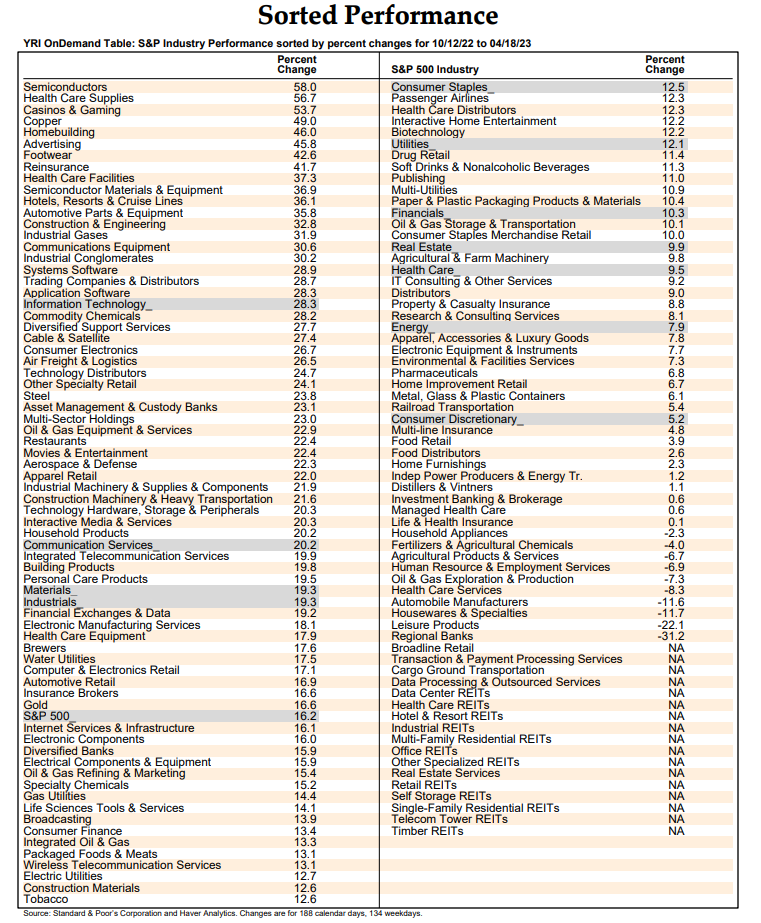

We remain convinced that the S&P 500 bottomed on October 12, 2022. The S&P 500 is up 16.2% since then (table below). Every sector of the S&P 500 is up since then. Even the Financials sector is up 10.3% despite the recent banking crisis.

We are still expecting to see the S&P 500 rise to 4600 by the end of this year. However, there could be some turbulence up ahead as a result of the partisan deadlock in Congress about raising the debt limit. We expect it will be resolved, but it may take a serious swoon in stock prices to force our politicians in Washington to get it done.

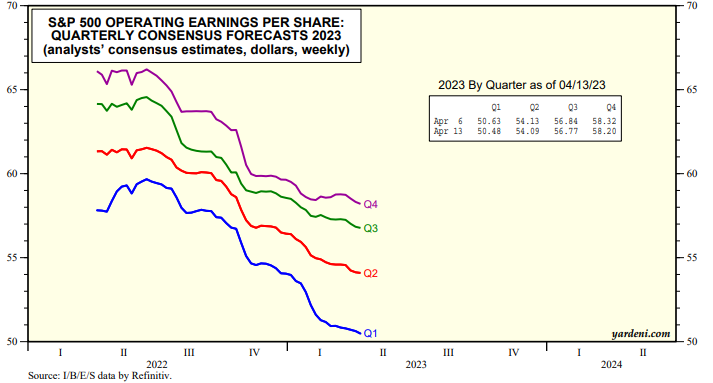

How can stock prices be rising in the face of industry analysts continuing to lower their earnings estimates for each quarter of this year (chart)?

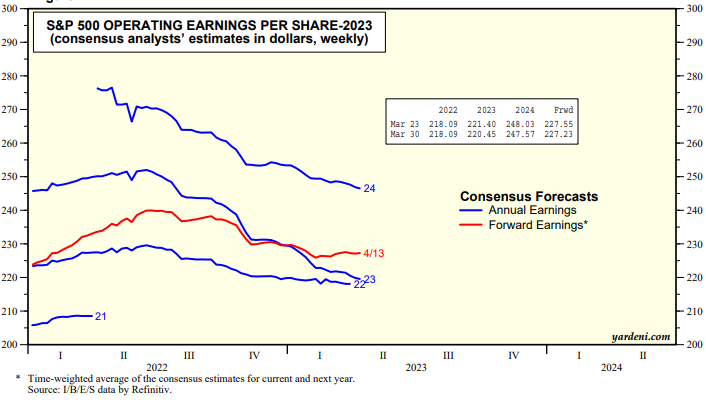

They are lowering not only their 2023 estimate, but also their 2024 earnings outlook (chart). However, their estimate for next year remains well above this year's latest estimate. As a result, forward earnings has flattened out in recent weeks around $227 per share. As the current year passes, investors are increasingly giving more weight to analysts' expectations for next year. That explains why all the recent chatter about a mild recession during the second half of the year by the Fed's staff and the usual pessimistic crowd isn't depressing stock prices.

We checked in with Joe Feshbach this past weekend to get his latest thoughts on the stock market. Joe writes: “The S&P 500 is approaching its early February high. While it may exceed that, I believe the bulk of this rally is behind us now. I suggest building up some defensive reserves for a better opportunity down the road. The sentiment measures just don’t support meaningful upside from here. Furthermore, the widely spoken about tech rally looks to me, chartwise, to be about 90% done.