The stock market has been rallying since June 16 on mounting expectations that the most widely expected recession of all times might be a no-show and that inflation is peaking. July's strong payroll employment report and peakish CPI and PPI readings suggest that the cat is out of the bag. That's confirmed by several technical indicators:

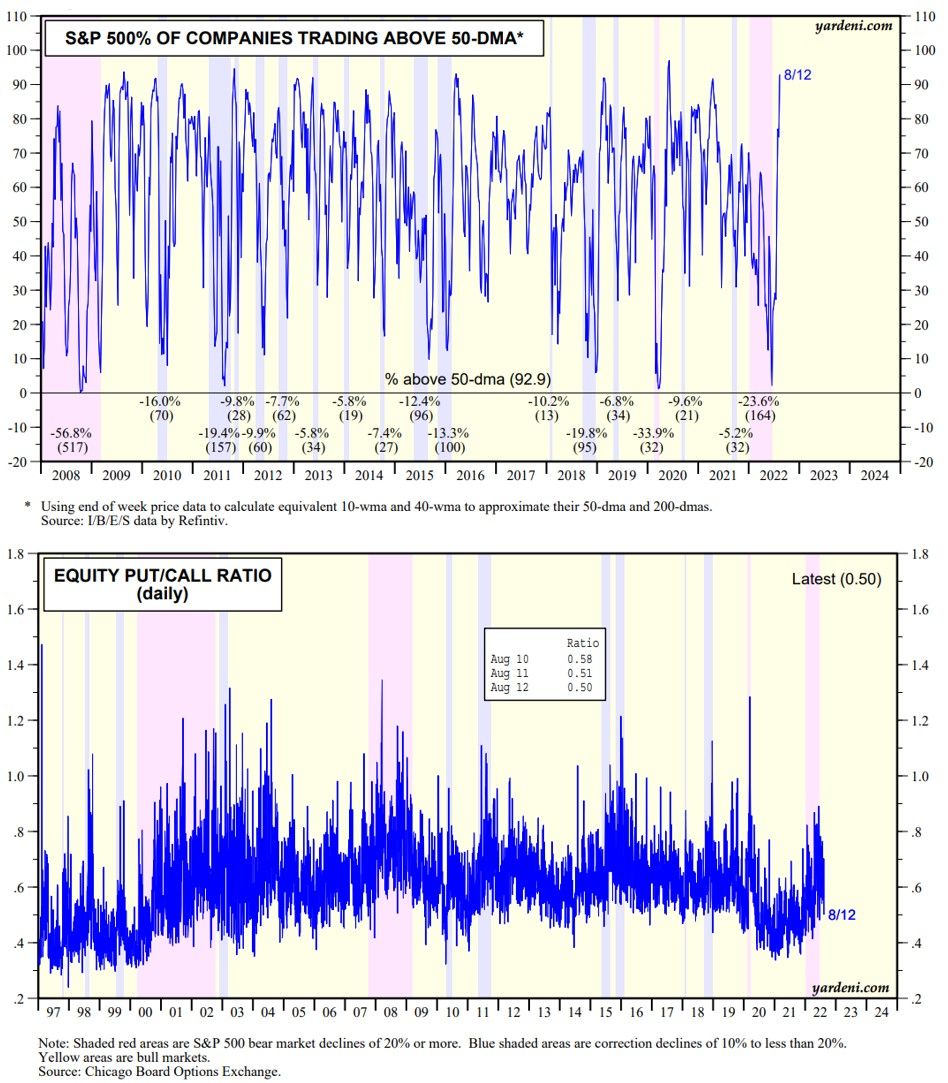

(1) Breadth. On Friday, over 90% of the S&P 500 stock prices exceeded their 50-dmas, up from nearly zero in mid-June (chart). That's consistent with previous peak readings in this breadth indicator. On the other hand, only 46% are above their 200-dmas, and only 41% are showing positive y/y price comps.

(2) Sentiment. The BBR advanced this week for the fifth week, from 0.76 to 1.60 over the period, to its highest reading since mid-January (chart). It was at 0.60 seven weeks ago, which was the lowest since the week of March 10, 2009, when it was 0.56. The BBR had been bouncing around 1.00 since late February before its recent move up.

(3) Put/Call. The CBOE's equity put/call ratio was relatively low at 0.50 on Friday, confirming that bearish sentiment has been subdued by the stampeding bull market.

(4) Feshbach's call. We asked our good friend and market maven Joe Feshbach for his latest assessment of the stock market. Here it is: "Friday was the lowest put/call ratio of the advance since June16. The good news is clearly out of the bag. Six weeks ago, when stocks were meandering at their lows, hardly anyone was bullish. Now we’re starting to get acceptance of the rally. This doesn’t mean it can’t go higher, but for those that bought stocks when the sentiment indicators were extremely low, I would hold off on any new purchases and start to book some gains here. My view is there will be another opportunity."