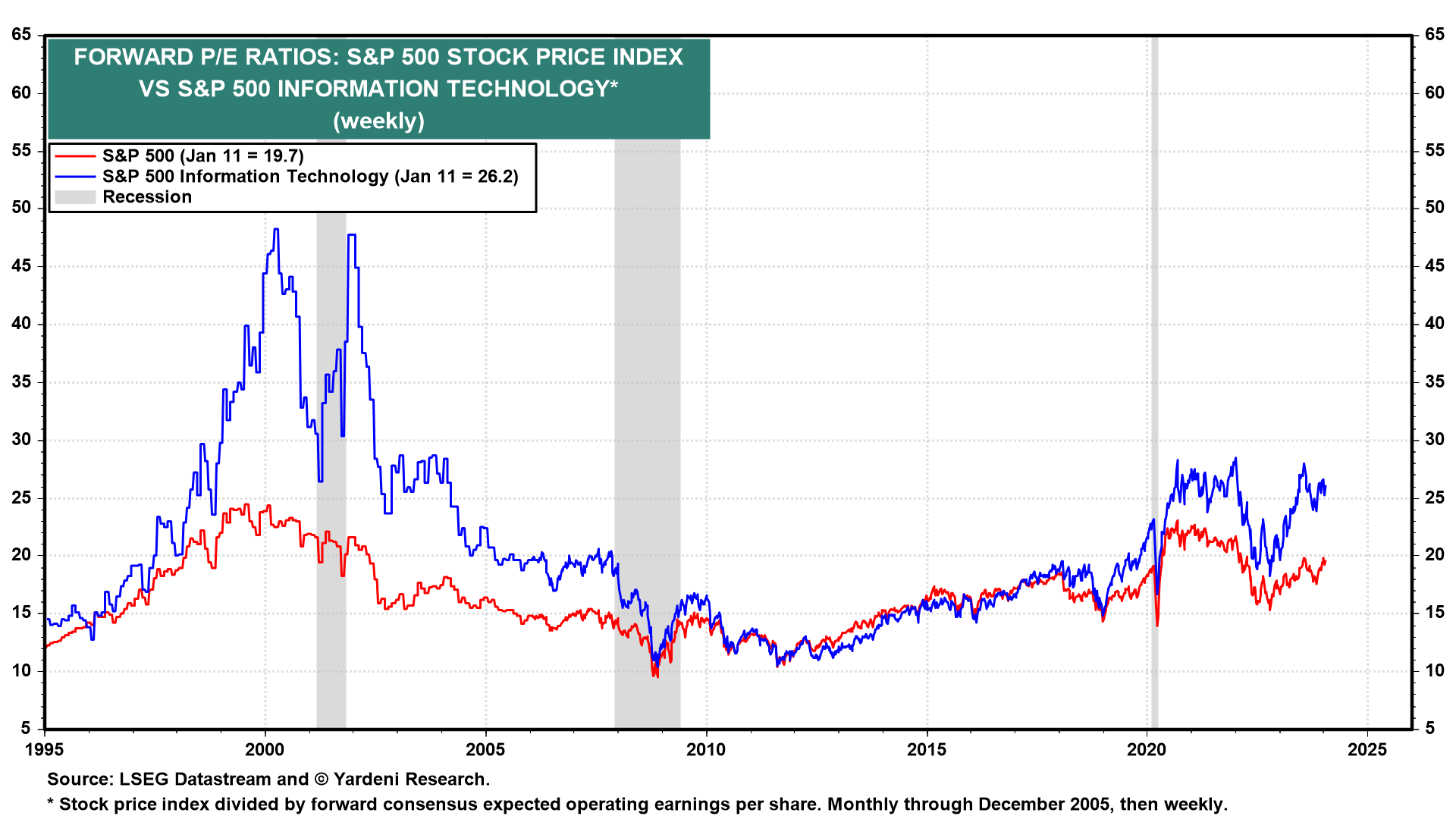

The forward P/E of the S&P 500 Information Technology sector is currently 26.2% (chart). It rose near 50.0 in 2000. Irrational exuberance would make a comeback in this scenario. It's lots of fun for stock investors while it lasts.