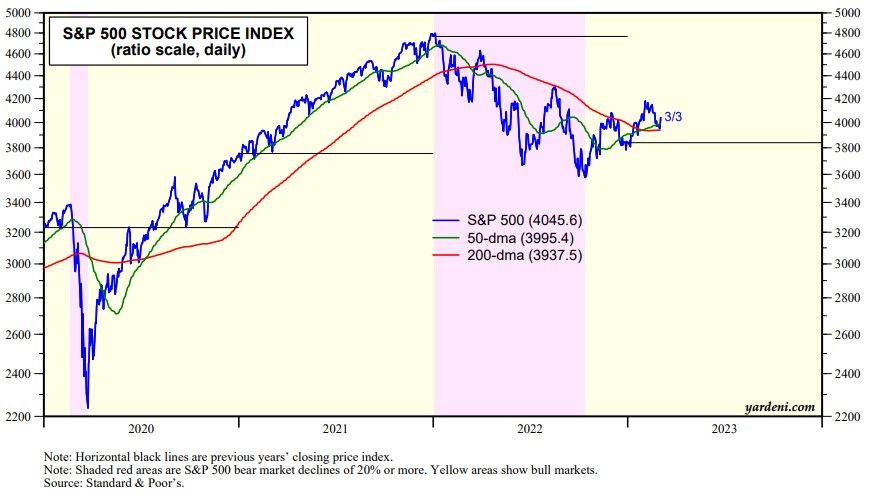

The S&P 500 may continue to mark time until the data more convincingly support either the bull or the bear case. The index bounced off its 200-day moving average (dma) and closed above its 50-dma on Friday (chart).

If the batch of economic indicators over the next two weeks is as strong as was January's comparable batch, the market will go down on fears that an inflationary no-landing scenario will force the Fed to push interest rates up to levels that cause a hard landing to subdue inflation. For now, we remain members of both the soft-landing and disinflationary no-landing clubs.

Meanwhile, the "CFO Put" continues to offset the lack of the "Fed Put." The S&P 500 companies are paying dividends at a record pace and continue to buy back lots of their equities (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a