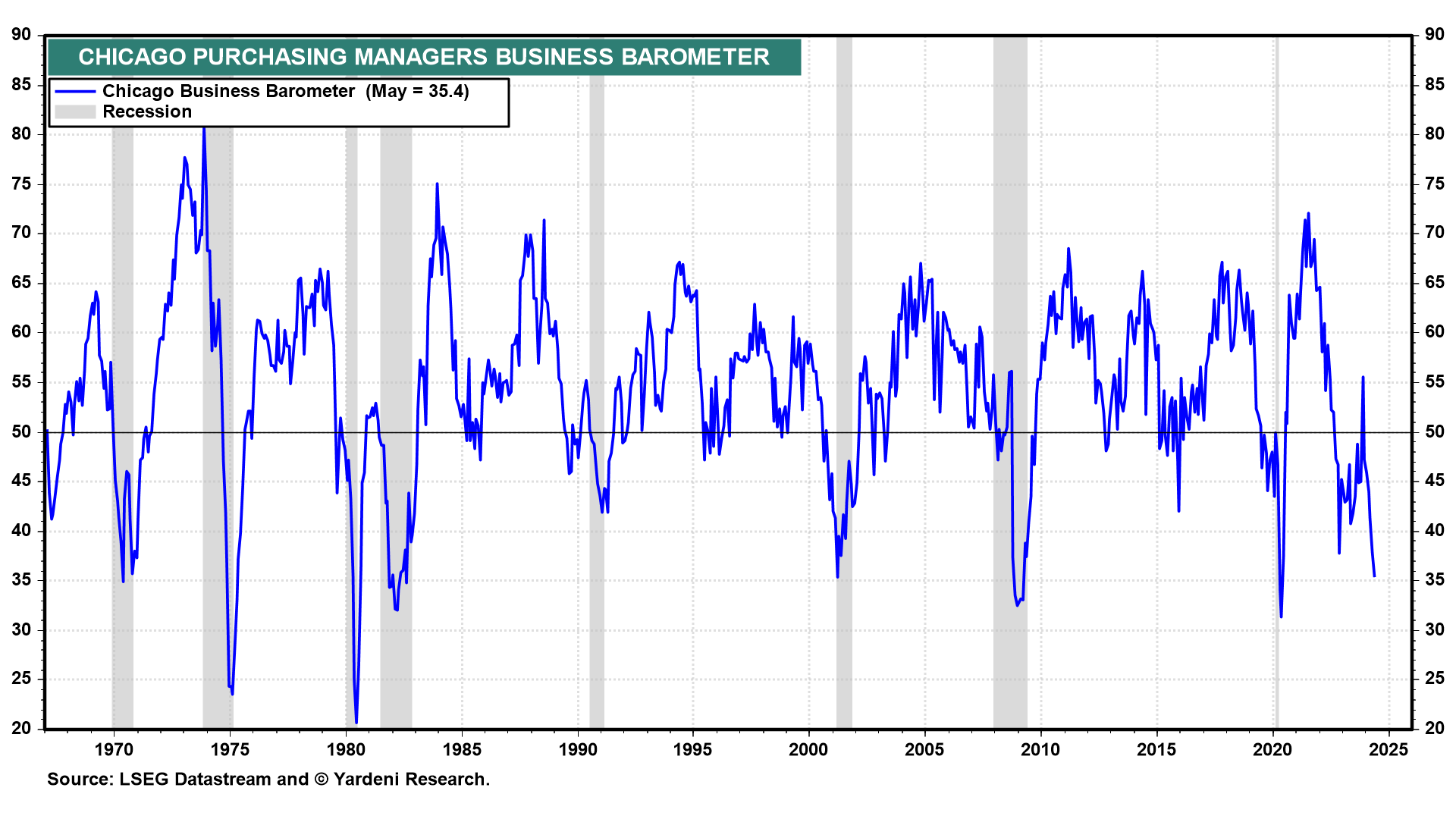

Friday was another wild ride on the S&P 500 rollercoaster. At first, stock prices rose after April's PCED inflation rate released at 8:30 am matched expectations. But then they dropped after a recessionary reading in May's Chicago Purchasing Managers Business Barometer at 10:00 am (chart).

The unexpected decrease in the business barometer partly reflected a steep drop in the new orders index, which tumbled by 9.2 points to its lowest level since May 2020. Meanwhile, the production index jumped 8.1 points following five consecutive months of decline, reaching its highest level since January.

The sharp decline in the Chicago indicator followed news at 8:30 am that April's real disposable personal income and real consumer spending both fell 0.1% m/m. By around noon, the selling pressure abated and stocks began to recover. Then about 15 minutes before the close buyers stampeded back into the market.

Perhaps they were responding to the drop in the 2-year US Treasury note yield earlier in the day from 4.95% just before 8:30's personal income, consumption, and inflation news to 4.88% by 10:55 am. Bad news on the economy is good news for stocks if it means that Fed rate cuts are still on the table, especially since the headline and core PCED inflation rates are every close to the Fed's 2.0% target at 2.7% and 2.8% y/y (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a