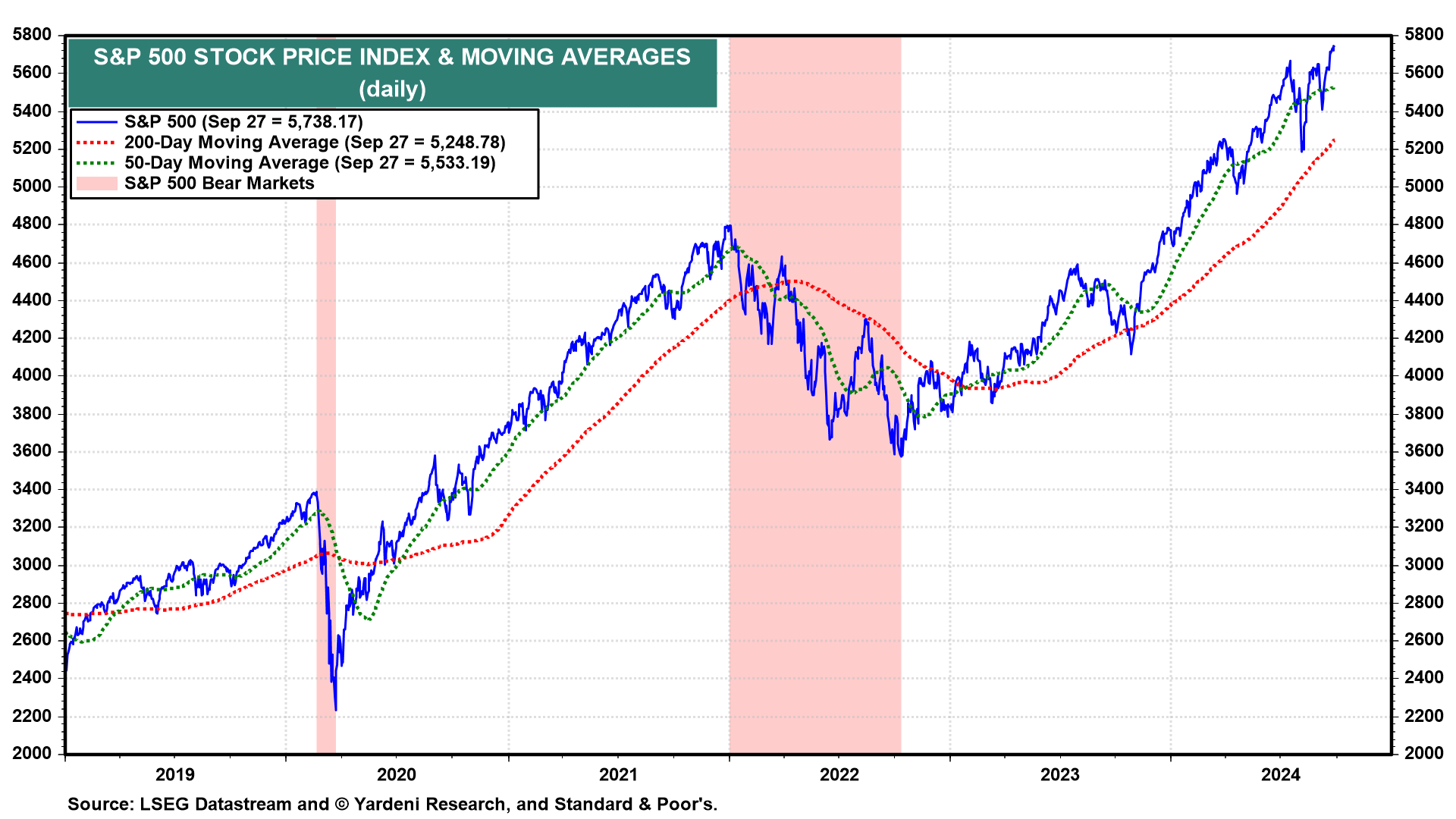

We asked the very same question at the start of September, and were hard pressed to come up with an answer. We concluded: "So perhaps, the path of least resistance will continue to drive stock prices higher. We are still expecting a yearend rally to 5800 on the S&P 500, but it could already be underway." The S&P 500 rose 1.6% during September as of Friday to close at 5738.17 with one more day to go in the month (chart).

The only slipup occurred at the beginning of the month following a weaker-than-expected August employment report. The same happened in early August following a weaker-than-expected July employment report. In both instances, we quickly recognized that the selloffs were likely due to carry-trade unwinds that would pass quickly.

The path of least resistance still looks higher for stock prices over the rest of the year. On Saturday, CNBC's Mike Santoli posted an article titled "Bull market enters fourth quarter with just about everything going its way." Our sentiments exactly.

The Fed cut the federal funds rate by 50bps on September 18 and is expected to cut again on November 7 by 25bps to 50bps depending on the strength or weakness in this week's employment reports (i.e. JOLTS, jobless claims, and payrolls) (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a