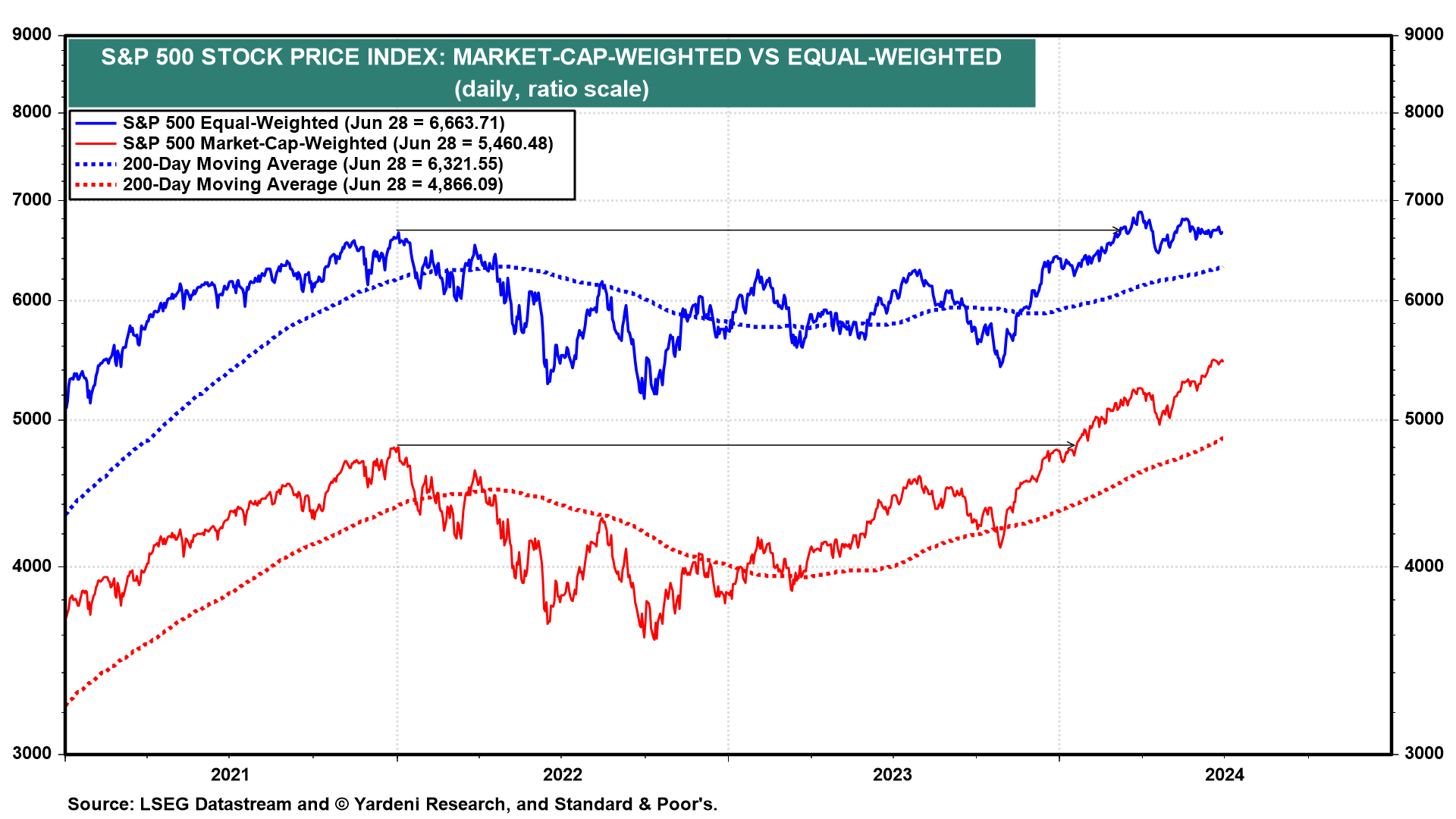

The stock market rose to another record high last week. It has been doing so in recent weeks led by fewer sectors and fewer stocks. The S&P 500 market-cap-weighted stock price index has significantly outperformed the equal-weighted index in recent weeks (chart). Many technicians warn that this could be a bearish sign in the short-run if the leaders experience a correction.

An alternative scenario we favor is that there might be significant rotation from the leaders to lots of the laggards. This could happen if investors recognize that while the breadth of the stock market's price rally has been narrowing, the percent of the S&P 500 companies with positive three-month percent changes in their forward earnings has been increasing (chart). The latter was up to 83.2% during the June 28 week. That's bullish for a broadening of the stock market rally, in our opinion.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a