Today's Employment Cost Index (ECI) for Q1 was another hotter-than-expect inflation report. It came out just as the FOMC started its latest meeting to discuss monetary policy. It increases the odds that Fed officials will sound more hawkish starting with Fed Chair Jerome Powell at his presser tomorrow following the meeting.

Stocks sold off hard as the 2-year Treasury note yield rose back above 5.00% to 5.05%, still implying one rate cut of 25bps over the next 12 months in the federal funds rate (FFR). The current pullback (a.k.a. a 5%-10% mini-correction) probably won't be over until the 2-year is at 5.25%, suggesting that the markets have given up on expecting any rate cut over the next 12 months.

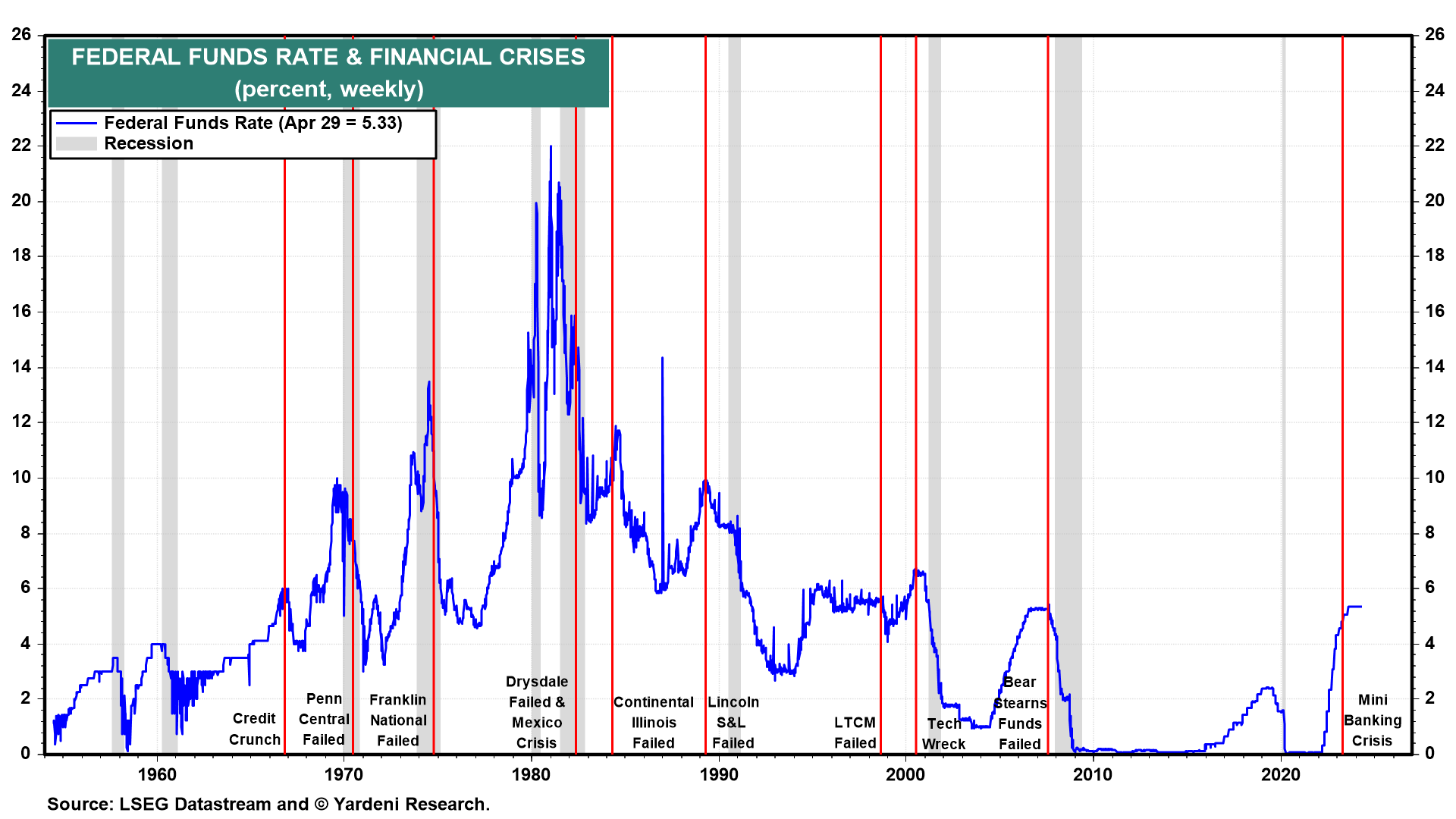

Indeed, we expect that the Fed's "Long Pause" at the current level of the FFR will be the longest one in Fed history. Previous ones didn't last very long because financial crises, caused by the tightening of monetary policy, forced the Fed to lower the FFR (chart). This time, the Fed dealt with last year's banking crisis by quickly establishing a bank emergency liquidity facility.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a