Stock and bond prices fell today as two none-voting FOMC participants (Bullard & Mester) suggested that higher-for-longer interest rates will be necessary to bring down inflation. They were reacting to the latest batch of economic indicators confirming that the labor market is tight, consumers are still spending, and inflation may not be falling fast enough.

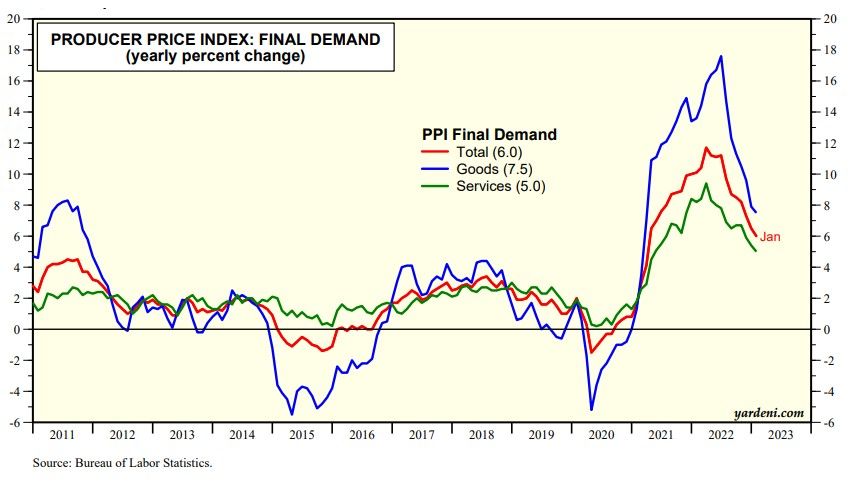

January's PPI, released this morning, rose 0.7% m/m. That was above the consensus forecast of 0.4%. This measure of prices increased 6.0% y/y, well off its 11.6% peak in March 2022 and the lowest since early 2021 (chart). Unlike the CPI, the PPI's services inflation rate (5.0%) is well below its goods inflation rate (7.5%), partly because the PPI doesn't include rent. In any event, both CPI and PPI inflation rates continued to moderate in January.

Also unnerving the financial markets today was initial unemployment claims, which slipped 1,000 to 194,000 for the week ended February 11. On Tuesday, the NFIB survey of small business owners showed that 45% had job openings (chart). The labor market remains tight.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a