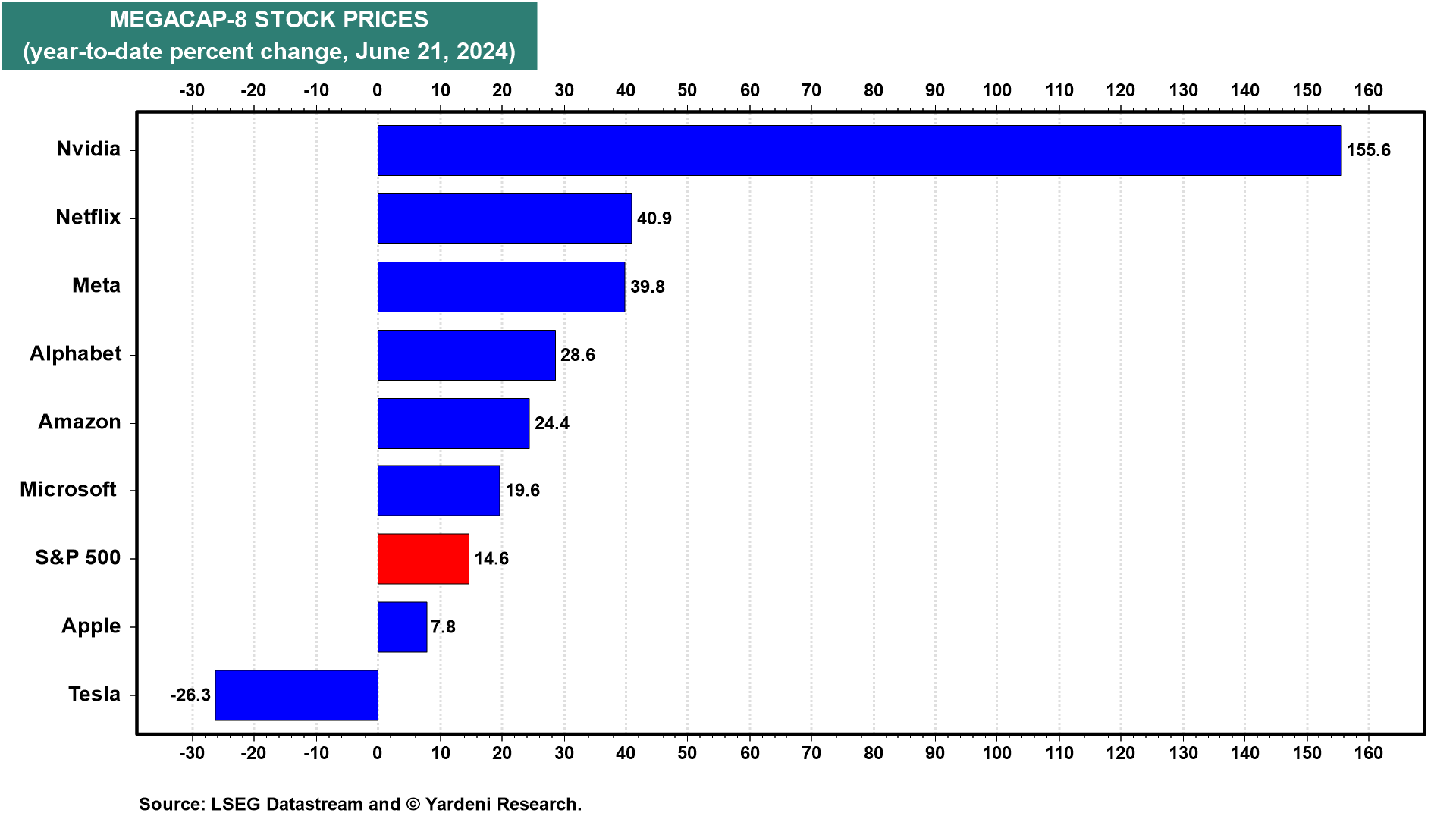

The stock market has a bad breadth problem again. For a while, it seemed to be attributable to the outperformance of the Magnificent-7. Many other stocks performed well, but not as well as the Mag-7. More recently, the outperformance seems to be narrowing to the Magnificent One, i.e., Nvidia (chart).

Technical analysts are warning that this development increases the risks of a selloff in the market led by technology shares in general and semiconductor shares in particular--especially Nvidia. Indeed, as the S&P 500 has been rising to new highs in recent days, the percent of S&P 500 companies trading above their 200-day moving averages has been falling (chart). That could signal a looming correction, though false positives have occurred in the past.

Meanwhile, investment strategists are scrambling to raise their year-end S&P 500 targets. For now, we are sticking with our year-end target of 5400. So we are neutral on the market's near-term prospects, but remain bullish on the long-term trend.

We think that growing jitters about the global and domestic political situations might start to weigh on markets during the summer. Both are unsettling. The escalating conflict between Israel and Hezbollah could soon expand the regional war in the Middle East. The partisan divide among Americans will only get worse as the US presidential election approaches.

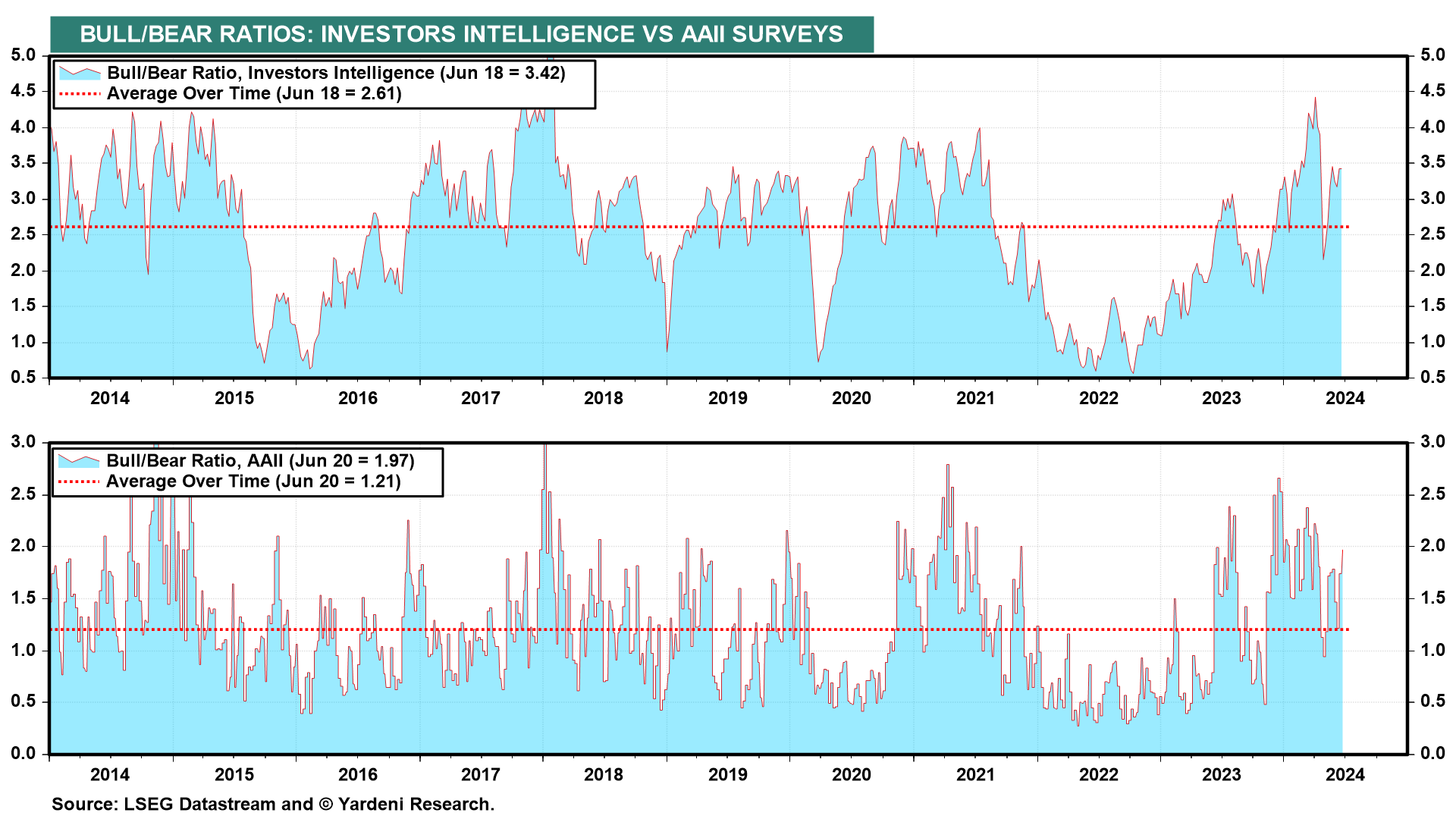

The two Bull/Bear Ratios we track remain relatively bullish (chart). However, that tends to be a bearish development from a contrarian perspective.

It will be interesting to see how the market responds to Friday's PCED inflation rate for May. We expect the news will confirm that inflation continues to moderate. That should be bullish for stocks unless the price of crude oil continues to rally as its geopolitical risk premium widens (chart).

We asked Michael Brush for an update on insider activity: "Insiders were at their most cautious this year in March, just ahead of the April stock market weakness. That was a good call. Since then, they've continued to turn more bullish as the market has advanced. They're still cautious, according to overall buy/sell ratios, but much less so compared to March. Last week, attractive actionable buys (based on bullish signals like cluster buys and size) happened mostly in cyclical areas like retail, tech, energy, and transport." Thanks, Michael!

We asked Joe Feshbach for his trading perspective on the market: "While the blowoff in AI-related stocks continues, there are warning signs for the broader market as well. Breadth stats are not impressive. The put/call ratio is on the low side. Interest rate sensitive stocks are struggling. The AI craze is somewhat reminiscent of the late 1990s when the Internet stocks went ballistic. However, there was a painful weeding out process after that craze. I don't think the corrective process is far off." Thanks, Joe!