The S&P 500 closed at 3916.64 on Friday, just above where it closed at the end of last year (chart). We asked Joe Feshbach for his latest trading thoughts. He observes:

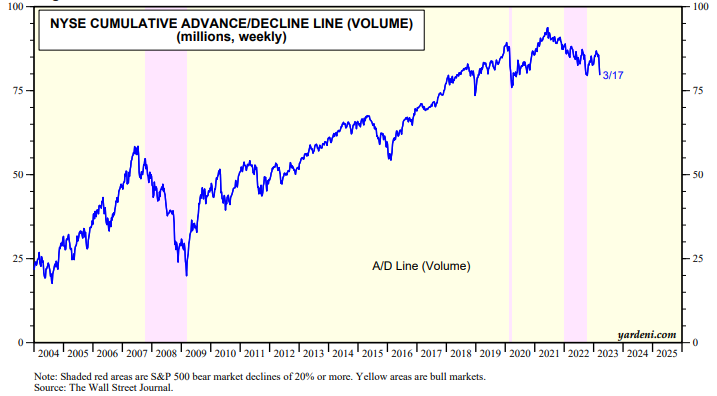

"The market doesn’t need these premature rallies. They only serve to prolong the correction as negative sentiment doesn’t have time to intensify. Surprisingly, the daily put/call ratio (PCR) fell way to quickly on the rally days, as if to suggest traders are comfortable with the government backstops. Stunningly, Fridays PCR at 0.65 was low, on a day of 5/1 negative breadth accompanied by negative news (chart)."

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a

¿Ya tiene una cuenta?

Iniciar sesión