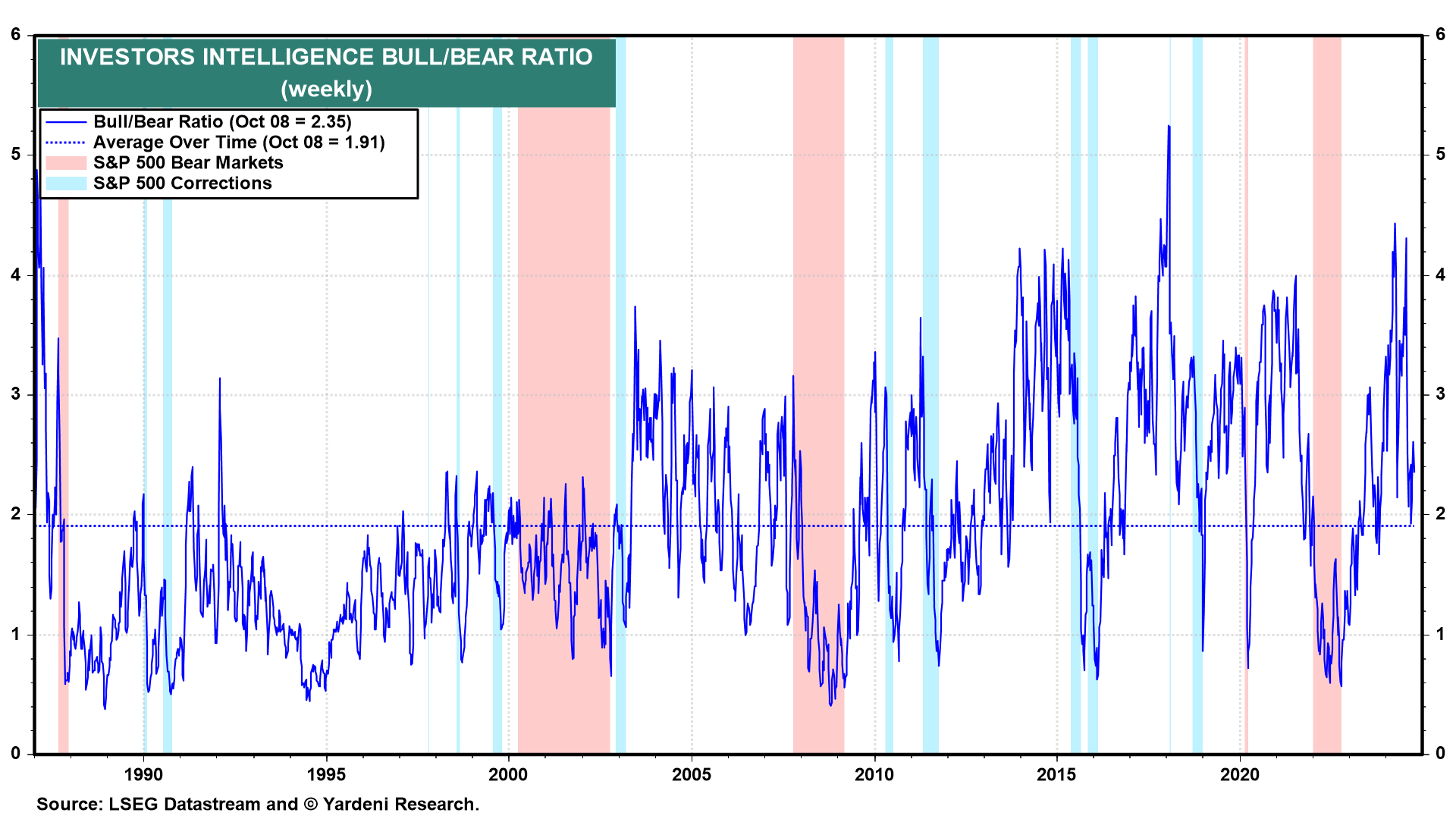

The S&P 500's latest bull market turned two-years old on Saturday. It started on October 12, 2022. Sentiment was extremely bearish back then (chart). There were widespread fears of a recession caused by the tightening of monetary policy. Those fears lingered through October 4 of this year, when a stronger-than-expected employment report once again confirmed that the young bull correctly discounted that inflation would fall while the economy remained resilient. That's been our forecast since early 2022.

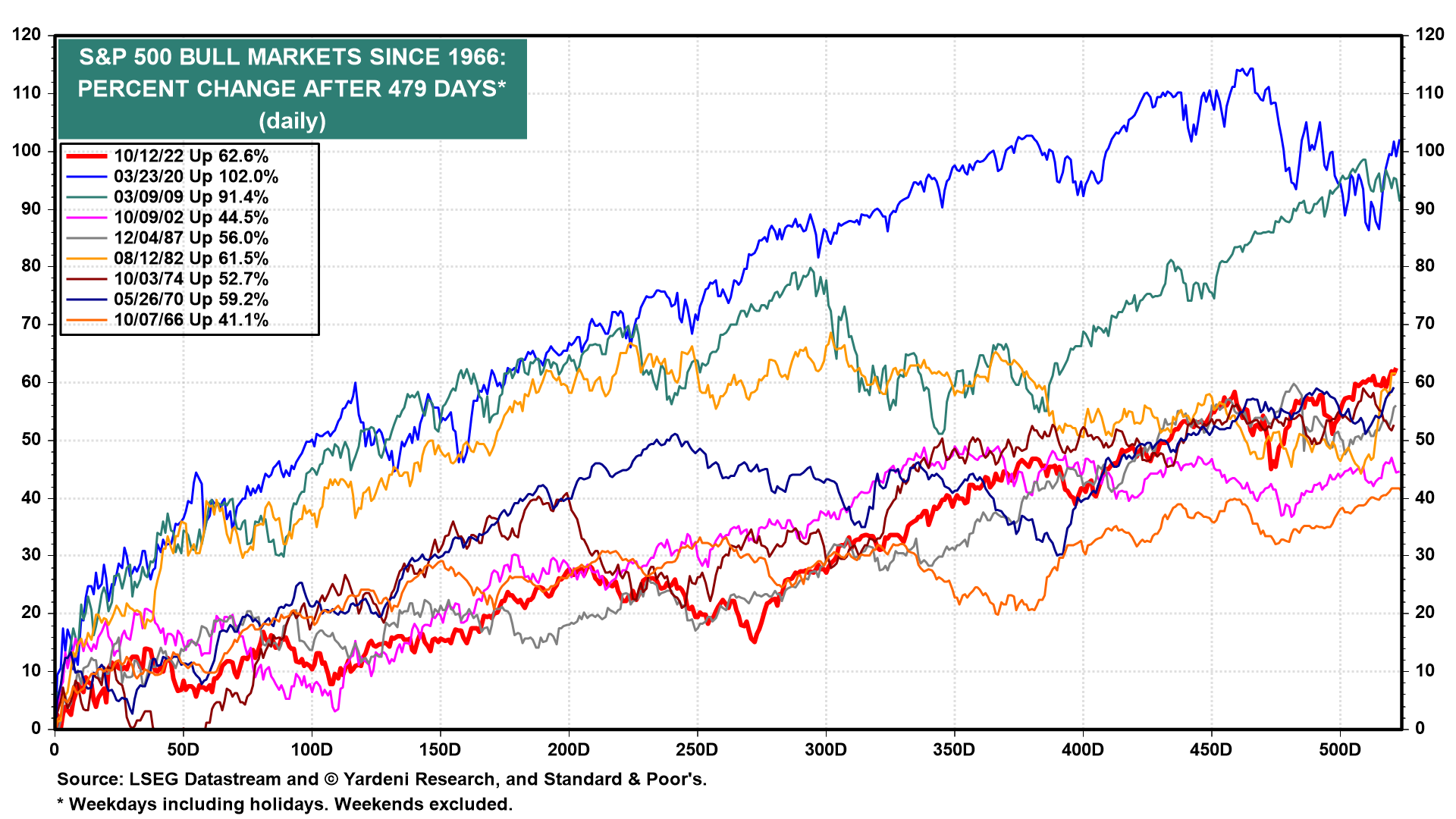

Since the latest bear market bottom, the S&P 500 is up 62.6% through Friday's close (chart). That's par for the course compared to the previous eight bull markets. In our Roaring 2020s scenario, the S&P 500 reaches 8000 by the end of the decade mostly led by rising earnings rather than rising valuation multiples.

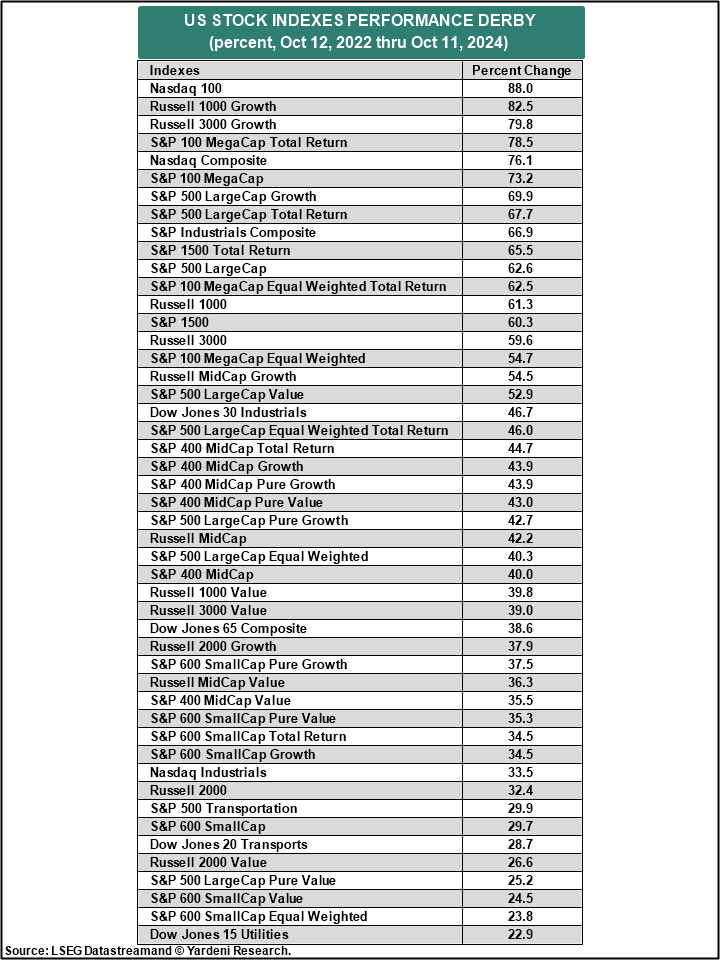

Among the bull market's skeptics were those who claimed that it was too narrowly based on the stock prices of the Magnificent-7. They warned that a narrow bull market isn't likely to be a sustainable one. We argued that the bull market would broaden as recession and inflation fears both abated, allowing the Fed to pivot from a hawkish to a dovish monetary stance. And so has it been. Indeed, since October 12, 2022, all of the major US stock market indexes are up at least 20% (table).

We asked Michael Brush for an update on insiders: "Outside of a few purchases by beneficial owners (larger owners who hold 10% or more) like Berkshire Hathaway and Steve Mnuchin, insider buying was extremely light last week. There were very few actionable buys, defined as large buys by insiders with good track records in bullish formations like cluster buys. This is only partly explained by earnings season lockdowns. Insider buying was light, even considering this limitation." Thanks, Michael!