Geopolitical events and crises rarely influence Fed policymaking. This time it might be different. The war that began on October 7 between Israel and Hamas is turning into a regional conflict in the Middle East. On Sunday, Iran-backed militants killed three US service members and wounded many more during an unmanned aerial drone attack in northeastern Jordan near the Syrian border.

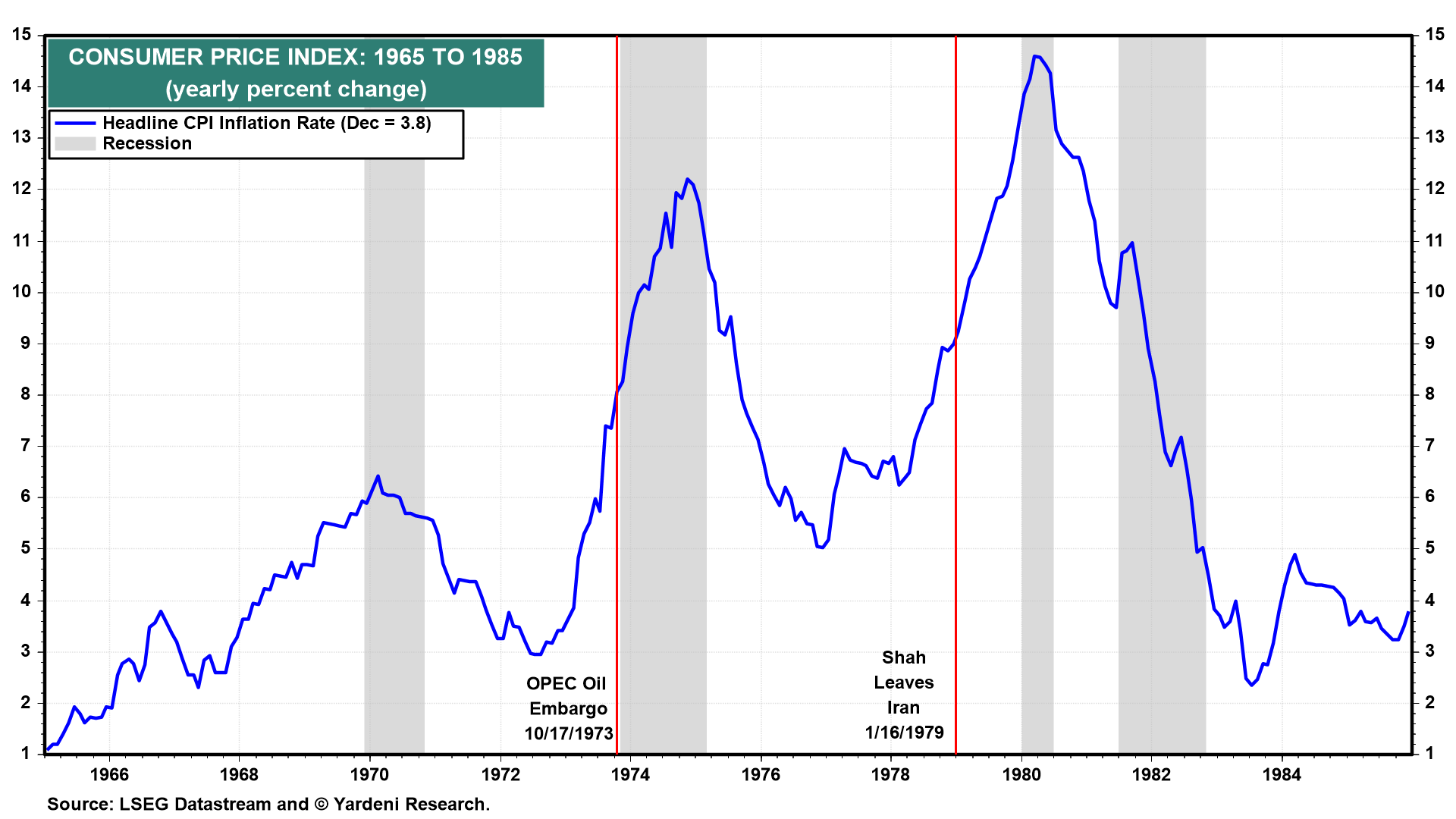

This latest escalation increases the risks of disruptions to the supply of oil and of higher transportation costs attributable to ships having to divert from shorter routes through the Red Sea. Thus, it also increases the risks of a second bout of inflation similar to what happened during the two energy crises in the 1970s (chart).

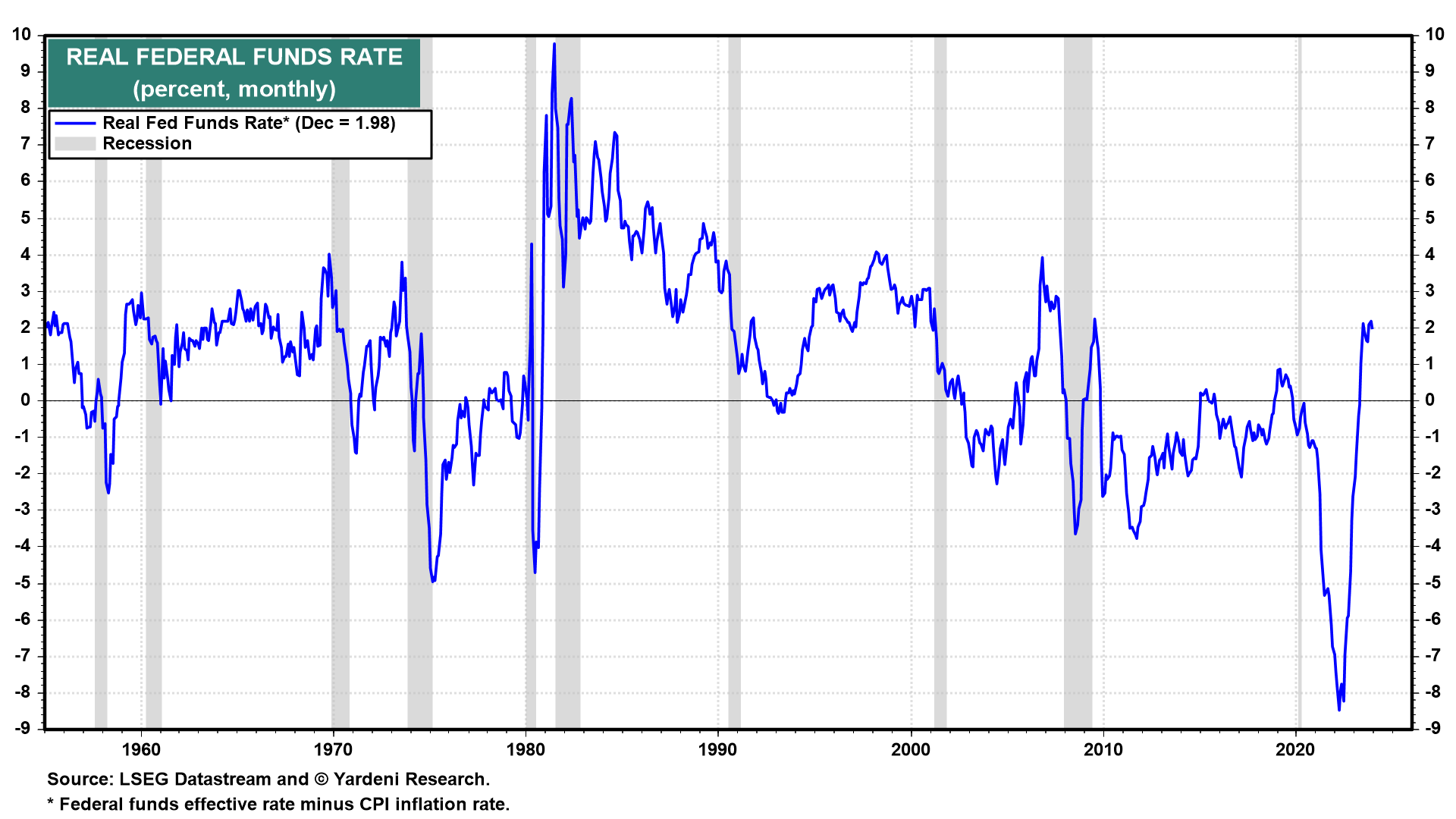

On the other hand, if inflation continues to fall and the Fed doesn't ease, the real federal funds rate , which is currently around 2.00% would continue to rise (chart). That could be restrictive and increase the odds of a recession according to some Fed officials.

"Nonsense," we say. Just have a look at the high-yield corporate bond spread (chart). It has narrowed by over 200bps since March 24, 2023 to the lowest reading since early 2022. Financial conditions have eased significantly since the banking crisis of March 2023.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a