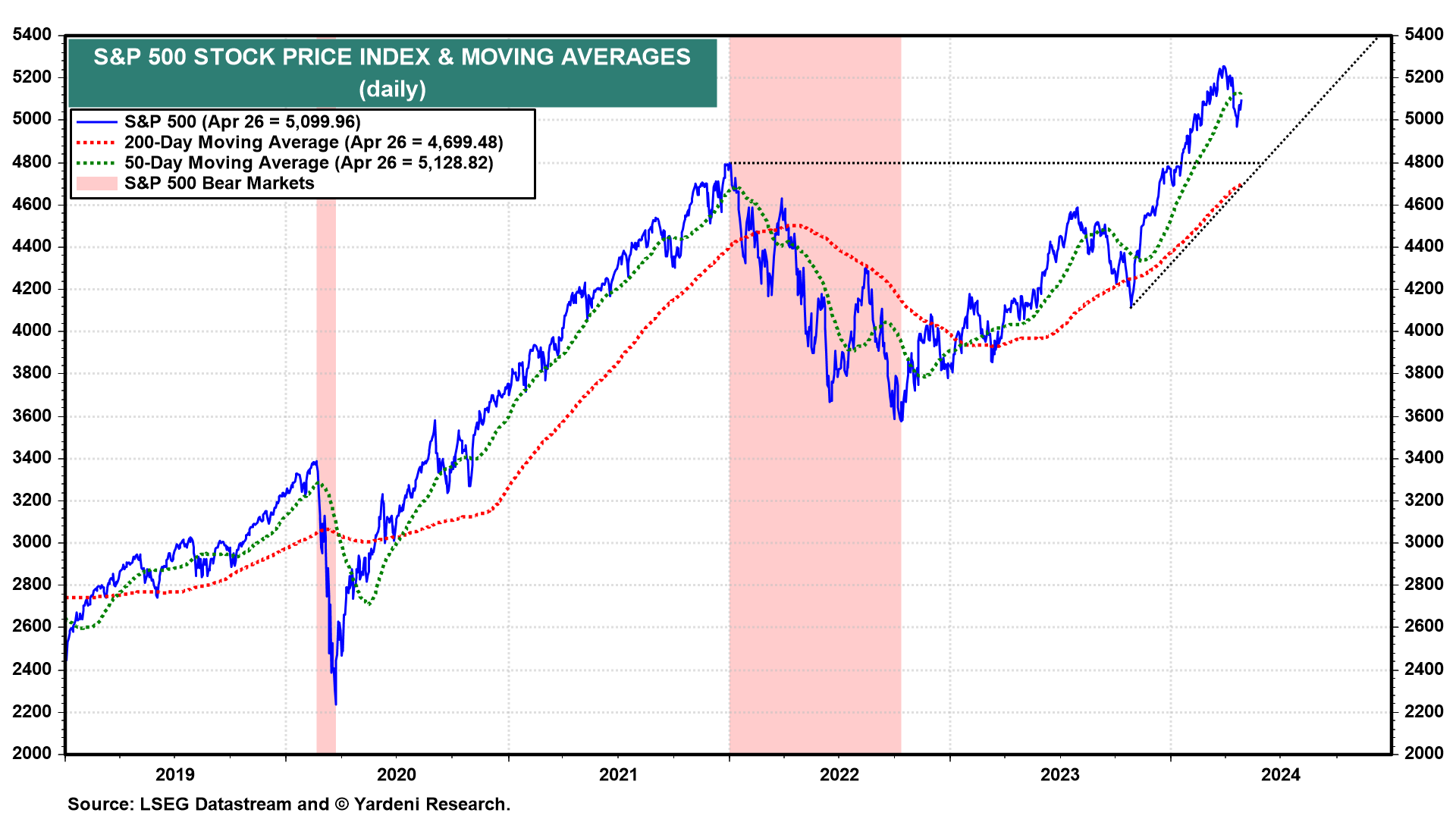

Keep your seat belts on: There may be a few more loop-the-loops in the stock market's rollercoaster ride. Or at least wear a neck brace. It's been a wild ride recently. After peaking at a record high on March 28, the S&P 500 plunged below its 50-day moving average and rose last week closing just below this average (chart).

Geopolitical risks remain high, though perhaps a bit less so after Iran and Israel played a dangerous game of tit for tat two weeks ago. Israel and Hezbollah were still playing that game today.

Among the most geopolitically sensitive commodity prices is that of a barrel of Brent crude oil (chart). It dipped a week ago but edged back to almost $90 at the end of last week.

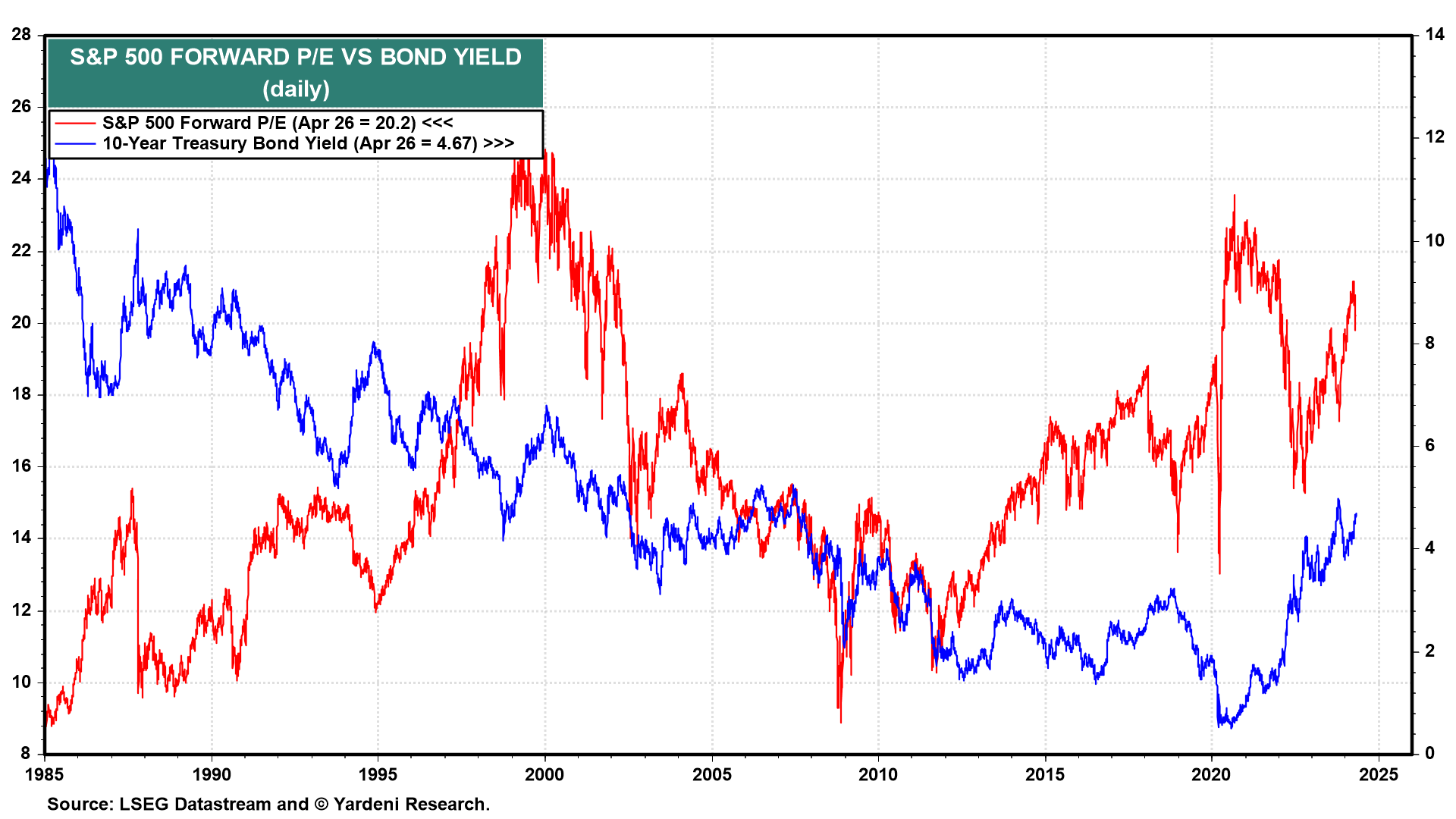

A more troublesome near-term issue for the stock market is the recent backup in the bond yield (chart). It might have started to weigh on the forward P/E of the S&P 500. The yield is likely to revisit 5.00% in coming days, providing another good buying opportunity for long-term investors.

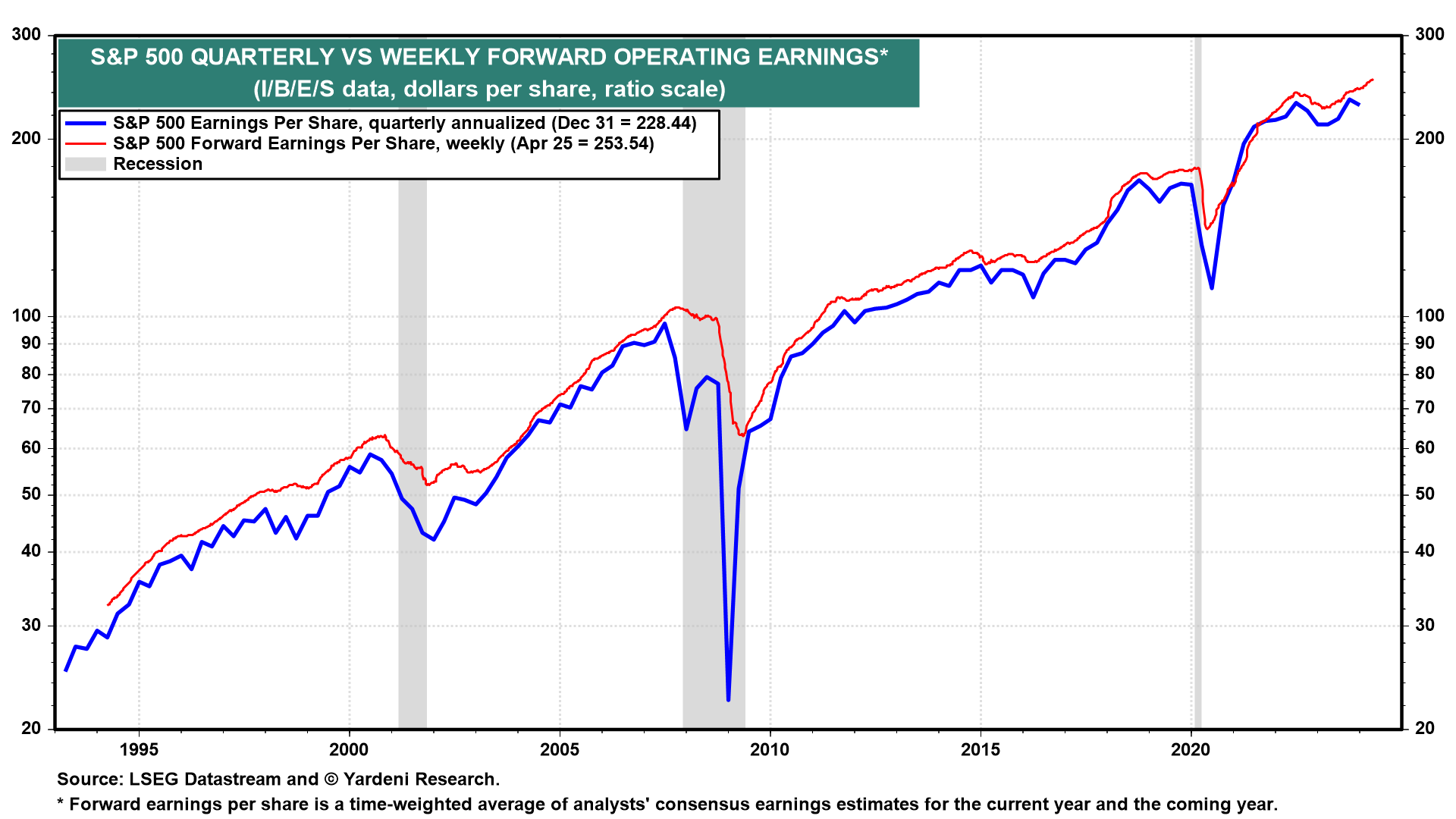

Meanwhile, the earnings reporting season is going well as evidenced by S&P 500 forward earnings, which rose to a record high of $253.54 during the April 25 week (chart). Google and Microsoft beat expectations and they also beat inflation fears following Friday's hotter-than-expected PCED inflation reading.

We asked Michael Brush for an update on insider activity: "'Insiders' have stepped up their buying in the stock market's pullback. But most of the insider buying represents money managers who have to report as 'insiders' because of their large ownership shares. So this insider buying signal is less meaningful than it would be if it represented buying by true insiders, i.e., executives and directors. The increased buying has merely leveled off the decline in the buy/sell ratio, which remains low enough to signal continued caution among insiders." Thanks, Michael!